Content

You could also use fee-based expatriate tax software or work with an accountant or tax professional. Furthermore, the CARES Act included stimulus payments to provide relief to U.S. citizens affected by COVID-19, including expats.

See our seriesabout how to reduce your tax liability as a US citizenfor other examples of credits and deductions. Although this article offers a simple example of how to file Form 1116 for the Foreign Tax Credit, it may be too complicated for expatriates who need to file US expat taxes. If you need any assistance with your Form 1116, or if you would like to know more about our expat tax services, pleasecontact us for expert help.

TurboTax asks you how much of the income reported on your 1099-DIV was from foreign countries. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

Get The Free Form 1116 Filla

Many foreign countries require residents to pay taxes regardless of the citizen’s nationality. For this reason, US expats have an opportunity to claim the Foreign Tax Credit to reduce their US taxes. To utilize this credit, you’ll need to complete Form 1116 and attach it to your US tax return, Form 1040. It sounds simple, but using this credit is easier said than done. Find out how to use this money-saving credit correctly.

They do not include sales, value-added, real estate or luxury taxes paid to a foreign government. Expatriates living abroad are generally required to file U.S. taxes as they would stateside. However, you’ll get an extra two months to file and pay your federal taxes. Also, you may be able to qualify for different exclusions as an expatriate. If you have adjusted gross income of $72,000 or less, you may be able to use the IRS Free File program to file your taxes for free using popular tax software programs.

I’ve never received or filled out this form in the past. Part 2 to list taxes paid in both the foreign currency and their U.S. dollar equivalent. use Form 1116 for a tax credit and subtract the taxes they paid to another country from whatever they owe the IRS. You may still need to pay taxes in the country where you reside, even if you’re not a resident. It will depend on the country’s tax laws in which you’re living and any agreements it has made with your home country.

Go to the “Foreign taxes” section under “Estimates and Other Taxes Paid” in the “Deductions & Credits” section of TurboTax to see if you qualify for a credit for foreign taxes paid. Keep in mind, even if you’re required to file a tax return, it doesn’t mean that you’ll be required to pay taxes. Many expats qualify for exclusions, but you need to claim them on your tax return. For example, the Foreign Earned Income Exclusion allows U.S. citizens or resident aliens who live outside of the states to exclude foreign earnings up to $107,600 for 2020 and $108,700 for 2021. You might think that you’re exempt from filing a tax return because you’re living abroad, but that’s not necessarily the case. This means you’ll generally be required to file a tax return just like you would if you lived stateside.

The H&R Block Expat Tax Services software is a cloud-based program that’s completely online. You can get started online for free and won’t pay until you’re ready to review and approve your tax return. Once you’ve paid and approved your return, H&R Block will e-file it for you. Additionally, the company offers a 100% guarantee that your return will be prepared accurately.

Plus, expert tax help is available for an additional fee, and there are even filing options for self-employed expats. If your taxes are complicated, you might be better off working with a tax advisor. However, an online tax software program can be a great option for expatriates who earn regular employment income and even those who are self-employed and report business income via Form K-1. If you have a complicated tax situation (e.g., you need to file taxes for a foreign business), you’ll probably need to choose a different option.

She earned her master’s from Grand Canyon University and has a bachelor’s in business accounting from the University of Phoenix. Once you have determined your adjusted foreign source income percentage, compute your foreign source income by multiplying the amount in Box 1a of your Form 1099-DIV by this adjusted percentage. This amount, together with the total of your adjusted foreign source income from other funds or sources, should be included on Form 1116, Part I, Line 1a. The adjustment factor is the difference between the highest marginal income tax rate and your lower qualified dividend tax rate, divided by the highest marginal income tax rate. I am using HRB but for me it is not giving the whole amount as credit. My Ireland Dividend is 2564 and the taxes are 641.

How Do I Get Or Access Form 1116?

You can get started preparing your tax returns online for free. If you need support while working on your taxes, you can use the company’s chat feature to ask questions. Plus, if you purchase the professional plan, a tax professional will review your tax return before it’s submitted.

- For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

- You don’t need to report income passed through from a mutual fund or other regulated investment company on a country-by-country basis.

- If the tax does not meet the above conditions, you cannot take the credit.

- bank accounts understand, complete, and submit the FBAR filing requirements.

In 2019, Blake & Lauren had an income of $65,000 and paid taxes to the Brazilian government in the amount of $15,000. They had a $3,000 foreign tax credit carryover from 2017 and a $4,000 carryover from 2018. Typically, all of their income would be excluded because of the Foreign Earned Income Exclusion, and Blake & Lauren would not have a US tax liability. However, for this example, we will assume that Blake & Lauren have not yet claimed the Foreign Earned Income Exclusion and will only be claiming the foreign tax credit. Additionally, Blake & Lauren had $17,129 in itemized deductions, $10,550 of which were due to home mortgage interest.

But, before you begin, there are some things you should be aware of — such as the foreign tax credit and other tax implications. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. We reviewed a dozen providers to find the best tax software for expatriates. We looked for the tax forms supported by each program, the level of support you can receive from a tax expert, and how much each program costs. The reputations of each provider were also considered.

This is because the forms that are available to expatriates via TurboTax are limited. Even so, it’s a good option for expats with relatively simple tax situations, including those who are self-employed. If you’re a U.S. citizen or resident alien living abroad, you’re generally required to file a U.S. tax return. You may not end up paying taxes because of special exclusions like the Federal Earned Income Exclusion , but you need to file your federal tax return to take advantage of those potential exclusions. If you have a complicated tax situation (e.g., you have complex holdings in foreign companies), you may want to work with an accountant. Although the IRS does require US citizens and Green Card-holders to report and pay taxes on their worldwide come, there are many ways to reduce double taxation, including the Foreign Tax Credit.

We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Learn about our independent review process and partners in our advertiser disclosure. Newsletter Subscribe to our monthly newsletter to get money-saving tips, latest expat tax news and exclusive promos straight to your inbox. Webinars Sign up for one of our live webinars hosted by our expert accountant team or watch one on-demand today.

Do I Need To File U S. Taxes If Im An Expatriate?

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner or investment manager.

Form 1116 first asks you to classify your foreign income by category. You must complete a separate form for each type of income you have. The software helps expatriates who have money in non-U.S. bank accounts understand, complete, and submit the FBAR filing requirements. The tax must have originated legally in a foreign country. Expat Partners Get access to special offers and resources from other expat services that will make your life even easier living abroad. Resources Blog Access up-to-date articles, breaking news, deadline information and in-depth case studies on US expat taxes.

When your total foreign taxes paid from all your 1099-DIV’s is over the $300/$600 threshold, you’ll need to include a Form 1116 in your tax return. I’ll show you how to do this in TurboTax and H&R Block software.

While TurboTax only includes three of the most common forms expats commonly need , its costs of $40 to $90 are competitive. Plus, you can get access to live support from a tax expert for an additional fee as an extra feature. The costs for the MyExpatTaxes program are more expensive than any of the other plans we reviewed, at a cost of approximately $178 to $597 for each federal tax return. However, it includes many of the most common tax forms expats need. Plus, business owners can get help from a tax accountant with corporate forms that might be required, such as Form 8858 and Form 5471.

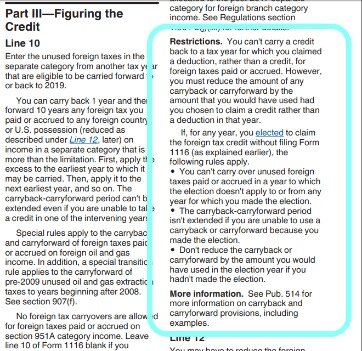

The RRIF income which I entered under IRA, 401K, Pension plan withdrawals with the foreign address and no ID for payer since the Canadian company does not have the ID that is compatible with other IRAs. I cannot find the Foreign Taxes under the Estimates and other taxes paid section. You don’t need to report income passed through from a mutual fund or other regulated investment company on a country-by-country basis. Total all income, in the applicable category, passed through from the mutual fund or other RIC and enter the total in a single column in Part I. Enter “RIC” on line i. Total all foreign taxes passed through and enter the total on a single line in Part II for the applicable category. If you have already input your foreign income into TurboTax, you can go to the search bar at the top of your screen and enter, foreign tax credit.Then click on the Jump to link. As you consider broadening your financial portfolio, you may be interested in foreign investments.

Find Schedule 3 in the left navigation pane and look at the number on Line 1. Now you say foreign tax paid from which 1099-DIVs were paid to country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7. You will not be subject to the foreign tax credit limit and will be able to claim the foreign tax credit without using Form 1116 if all of the following requirements are met.

Understand common costs of investing, and what you could pay at Schwab. If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice. H&R Block software asks upfront about the simplified election. I’ll use the same example in H&R Block downloaded software. Next, TurboTax asks you which countries you received dividend income from.

Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank , provides deposit and lending services and products.

All of the options on our list allow expatriates to file their taxes online. However, it’s important to determine how much support you’ll need and how complex your tax situation is before deciding to do it yourself. Several of the options we reviewed offer support from a tax expert, but this usually comes for an added fee. Plus, not all of the tax forms commonly required for expats are included in some software programs. TaxAct is a tax software company founded in 1998 and headquartered in Cedar Rapids, Iowa.