Content

When I did my taxes in Turbotax for 2013, Turbo tax asked if I had sold a home and I answered yes, but it didn’t appear anywhere in the tax forms . I walked away with $65,000 after paying off the mortgage. I was unemployed throughout 2014, but I did make $6,500 in charitable donations. I am single with no dependents, if that info is needed for the answer. If you didn’t claim home mortgage interest that is on the 1098 form, that mortgage interest can save you money on your taxes. You can deduct your home mortgage interest and property taxes.

You can receive your refund by check, whether you’re printing or e-filing. If you’ve already e-filed, you can track your refund by signing in.

When determining whether you need to file a return, you don’t include tax-exempt income. I sold my house in Texas in December of 2013 and moved to Washington state.

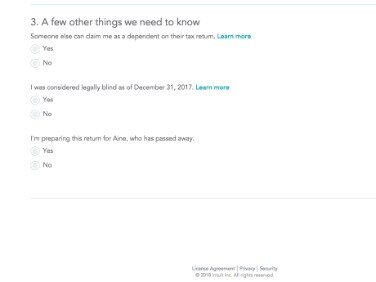

When you have finished entering your expenses for the time when you drove for yourself, we will now go into the PERSONAL tab at the top of the screen, and enter your W-2. If you had any other personal income, enter them here also., Otherwise, click on the DEDUCTIONS & CREDITS tab at the top of the page. You can walk through them all, or select “I’ll choose what I’m working on” and scroll down to EMPLOYMENT EXPENSES, near the bottom of the page.

If you took a retirement account withdrawal in 2020, look for Form 1099-R from your financial institution around the end of January 2021. You’ll need to report the amounts shown on 1099-R when you prepare your 2020 tax return. Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives. But thanks to the Families First Coronavirus Response Act and the Coronavirus Aid, Relief and Economic Security Act, you might see some relief when you file your 2020 taxes , in some cases, even earlier.

Estimated Taxes: Common Questions

Ignoring the rules might save you some time during the year, but you’ll pay the piper come tax day. Another idea is to make sure you plan ahead to have the necessary cash to pay your tax bill when you file. Just be careful because not being able to pay your total tax bill can lead to penalties and interest.

For most married taxpayers filing joint returns, it’s $24,800 and $18,650 for the head of household filers. Although the CARES Act waived the 10% penalty, the withdrawals are still taxable as ordinary income.

Latest Tax And Finance News And Tips

There’s no software to install and nothing you’ll need to save on your computer. We’ll store all of your information on our secure servers. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

- Your friend needs more help than we can give in this user forum.

- By accessing and using this page you agree to the Terms and Conditions.

- By accessing and using this page you agree to the Terms of Use.

- If a due date falls on a weekend or legal holiday, the deadline is pushed to the next business day.

- You don’t have to wait until you file your 2020 tax return to take advantage of these credits.

The first quarter is three months , but the second “quarter” is two months long , the third is three months and the fourth covers the final four months of the year. The first link I provided is for expenses as an employee. Please remember, you must itemize your expenses on your return to claim some of these. Again Turbotax will help you determine if it is best to itemize your personal expenses, or take the standard deduction instead. I have included a link from The IRS that has some more great tips of deducting expenses.

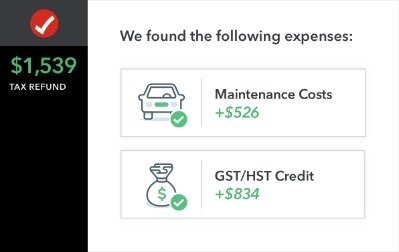

When you prepare your 2020 tax return, TurboTax will ask simple questions about your tax situation and help you choose the right deductions and credits based on your answers. If you have any questions, you can connect to a TurboTax Live tax expert or CPA for unlimited advice as you do your taxes, or even have your own tax expert do them for you from start to finish. If your income was lower in 2020 than it was on your prior-year return, you could be eligible for a higher stimulus payment once you file your 2020 tax return. However, if your 2020 income was higher than what was used to determine your rebate amount, you won’t be forced to pay back the stimulus money or lose any of your refund. Any adjustment to the stimulus payment on your 2020 tax return will be in your favor. After you start paying estimated taxes, be sure to keep a separate record of the dates you paid them and how much you sent for each period. If you don’t keep accurate records, it can take you longer to prepare your income tax return, and you may miss one or more of the payments you made.

If wage withholding for the year equals the amount of tax you owed in the previous year, then you wouldn’t need to pay estimated taxes, no matter how much extra tax you owe on your windfall. I just found out that I should have been filing state returns in multiple states other than my own for income earned from a real estate fund . I am a limited partner and have only been filing in my home state . I didn’t realize I was responsible for filing in each state that the fund was active.

Have A Tax Expert Do Your Taxes, Start To Finish

(Just remember we are only deducting the expenses for the part of the year you worked for yourself at this point, or your 1099 income, in the next section we’ll cover your expenses as an employee. You can claim your parent if you provided over half of her support and they did not earn over $3,950 in taxable income.

You don’t really need anything but your email address to get started! Just answer a few simple questions and you’re on your way. By accessing and using this page you agree to the Terms of Use.

Because filing a state return is an entirely separate process from your federal taxes there may be an additional charge, based on whether you use TurboTax Online or CD/Download. For the 2020 tax year, you had more time to make those first- and second-quarter estimates. That means the installments that would typically be due on April 15 and June 15 were pushed back to July 15, 2020. As long as you made your required estimated payments by that date, you won’t get hit with an underpayment penalty. The third-quarter estimate was still due September 15, 2020, and you have until January 15, 2021 to make your fourth-quarter estimated payment.

you are using online TurboTax to prepare your returns, you will need to prepare two separate returns and pay twice. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog.

You can spread the taxable income over a three-year period or include the full distribution in your taxable income for 2020. You can also put the money back into your retirement plan within three years and undo the tax consequences by filing an amended tax return. Many taxpayers are feeling the impact of the COVID-19 pandemic on their everyday lives. But thanks to a number of changes to the tax laws, you could see some tax relief when you file your taxes. Some retirees avoid the need to make estimated payments by having enough tax withheld from required distributions from IRAs at year-end to cover their tax bill for the year. You can even have federal income tax withheld from your Social Security income if you are receiving benefits.

Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted.

Whether it’s personal or business-related taxes, including more complex situations, TurboTax Live has you covered. Screen sharing capability allows our credentialed tax experts to show you relevant information and answers right on the screen so you can be confident you’re getting every deduction and tax benefit. Connect right on your screen with a live expert to discuss your taxes this year. They can even customize your experience so you only answer questions that apply to you and your situation.

Keep in mind the space you claim as a home office should be used exclusively and regularly for that purpose. Don’t forget to include the square footage of your home office used for product storage or inventory. withdrawing money early from a retirement accountcomes with a 10 percent tax penalty if you withdraw your money before 59-1/2 in addition to the regular income tax on the amount withdrawn. The retirement money may also bump you into a higher tax bracket, which can result in the taxation of other income, such as social security, that you may have not been taxed on otherwise. there have been questions around the requirements to have health care coverage.

There’s no purchase necessary to participate, but it is subject to availability, so be sure to take advantage of the free offer with your taxing question. Starting today taxpayers with tax questions can get an easy – and free – answer from a TurboTax expert. No matter what your tax situation is, TurboTax Live tax experts have the answers and the tax advice you need to get every dollar you deserve. With the simple click of the “Live Help” button, you can connect with a TurboTax Live expert using one-way video technology, including access to Spanish-speaking tax experts. With TurboTax Live, 100% of our experts are IRS credentialed CPAs and EAs with an average of 15-years of experience, ensuring that you’re getting the most money you deserve, and your taxes are done right.

Previously, the cap was 60% of adjusted gross income for most cash donations. The CARES Act temporarily waived the 10% early withdrawal penalty on up to $100,000 of withdrawals. It was a little easier to withdraw money from your retirement account if you were out of work or needed cash in 2020. Normally, if you withdraw money from your IRA, 401 or other employer-sponsored retirement account before the age of 59½, you must pay an early withdrawal penalty. To hold your payments to a minimum, base each installment on what you have to pay to avoid the penalty, using any exceptions that benefit you. Never accused of oversimplifying things, the IRS doesn’t break the tax year into four three-month quarters.

But what if you receive income during the third quarter that, for the first time, makes you liable for estimated tax payments? Your first payment would be due on the third installment date—September 15—and you are expected to pay 75% of the tax that is due. You will need to use IRS Form 2210 to show that your estimated tax payment is due because of income during a specific time of the year. If not, the IRS assumes that you had the income throughout the year and simply underpaid your estimated tax. You don’t have to make any payment until you have income on which estimated taxes are due. If you know early in the year that you will have to make estimated payments, each of the four payments should be 25% of the amount due. This rule helps if you have a big spike in income one year, say, because you sell an investment for a huge gain or win the lottery.

Basically I want to know what money is taxed using this model of a BDIT. Do you have to file a10-99R form once you receive it. You can try and contact the IRS before they issue the check and see if they will make the change for you. I entered the wrong routing number and account number, what can I do ?

The stimulus bills didn’t make any significant changes to the standard deductions available on 2020 tax returns, but the amounts available for 2020 did increase slightly for inflation. It sounds like you do not need to file a tax return for 2014. Generally, if your total income for the year doesn’t exceed the standard deduction plus one exemption and you aren’t a dependent to another taxpayer, then you don’t need to file a federal tax return. In 2014 for example, if you are under age 65 and single, you must file a tax return if you earn $10,150 or more, which is the sum of the 2014 standard deduction for a single taxpayer plus one exemption. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

The first one will say that your return was submitted. Your friend needs more help than we can give in this user forum. He needs to see a really good local paid tax professional and get help from a pro. A professional can help sort out what is surely a mess and then help him negotiate with the IRS. I was wondering if I could avoid jumping into another tax bracket by my husband and I filing separately. By accessing and using this page you agree to the Terms and Conditions. Contact Us to get the toll-free number of a TurboTax expert who is specially-trained to handle your question or concern.