If you don’t know the necessary information, contact your employer or insurance company for help. What if I receive another tax form after I’ve filed my return? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return.

100% of the fees we collect are used to support our nonprofit mission. They qualify for an exemption for one of several other reasons, such as a hardship that prevents them from obtaining coverage. The views expressed on this blog are those of the blog authors, and not necessarily those of ADP. This blog does not provide legal, financial, accounting, or tax advice. The content on this blog is “as is” and carries no warranties. ADP does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. If you have any questions regarding our services, please call .

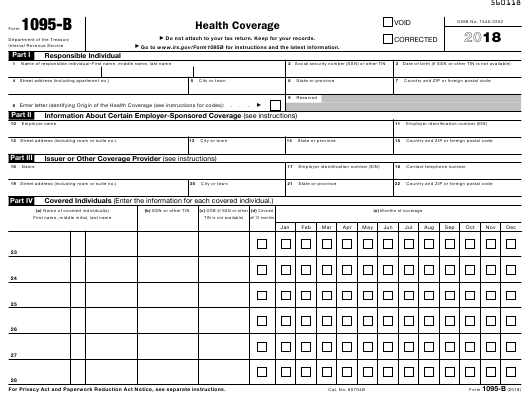

“Even with this relief, employers should focus on making sure reporting is accurate and timely, especially given that this is the last time the good-faith relief is expected to be extended,” according to an alert by compliance firm Hub International. By filing Forms 1095-C with the IRS and providing employees with copies, employers with 50 or more full-time or equivalent employees, known as applicable large employers , show they offered eligible employees health coverage that was compliant with the ACA. On Oct. 2, 2020, the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095-C or 1095-B reporting form, as required by the ACA, from Jan. 31, 2021, to March 2, 2021. In addition, the IRS again extended “good-faith effort” transition relief to employers for plan year 2020 reporting. mployers should keep in mind approaching 2021 deadlines for distributing health care reporting forms to employees and filing these forms with the IRS, as required under the Affordable Care Act . However, just like with the 1095-B, most people already know this info and won’t need to refer to a 1095-C to complete their tax returns. So, there’s no need to delay filing until this form you get this form.

Most employees will not need Form 1095-C to prepare their income tax return. Prior to 2019, some employees may have referenced Form 1095-C, Part III, to determine whether a health insurance coverage shared-responsibility payment applied. However, as of January 1, 2019, the individual health coverage mandate penalty was reduced to zero as a result of the 2017 Tax Cuts and Jobs Act. Accordingly, the “Full-year health-care coverage or exempt” box has been removed from Form 1040. Health coverage information is still relevant for residents of California, the District of Columbia, New Jersey or Rhode Island, which have individual health coverage mandates in effect. Taxpayers may also rely on other information received from their employer or coverage provider for purposes of filing their returns. Valid for 2017 personal income tax return only.

What To Do With Your 1095 Forms

We’re here for you when you need us. We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years. 1099 Pro’s 1094 & 1095 ACA reporting module comes as an add-on module for the Corporate Suite Software. To find out more about Corporate Suite, or the specifics of the 1094 & 1095 ACA reporting module, please contact Jonathan Cunanan – You only pay when you’re ready to file. 1099-MISC for Delaware, North Carolina, Oregon, Rhode Island, Vermont, Virginia and Wisconsin, and W-2 for Delaware, Georgia, Illinois and Michigan.

File with a tax Pro At an office, at home, or both, we’ll do the work. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments from IRS.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave.

- Only available for returns not prepared by H&R Block.

- Let’s explore four common tax myths.

- NW, IR-6526, Washington, DC 20224.

- The extension is automatic and does not need to be requested.

- Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17).

- To get a head start determining whether you’ll pay a penalty or be eligible for a premium tax credit, use theinteractive toolson the IRS website.

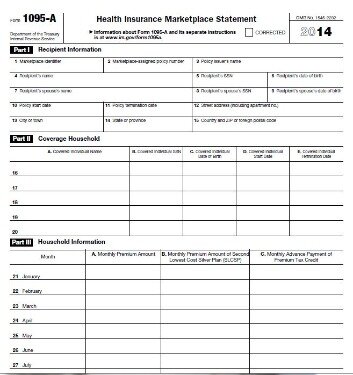

Information about individuals enrolled in the same policy as the tax filer’s tax family who are not members of that tax family, including children, must be reported on a separate Form 1095-A. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

Your Information Contains Error(s):

IRS Notice announced an extension of the deadline to furnish Forms 1095-C to employees until March 2, 2021, but employers are encouraged to furnish such statements as soon as possible. The extension is automatic and does not need to be requested. The deadline for filing Forms 1095-C is not extended and remains February 28 for paper filers, or March 31 for electronic filers.

For this and upcoming years, “employers that are ready to go by the original deadline should not hesitate to go ahead,” Capilla advised. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Available at participating U.S. locations. Your tax preparer also might ask for these forms to confirm that you were covered, but you can get that information from other sources, including your employer orhealth insurer. For instance, your family’s health insurance cards will show when your coverage was effective.

Healthcare

1099 Pro is offering two separate models for ACA reporting; one web-based model & one software-based model. Efile4Biz integrates with these popular packages so you can quickly import your vendor data, complete 1099 forms and electronically file your data to the IRS. Maintain access to filed forms for at least four years. Our easy-to-use interface will have you filing forms in just minutes so you can spend time on what matters most to you. For tax year 2019 and beyond you won’t receive Form 1095-C because the IRS won’t require proof that you had coverage.

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. It is used by larger companies with 50 or more full-time or full-time equivalent employees. This form provides information of the coverage your employer offered and whether or not you chose to participate. You can use this to complete your tax return.

About Form 1095

If anyone in your household had a Marketplace plan in 2020, you should get Form 1095-A, Health Insurance Marketplace® Statement, by mail no later than mid-February. It may be available in your HealthCare.gov account as soon as mid-January. Form 1095-C is filed and furnished to any employee of an Applicable Large Employers member who is a full-time employee for one or more months of the calendar. ALE members must report that information for all twelve months of the calendar year for each employee.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Small Business Small business tax prep File yourself or with a small business certified tax professional. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. In this case, you must wait for Form 1095-A to file your taxes. The information on 1095-A can also help determine whether you’re eligible for a premium tax credit to subsidize your 2019 coverage. If you haven’t received Form 1095-A yet, contact yourstate marketplaceto ask for it. Form 1095-C is used by larger companies with 50 or more full-time or full-time equivalent employees. This form is used by the employee to report the healthcare coverage offered to them by his or her employer.

See your Cardholder or Account Agreement for details. If you’re using an H&R Block Online tax filing program or H&R Block Software, we’ll ask you about this topic when you’re working on the Health Care section of your return. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required by the Internal Revenue Code to give us the information. We need it to ensure that taxpayers are complying with these laws and to allow us to figure and collect the right amount of tax. If a Form 1095-A was sent for a policy that shouldn’t be reported on a Form 1095-A, such as a stand-alone dental plan or a catastrophic health plan, send a duplicate of that Form 1095-A and check the void box at the top of the form.

If the plan is self-insured, all of the ACA reporting information for ALEs is included in the Form 1095-C and covered individuals will not receive a Form 1095-B. While the date for filing forms with the IRS was not automatically extended, filers can obtain a 30-day extension by submitting Form 8809—Application for Extension of Time to File Information Returns—by the filing due date. If you haven’t filed tax returns in awhile, there are things you need to know. Learn how to address back tax returns and what you can expect when you file. When taxpayers receive forms 1095-B or C after filing, they should review them for accuracy and report any issues to the issuer for correction.

The IRS may impose penalties of up to $280 per form for failing to furnish an accurate Form 1095-C or 1095-B to an employee . A separate $280 per-form penalty may be imposed for failing to file an accurate form with the IRS. “However, it is important for employers to remain compliant with the always-evolving ACA rules and regulations,” he said. Members may download one copy of our sample forms and templates for your personal use within your organization.

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. When it comes to making everyday tax decisions, we find that there’s a gap between what’s true and what’s rumored.

Think the “monthly enrollment premium” may be wrong? Read this before contacting the Call Center. You can enroll in Marketplace health coverage February 15 through May 15 due to the coronavirus disease 2019 (COVID-19) emergency.

To avoid such penalties, employers may need to follow Publication 1586 guidance to check with employees if they become aware of a name/SSN error. For example, the IRS electronic filing system for Forms 1095-C notifies employers of any errors in names and SSNs.

Who Is Required To Report To The Irs?

Businesses use efile4Biz to save on the labor costs of printing, mailing and manually submitting forms to the IRS. Access your records and forms on efile4Biz.com from any device with internet access. You’ll need a numerical code on Form 1095-C to help determine whether you’re exempt from the tax penalty for 2018 or you need to pay. If you’re using do-it-yourselftax software, it will prompt you with where to locate the code. When you shop through retailer links on our site, we may earn affiliate commissions.