Content

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com. This section is dedicated to keeping you updated.

People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund. Everyone gets free, unlimited phone and email support.

There is a convenience fee depending on your transaction amount. Submit a tax payment through the NCR Payments site. There are two types of dividends – ordinary and qualified. Qualified dividends are taxed as long term capital gains. The rate you pay for long term capital gains depends on your income but will be between 0 and 20%.

Ready To Try Turbotax?

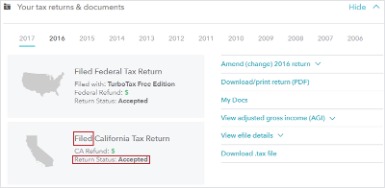

If you’ve wondered about e-filing, here are the answers to frequently asked questions, including why e-filing is a good idea, which states let you e-file, how much e-filing costs, and how soon you’ll receive your refund. TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes. And the great thing is they guide you through your tax return so you don’t need to know which tax forms to file.

If you’re subject to the net investment income tax, we prepare the Form 8960, and include the tax deductions available to you. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current.

Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records. If you make other use of this Site, except as otherwise provided above, you may violate copyright and other laws of the United States, other countries, as well as applicable state laws and may be subject to penalties. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed.

Both can do your taxes and represent you before the IRS, and there are important distinctions between them. See the article below learn about how their skills can you help with your income tax preparation needs. Connect right on your screen with a live expert to discuss your taxes this year. They can even customize your experience so you only answer questions that apply to you and your situation. If you’re looking for an excuse not to e-file, it isn’t cost, because the IRS and states do not charge for e-filing. The only costs associated with e-filing are those charged by a tax preparer or tax software. Depending on the software brand and version, electronic filing charges have ranged from free to around $25.

Connect With Real Tax Experts On Demand

TaxSlayer Simply Free includes one free state tax return. Actual prices are determined at the time of print or e-file. Offer is subject to change or end without notice. If you get a larger refund or smaller tax amount due from another tax preparation engine with the same data, we will refund the applicable purchase price you paid to TaxSlayer.com.

Then choose “Personal Income Tax Balance Due or Billing Notice” as the payment type. You will need to enter your SSN to verify your information. Find detailed instructions on how you can only prepare and mail in – not eFile – a Missouri 2020 Tax Return- here via eFile.com. However, you must download/print and sign the forms and mail them to the Tax Agency. If you happen to need a form that isn’t covered by Credit Karma Tax, then you won’t be able to file with them. If you’re using the online version, you can only do one return. When you buy TurboTax, you’re allowed to install it on any computer you own.

Many of these online IRS tax payment options can be used before or after you e-Filed your Income Taxes. You can pay tax extension and tax estimate payments. For estimate payments, you do not have to submit a form. Jim is wrong unless he’s only talking about online versions.

From savings accounts, to a diversified portfolio of stocks, bonds and mutual funds, these holdings generate varying types of investment income, each with distinct tax rates. With EY TaxChat, you’ll have access to a dedicated and experienced tax professional.

In fact, TaxSlayer offers highly affordable pricing for filers with basic and more complicated returns. Before calling, make sure that you have before calling, make sure that you have gathered relevant documentation.

Some states accept e-filed tax returns directly while other states have the return sent to the IRS first and then the return gets passed along to the state taxing authority. EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021.

Considering Tax Attorneys

If your computer or device is incompatible with TurboTax, a customer service agent may be able to suggest a workaround, but he or she cannot be responsible for completely resolving the issue with third-party products. You may need to contact the manufacturer or use a different device with TurboTax products. Research indicates that there are no patterns of complaints regarding TurboTax customer service online. This suggests that customers are generally satisfied with the level of support that they have received. Use this payment option if you want to pay your tax payment via your credit or debit card.

- EY tax professionals consistently work with multistate filers, to submit the proper forms, credits and state tax returns.

- Failure to Comply With Terms and Conditions and Termination.

- TurboTax is a company that sells tax preparation software, online tax preparation and other services.

- They offer free federal tax preparation and e-file, with many of the forms supported by Premier and Home & Business.

- Depending on the software brand and version, electronic filing charges have ranged from free to around $25.

Simply Free For those with a simple tax situation. While is TurboTax’s best toll-free number, there are 6 total ways to get in touch with them. The next best way to talk to their customer support team, according to other TurboTax customers, is by calling their phone number for their Intuit Support department. Besides calling, the next favorite option for customers looking for help is via for Intuit Support. If you think this information is inaccurate or know of other ways to contact TurboTax please let us know so we can share with other customers. Politely explain how your first call went awry and that you would like a resolution.

Now the packages are only available with state – if you don’t have to file a state return, you may want to go with TurboTax online. A business can be anything from a formal corporation with Articles of Incorporation to something less formal, like being a rideshare driver or selling clearance items on eBay. If you earned income from a side hustle, you will need to claim it on a Schedule C. If you run a business, you need to declare your income on a Schedule C and so you must use TurboTax Self-Employed (also called Home & Business). Enrolled agents, or EAs, and certified public accounts, or CPAs, are credentialed tax preparers who have a lot in common.

We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges. You are responsible for paying any additional tax owed.

While 2020 is over, some of the tips to minimize your tax liability are still available until April 15th, 2021. Plus, if you’re interested in tax tips from the pros throughout the year, this section is for you! From practical tips to in-depth tax topics, we’ve compiled various resources to keep you informed. The good news is our EY tax professionals are here to address the complexities of your tax filings. EY TaxChat™ can help you navigate through these complexities of state filing requirements. TaxSlayer.com Classic includes Live Phone Support.

Whether you’re filing as single, married, or head of household, you can rest assured that you’ll get every tax break you deserve. Same is true if you’re employed, self-employed, or run a St. Louis small business.

Which Turbotax Version Should I Use In 2021?

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. Please be aware there is a handling fee of 50 cents to pay via e-Check. The deadline to e-file an IRS extension for 2020 Tax Returns is April 15, 2021.