Content

By taking advantage of the Lifetime Learning credit, you may be able to use the costs of the course to take money off your taxes again next year. Many Americans don’t have an adequate savings account accessible in case of a sudden financial need. Using your refund to start or augment an emergency fund could leave you breathing easier should one of those events arise. To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Please allow up to 6 months from the date you filed the 1040NR for your refund.

You don’t have to quit your current job to start your own business. You know you should do more of it, but it’s hard to resist making spur-of-the-moment choices that make you happier now but worse off later. A tax refund marks a great chance to set yourself in a better position for the future. If you’re getting a windfall from the IRS, here are a dozen great ways to make sure your money continues to work for you.

Sam Price, an independent insurance broker and owner of Assurance Financial Solutions in Birmingham, Alabama, says starting an emergency fund with your refund makes more sense. There are a number of reasons why you could experience a tax refund delay. Some reasons won’t require any additional work on your part. This is the case if you claimed certain credits or if you file at certain times.

How Long It Takes The Irs To Process A Tax Refund

These five ideas can keep the “fun” in your refund while being mostly responsible and strategic with your money. If you’re waiting for your tax refund, the IRS has an online tool that lets you track the status of your payment.

You also have the option of using your tax refund to buy $5,000 or less in Series I savings bonds. There are different reasons why taxpayers get refunds, and in other cases owe money to the government. If you work for an employer, you were required to fill out a W-4 form when you were hired. On that form, you indicated the amount of taxes that needed to be withheld from each paycheck. But in reality, they often mean that you made a mistake by paying more income taxthan was necessary.

Reason For Tax Refund Delay: Mistakes On Your Return

An emergency fund is a great tool to keep you from sliding into debt when unexpected things happen in your life, and your tax refund is great seed money for an emergency fund. Simply open up a savings account at a new bank, deposit your tax refund in there, and let it sit until something goes bad in your life.

- One reason for this is because the IRS may still be making changes to their processes.

- There’s actually more than one way to receive your tax refund.

- While paying someone to file your taxes for you is convenient, there are plenty of affordable tax preparation software products that can walk you through the process of filing your taxes.

- But you also probably know that socking away that refund is wise for the long term.

If you file your tax returns electronically using e-file, you will likely receive your tax refund within 21 days. However, if you file your taxes by mail, it can take about six weeks to receive your tax refund. Filing your taxes electronically will also help protect you from tax fraud, since you aren’t sending sensitive information through the mail. There are so many ways to spend your tax refund, and while it’s tempting to go on a shopping spree, that virtually guarantees your windfall won’t last. Consider your options for saving, paying down debt and spending the money on things or experiences that could yield a physical, emotional or professional benefit. Then make a plan and commit so that when your refund arrives, you’ll know exactly how to put it to work.

Courtney Mihocik is an editor at The Simple Dollar who specializes in personal loans, student loans, auto loans, and debt consolidation loans. She is a former writer and contributing editor to Interest.com, PersonalLoans.org, and elsewhere. Trent Hamm founded The Simple Dollar in 2006 and still writes a daily column on personal finance. We are an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which TheSimpleDollar.com receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear.

Getting an income tax refund can be both exciting and stressful, as you’ll have to decide what to do with your sudden — and possibly unexpected — windfall. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. If you’re getting a huge refund each year, it may be time to adjust your tax allowances. The IRS has a withholding calculator that you can use to determine the amount you should claim on your taxes.

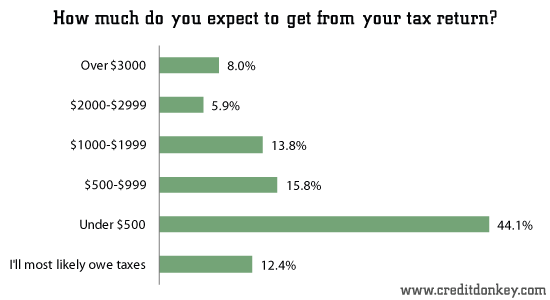

Here are five balanced options for this year’s tax refund. The key to “fun-sponsible” is using a small portion—say 10%—for fun. Then use the rest to get ahead on one of your financial goals. Last year’s average refund, according to the IRS, was $2,869. Tax season can be taxing, so a refund could make you feel rich and inspire you to splurge on unnecessary things. Instead, consider one of these eight savvy steps to turbocharge your financial security. If you adjust your withholdings, you may have more money throughout the year to reach your other financial goals, such as buying a home or paying for your child’s education.

In some states, the average federal income tax refund is over $3,000. If you lost your job during the coronavirus-caused recession, you may need to spend the refund on essentials. But if you don’t need to spend it, consider paying down your credit card debt this year. Putting your refund toward debt can certainly help you in the long run. If you have debt but are unsure which debt to tackle first, talking to a financial advisor can help you create a plan. There are many reasons your tax refund could be delayed. Perhaps your numbers and your employer’s numbers didn’t match.

A tax transcript will not help you find out when you’ll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation. According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February.

Refunds

This is particularly true if you’re committed to not getting back into debt once it’s paid off. Start by building a debt repayment plan, then use that for guidance as to what debt to pay off first. The first step in getting a tax refund is to file your tax return. You can handle this yourself, or you can pay a tax specialist like H&R Block to file on your behalf. Here are some financially smart suggestions for using your tax refund for maximum benefit, but first, let’s talk a bit about actually filing your tax return. Another not-so-glamorous, but smart way to use your tax refund? Although it can be tempting to think of your refund as ‘free money’ , your tax refund is actually money that you worked hard to earn.

You’d be better off putting that money in the stock market. It’ll still give you the thrill of the unknown, but, depending on what you invest in, you could have much better odds of receiving a return. You may be tempted to take your tax return to your local casino. Since it’s money that you didn’t expect to have, it can be easy to justify gambling with it for the chance to win even more money.

Also, if you’re struggling to get this done by April 15, you don’t have to stress out — it’s easy to file an extension on your taxes. Depending on your financial situation, there are some smart moves to make. In the event that the IRS garnishes your refund, you will receive a notice explaining why it did so. If you don’t think you owed that debt, you will need to dispute it with the agency to whom the money was paid. The IRS will contact you if there are any issues with your return. In some cases, the IRS will correct small mathematical errors. That could save you the work of having to file an amended return.

One of the factors that affects your credit score is your credit utilization ratio, or how much of your available credit you’re using on revolving accounts. Costanz says using your refund to pay down cards that are near the limit could help improve your credit utilization ratio and boost your credit score. In addition to saving for emergencies, paying down debt and funding other financial goals are productive things to do with your tax refund. If you have multiple debts, consider applying your refund to those with the highest interest first. Sometimes it’s a tough call, he adds, since financial priorities often compete. You may be torn between saving for a child’s college tuition or putting away money for retirement. Paying off debt may also be on the list of ways to spend your tax refund.

According to a 2017 GOBankingRates survey, 57 percent of Americans have less than $1,000 in savings to handle these types of situations. Even though tax season happens predictably every year, have you ever found yourself wondering, ‘What do I do with my tax refund? ’ If so, and if you’re expecting a refund this year, now’s the time to consider where it fits into your financial plan. Preparing in advance for ways to spend your tax refund lessens the odds of being caught off guard when it lands in your bank account. Putting in the prep time now may also help you avoid splurging on an impulse buy. If you received a large refund, one reason could be that you’re claiming fewer allowances on your W-4 than you should, which causes your employer to withhold more federal taxes from your paycheck. You might want to readjust your income tax withholding and have more money in your pocket every month that you could put to better use.

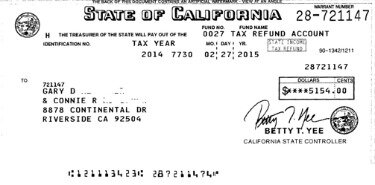

Even an extra payment or two now can make a big difference in your future obligation to the bank. Please don’t cash the refund check or spend the direct deposit refund. Tax Topic 161, Returning an Erroneous Refund – Paper Check or Direct Deposit has more information on what to do.

Here’s a guide to starting an emergency fund, along with reasons why you shouldn’t trust a credit card for this job. As long as you have at least $1,000 in a starter emergency fund, there’s no reason not to use your tax refund to pay down your debt. If you are carrying a credit card balance, consider using your tax refund to pay that off. It doesn’t make much financial sense to put the IRS check for $3,000 in a fund yielding 1% interest and maintain a $3,000 balance on a credit card account charging 18% interest.

If a bathroom or kitchen remodel or a new deck would increase your enjoyment of your abode, that’s reason enough to use your tax refund to spiff up the joint. If you have outstanding high-interest debts, start crafting your debt payoff plan. If you don’t need the money for essentials right now, you might feel more of a pull than usual this year to use it to treat yourself. How to get the most out of your tax refund this year and beyond.

Sending a check through the mail also creates the possibility of the check getting lost or sent to the wrong address. That would delay your refund similarly to the way sending a refund to the wrong bank account would. As mentioned earlier, the IRS normally takes longer to process paper returns than electronically filed returns.

Another way to use your refund is by putting it toward retirement. That may not sound very fun but it’s important to ensure you can live your golden years doing whatever you want to do. If you entered the wrong account information, there are a few things you can do.

It’s important to plan wisely and put your refund toward smart financial goals. Giving back feels good and has societal benefits, too. emergency fund to cover at least three months of must-pay living expenses. That said, having even $500 saved can help you weather a lot of emergencies, so aim for that first if you’re starting from zero. Earmarking a portion of your tax refund for the cause will give you a head start on building up your financial fortress. A tax refund can be the tool you need to take your career prospects to the next level. If you’re noticing that those co-workers getting promoted all seem to have programming skills or experience working with databases, the refund check can go toward tuition for courses in those subjects.