Content

Depending on a person’s situation, this information may cause them to make changes to their W-4. It will help with estimating income and other items for the current tax year. Finances and TaxesIf you work more than one job, steps 3 through 4b should only be completed on one W-4 form. All employees need to complete steps 1 and 5 in the new W-4. Steps 2, 3, and 4 are only completed if certain criteria apply.

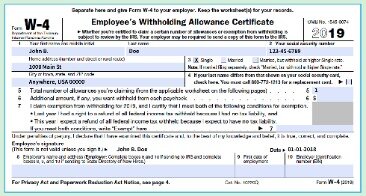

Learn everything you need to know so you can update your W-4 with confidence. A W-4 form is completed by employees to let employers know how much tax to withhold from their paycheck.

Make Payroll A Breeze

The W-4 form had a complete makeover in 2020 and now has five instead of seven sections to fill out; the reason for the makeover was to improve clarity for taxpayers completing the form. If tax forms fill you with dread—you don’t understand them, you’re afraid of what will happen if you make a mistake—just keep reading. The W-4 form had a complete makeover in 2020 and now has five instead of seven sections to fill out; this article will explain what a W-4 is and walk you through how to fill out the new form line by line.

The Internal Revenue Service has launched an online assistant designed to help employers, especially small businesses, easily determine the right amount of federal income tax to withhold from their workers’ pay. Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your employees’ income tax withholding. If you do not make adjustments to your withholding for these situations, you will very likely owe additional tax when filing your tax return, and you may owe penalties. For income from sources other than jobs, you can pay estimated tax instead of having extra withholding. Step 3 is where the employee claims any dependents and deducts the $2,000 per-child tax credit out of their withholding ($500 for non-child dependents).

Step 4: Add Other Adjustments

If you’re filling out a Form W-4, you probably just started a new job. The W-4, also called the Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from your paycheck. The form was redesigned for 2020, which is why it looks different if you’ve filled one out before then. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Instead, if you want an additional amount withheld , you simply state the amount per pay period. Here, we answer frequently asked questions about the W-4, including how to fill it out, what’s changed and how the W-4 is different from the W-2.

If you have additional questions or if you’re looking for additional information about the latest Form W-4, visit the IRS website. Those starting a new job will have to fill out a new Form W-4. You don’t have to start a new job to fill out a Form W-4, though. If you itemize or take other deductions, you may want to add them here. You can use other adjustments to make your withholding more accurate.

As with the changes for multiple jobs and working spouses, the new W-4 form makes it easier to adjust your withholding to account for tax credits and deductions. There are clear lines on the revised form to add these amounts—you can’t miss them. Including credits and deductions on the form will decrease the amount of tax withheld—which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return.

Employee Faqs

Her work has been featured in Business Insider, AOL, Bankrate, The Huffington Post, Fox Business News, Mashable and CBS News. Born and raised in metro Atlanta, Amanda currently lives in Brooklyn. If you want to preserve what you’ve earned and grow it in the most tax-efficient way, a financial advisor can help. To find a financial advisor to work with, useSmartAsset’s free tool. If you’re ready to be matched with local advisors, get started now. How the IRS Form W-2 Wage and Tax Statement Works & How to Get One by Tina Orem You need it to do your taxes, and no, you can’t shove it in a drawer and forget about it. Employers must send employees a W-2 by the end of January each year.

Or, you can check the box for step 2 for both jobs if there are only two jobs total and the earnings are fairly similar. This section is for if you work multiple jobs at the same time or are married filing jointly and both you and your spouse are employed. To be accurate, both spouses should fill out the new Form W-4 for each job. The allowance system was tied to the use of exemptions and deductions on your tax return. You can change your withholding at any time by submitting a new W-4 to your employer.

- It also replaces complicated worksheets with more straightforward questions.

- The IRS advises that the worksheet should only be completed on one W-4, and the result should be entered for the highest paying job only, to end up with the most accurate withholding.

- This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home.

- If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form.

- if they do not furnish a new Form W-4, withholding will continue based on a valid form previously furnished.

- The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability.

Next, you’ll need to add the wages from your two highest jobs together. If you have three or more jobs combined, between yourself and your spouse, you will need to fill out the second part of the Multiple Jobs Worksheet. First, select your highest paying job and second highest paying job. Use the graphs on page 4 to figure the amount to add to line 2a on page 3. This step is the same as the example above, except you’re using the second-highest paying job as the “lower-paying job.” In order to accurately fill in line 1, you’ll need to use the graphs provided on page four of Form W-4.

Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. Instead of having the tax come directly out of your paycheck, send estimated quarterly tax payments to the IRS yourself instead. On line 4, instruct your employer to withhold an extra amount of tax from your paycheck. For the highest paying job’s W-4, fill out steps 2 to 4 of the W-4. If you change jobs or want to adjust your withholdings at your existing job, though, you’ll likely need to fill out the new W-4.

Whether you’re filling out paperwork for a new job or got an email notification from HR, you might have noticed that the W-4 form changed from what you might have been used to. Your W-4 is what determines your federal income tax withholding, and making sure it’s accurate is the first step to in determining whether you get a tax refund or will owe taxes when you prepare your tax return.

This happens despite the fact that there are significant things that can occur in any given year that might influence how you fill out a W-4. We’d argue that reviewing Form W-4 annually is an excellent habit for just about anyone, even if it’s not a federal requirement. The answer to this question comes down to whether your stimulus check increases your “provisional income.” Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. An exemption is also good for only one year—so you have to reclaim it each year. If you were exempt in 2019 and want to reclaim your exemption for 2020, you need to submit a new Form W-4 by February 17, 2020.

Adding these two amounts together results in $6,830 for line 2c. The 2020 version of the W-4 form eliminates the ability to claim personal allowances. You can claim anexemptionfrom withholding any money if you did not owe tax during the previous year and expect to have zero tax liability in the next year. If you have an accountant or another tax preparer, confirm your decisions with them before you turn in the form. Use the Standard rate if employees only fill out Steps 1 and 5 .

Most people cross paths with a W-4 form, but not everybody realizes how much power Form W-4 has over their tax bill. Here’s what the form is used for, how to fill it out and how it can make your tax life better. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Our partners cannot pay us to guarantee favorable reviews of their products or services. People with two or more jobs at the same time or who only work for part of the year. Line 4 simply divides the amount on either line 1 or 2c by the number of pay periods on line 3. For line 2b, the wages and salaries for the two highest-paying jobs need to be added together and found in the column on the left.

In December 2020, the IRS released the final version of the 2021 Form W-4. The important tax form includes very few changes from the 2020 version, which was overhauled to feature more accurate withholding information in a simpler and more private format. Any additional amount you wanted to be withheld from your paycheck. When these exemptions deductions were removed in the Tax Cuts and Jobs Act, the Form W-4 no longer estimated the correct amount that needed to be withheld from paychecks as well as it used to. A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes. This section allows you to have any additional tax you want withheld from your pay each pay period, including any amounts from the Multiple Jobs Worksheet, above, if this applies to you. In this section, the IRS wants to know if you want an additional amount withheld from your paycheck.

Get Comfortable Fiddling With Your Withholdings

Members may download one copy of our sample forms and templates for your personal use within your organization. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission. To request permission for specific items, click on the “reuse permissions” button on the page where you find the item. BerniePortal® is an all-in-one HRIS that allows small and mid-sized businesses to optimize HR, improve employee experiences and spend more time building the businesses they love.