Content

Your property value will normally be assessed by local and municipal governments. This amount can directly affect the amount of annual taxes you pay. The easiest way to calculate your property tax is by multiplying the current local property tax rate by the current market value of your property. A tax appeal can be a final option for homeowners that want to lower their property taxes. Although you cannot argue against the tax rate, you could file an appeal with the assessor’s office to change the assessed value of your home. If you ask most homeowners about their property taxes, they’ll likely tell you they pay too much. Property taxes are real estate taxes calculated by local governments and paid by homeowners.

In most cases, it just requires a simple application. For those unable to receive a new property assessment in time, there is one more step you can take to avoid overpaying in property taxes. This involves appealing your tax bill with the help of an attorney.

If the assessments on your comps are lower, you can argue yours is too high. In some parts of Illinois and Connecticut, for example, where property tax rates can approach 4% of a home’s value, potential savings are greater. Ditto for communities with home prices well above the U.S. median. If you see an error on your property card, or you think your assessment is too high, you have the right to file an appeal, and you should definitely exercise it.

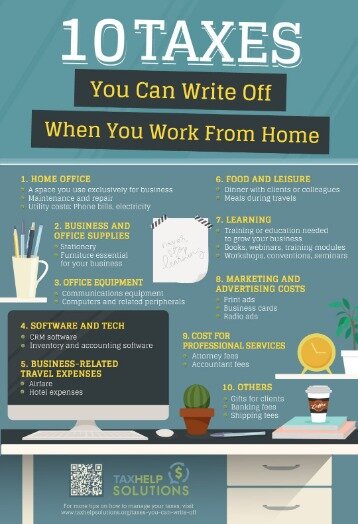

The mortgage interest deduction and other tax deductions for homeowners have fewer takers these days. An easier route to savings might lie in determining if you qualify for property tax exemptions based on age, disability, military service, or other factors. A reduction in your assessment right before you put your house on the market could hurt the sale price. Armed with your research, call your local assessor’s office. Most assessors are willing to discuss your assessment informally by phone. If not, or if you aren’t satisfied with the explanation, request a formal review.

Even if the assessments are similar, if you can show that the comparable properties are superior to yours, you may have a case for relief based on equity. Maybe your neighbor built an addition while you were still struggling to clean up storm damage. In that case, the properties are no longer comparable. Ask a REALTOR® to find three to five comparable properties — comps in real estate jargon — that have sold recently. If you’re willing to shell out between $350 and $600, you can hire an appraiser to give you a professional opinion of your home’s value. TaxesFor most tax deductions, you need to keep receipts and documents for at least 3 years. Many of the programs outlined above are stackable, meaning you could apply for both a tax freeze and a tax relief program.

Tax assessors are given a strict set of guidelines to go by when it comes to the actual evaluation process. However, the assessment still contains a certain amount of subjectivity. This means more attractive homes often receive a higher assessed value than comparable houses that are less physically appealing. Few homeowners realize they can go down to the town hall and request a copy of their property tax cards from the local assessor’s office. The tax card provides the homeowner with information the town has gathered about their propertyover time.

The New York Department Of Finance Breaks It Down Even Further If Youre A State Resident, Your Property Tax Dollars May Go To:

Here, we’ve compiled a guide on how to cut your property taxes, with tips for doing it smartly. If you have additional questions about how to lower your property taxes, you can reach out to our Consumer Action Center for free advice. This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic.

Since 1973, the Volunteer State has operated a tax relief program for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving spouses. If the review is unsuccessful, you can usually appeal the decision to an independent board, with or without the help of a lawyer. You may have to pay a modest filing fee, perhaps $10 to $25. If you end up before an appeals board, your challenge could stretch as long as a year, especially in large jurisdictions that have a high number of appeals. TaxesHere’s the scoop on what’s tax deductible when buying a house.

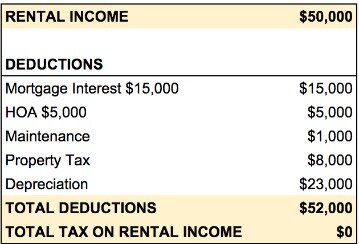

from industrial and office property to single and multi-family residential. These benefits weren’t enough for Uncle Sam, though, as a new tax loophole now allows those prudent investors who act today to lock in decades of tax-free returns. We’ve put together a comprehensive tax guidethat details how you can benefit from this once-in-a-generation investment opportunity. Access to timely real estate stock ideas and Top Ten recommendations. This article provides general information about tax laws and consequences, and shouldn’t be relied on as tax or legal advice applicable to particular transactions or circumstances. There are a few things to keep in mind as you weigh an appeal.

Your local tax collector’s office sends you your property tax bill, which is based on this assessment. If you feel you are paying too much, it’s important to know how your municipality reaches that figure on your bill. Sadly, many homeowners pay property taxes but never quite understand how they are calculated. It can be confusing and challenging, especially because there may be a disconnect between how two neighboring towns calculate their property taxes. If you’re eligible for any special property tax rebates — perhaps because you’re a senior citizen, have a low income or simply live in your state. For example, New York has a program known as STAR to save homeowners money on their school taxes.

The local tax office may have forms you have to fill out. Make sure you organize photos and documents neatly, and highlight key findings.

The Senior Citizen Property Tax Exemption

When the value of your property increases in the eyes of a tax assessor, you’ll see your bill for property taxes rise. But there are a few ways to lower them, including applying for exemptions and filing tax appeals. We’ll explore how to lower your property taxes so that you can save more money on the upkeep of your home. Revenue generated from property taxes is generally used to fund local projects and services such as fire departments, law enforcement, local public recreation, and education. Although these services benefit all residents, property taxes can be extremely burdensome for individual homeowners. Even after you pay off your mortgage, the tax bills keep coming.

If you discover that they pay less in taxes, you’ll have a good case to make. Similarly, if you know of any homes that have recently sold in the area, include them as well. If they are comparable to your home but sold for significantly less than your home’s assessment, you’ll have more to talk about at the hearing. Either way, it’s simple to fill out the form or drop an email. I’ve done a property tax appeal twice since buying my home. Each time, I’ve only spent a few minutes sizing up market conditions and values based on comps.

What many individuals don’t realize is that in many cases, information about other home assessments in the area is also available to the public. Keep in mind, your property is essentially being compared to your neighbors’ during the evaluation, as well as others in the general vicinity. While it may be difficult, resist the urge to primp your property before the assessor’s arrival. You should be able to plan ahead because the assessor normally schedules a visit in advance. Any structural changes to a home or property will increase your tax bill.

Property taxes can be one of the most frustrating expenses for homeowners, especially as they increase over time. Unfortunately, property taxes are an unavoidable aspect of homeownership, and you will be responsible for them even after you pay off your mortgage. The amount you owe will be dependent on a few factors, but you can learn how to lower your property taxes if they are too high.

Ask For Tax Breaks

Many states will allow you to freeze your property taxes at their current rate if you’re a senior, a veteran or disabled. Eligibility requirements vary from state to state, so you’ll need to check with your state’s department of taxation to find out if this is an option for you.

TaxesThe mortgage interest deduction and other tax deductions for homeowners have fewer takers these days. TaxesWhat you can deduct, such as property tax, and what you can’t — but there are definitely more cans than can’ts. If you’re paying more than neighbors in comparable houses, you need to supply the information to prove it. A realtor can pull selling prices on comparable houses for you or you can comb through tax records yourself. Elko County, Nevada, recently raised assessed valuations after it switched to new software. Even though the deadline to formally appeal had passed, the assessor promised residents it would work with them to correct any mistakes. If there are any mistakes, bring that to the attention of the assessor.

File A Tax Appeal

Study all of your state’s offerings carefully to make sure you’re taking advantage of everything that you’re eligible for. NMLS License #2611 Arizona Mortgage Banker License # N. Ravenswood Chicago, IL The company name, Guaranteed Rate, should not suggest to a consumer that Guaranteed Rate provides an interest rate guarantee prior to an interest rate lock. Housing market information is provided by Altos Research, Inc. based on analysis of all active market properties for sale in the US in the preceding week.

- When people get their annual notice of assessment in the mail, that’s when they typically get fired up about lowering their property taxes.

- Once you’re armed with information, it’s time to head back to the tax office to present your case as clearly and professionally as possible.

- Here, we’ve compiled a guide on how to cut your property taxes, with tips for doing it smartly.

- After all, the tax bill will come on its own, but you typically have to go find each property tax break on your own.

- Such links are only for the convenience of the reader, user or browser; we do not recommend or endorse the contents of any third-party sites.

The county will send the appraiser, and then it’s pretty much up to you. After all, the tax bill will come on its own, but you typically have to go find each property tax break on your own. Each jurisdiction, from townships to cities to counties to states, has its own property tax rules as they raise revenue for schools, public safety, roads and recreation. Of course, some are offered to everybody who files a return with the IRS, such as the mortgage interest deduction from your income tax. Others are very local or specific, such as tax abatements offered to investors, developers, and residents who commit their dollars to helping revive urban neighborhoods.

A deck, a pool, a large shed, or any other permanent fixture added to your home is presumed to increase its value. As you review this card, note any discrepancies, and raise these issues with the tax assessor.

How To Lower Your Property Taxes In 6 Steps

Property tax considerations for residential landlords and for farmland are two whole other fields. Many states offer property tax exemptions and other breaks to former military service people. The Lincoln Institute says that 31 states provide property tax exemptions or credits for service-related disabilities, but only 15% of veterans typically qualify. For instance, New Jersey has an average property tax rate of 2.44% and average tax bill of $7,800. High-end public school districts, for instance, often come with a high property tax bill and high appraised value for each home. Once you identify comps, check the assessments on those properties. If yours doesn’t, seek help from a real estate agent or ask neighbors to share tax information.

Some states, like Michigan, make this mill rate calculation easy on homeowners by providing an online Property Tax Estimator that includes a millage rate database. Your property tax has a purpose — funding local government. The amount you pay in property tax is based on a percentage, calculated from the value of your property.