If present, residual balances are usually the result of incorrect posting by accountants, or improper payments. After completing due diligence for each payables account, organizations can write these amounts off. In the case of personal income taxes, the term “write-off” is often used as a synonym for tax deductions that the taxpayer can use to reduce the amount of income on which they will have to pay taxes. Common deductions include state and local income and sales taxes, property taxes, mortgage interest, and medical expenses over a certain threshold. Taxpayers have a choice of writing off these deductions individually, known as itemizing, or taking the standard deduction instead. The Internal Revenue Service (IRS) allows individuals to claim a standard deduction on their income tax return and also itemize deductions if they exceed that level.

Tax credits are applied to taxes owed, lowering the overall tax bill directly. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. And when you use Planergy to track all of your procurement from purchase to pay, because it integrates with Quickbooks, it keeps workflows automated and running smoothly. After the term expires, the payable amount can be written off, as shown below with this $5,000 example. We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

What Is a Write-Off on Personal Income Taxes?

A write-off is when the recorded value of an asset is reduced to zero. A write-off may occur when an asset can no longer be liquidised, has no further use for the business, or no longer has market value. When an allowance account (contra account) is used, then the credit is to an allowance account. Later, when a specific write off is found, it is offset against the allowance account. Write-off e-docs for sponsored funds will be originated by Sponsored Financial Services.

- A reduction in the value of an asset or earnings by the amount of an expense or loss.

- Accounts payables or trade creditors may be canceled in certain circumstances.

- Later, when a specific write off is found, it is offset against the allowance account.

- Negative write-offs can harm relationships with customers and also have negative legal implications.

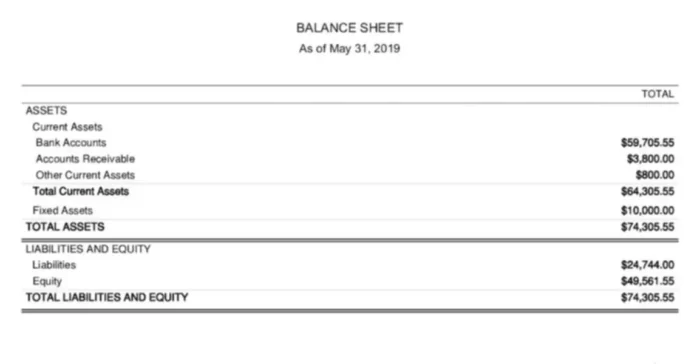

A business may need to take a write-off after determining a customer is not going to pay their bill. Generally, on the balance sheet, this will involve a debit to an unpaid receivables account as a liability and a credit to accounts receivable. Similarly, banks write off bad debt that is declared non collectable (such as a loan on a defunct business, or a credit card due that is in default), removing it from their balance sheets. A reduction in the value of an asset or earnings by the amount of an expense or loss.

Writing Off Uncollectable Receivables

Units are expected to include accounts receivable write-offs as part of the internal control initiative and include the unit-specific process and materiality threshold. When bookkeeping is combined with appropriate accounting software like Quickbooks, financial reporting is simplified. Accounts payables or trade creditors may be canceled in certain circumstances.

The item’s potential return is thus canceled and removed from (‘written off’) the business’s balance sheet. Businesses and individuals have the opportunity to claim certain deductions that reduce their taxable income. The Internal Revenue Service allows individuals to claim a standard deduction on their income tax returns. Individuals can also itemize deductions if they exceed the standard deduction level. Financial institutions use write-off accounts when they have exhausted all methods of collection action.

Thus, if a person in the United States has a taxable income of $50,000 per year, a $100 telephone for business use would lower the taxable income to $49,900. If that person is in a 25% tax bracket, the tax due would be lowered by $25. The payable party recognizes the canceled balance as income because of increased cash flow, since payment is no longer required.

When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes. You can consent to processing for these purposes configuring your preferences below. If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. Companies can also reduce a portion of an asset’s value based on depreciation or amortization. The difference between them is largely a matter of degree, but it’s also be important to understand which one to use under what circumstances.

Accounts Payable Policy: What Is It, Best Practices, and an Example Template

Asset/Liability Reconciliation Guidelines require that accounts receivable object codes be reconciled monthly, assuming monthly activity has been posted. An accounts receivable reconciliation should include an aged list of outstanding invoices and amounts that agree to the general ledger balance. Understanding write-offs—and the difference between a tax write-off and a write-down can help you reduce taxable income and increase the accuracy of how you record a business’ financial situation. Learn about the write-offs that apply to your situation and don’t miss the chance to take advantage of them when they apply.

Accounts Payable Cash Flow: How AP Impacts Cash Flow and Your Cash Flow Statement

Companies are able to write off certain expenses that are required to run the business, or have been incurred in the operation of the business and detract from retained revenues. According to those guidelines, financial liabilities should only be derecognized by the company when the obligation to pay is expired, canceled, or discharged. However, accounts receivable (AR) write offs occur once a substantial amount of time has passed after the final payment is due. Once the expense has been moved, the unit’s finance manager, BSC director, or college business officer should send the write-off request to the university controller. Include in the backup a brief narrative of the reasons for the write-off, evidence of multiple collection attempts, and the account number that will fund the write-off. A write-off is an elimination of an uncollectible accounts receivable recorded on the general ledger.

Three of the most common scenarios for business write-offs include unpaid bank loans, unpaid receivables, and losses on stored inventory. Generally accepted accounting principles (GAAP) detail the accounting entries required for a write-off. A write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account. It is primarily used in its most literal sense by businesses seeking to account for unpaid loan obligations, unpaid receivables, or losses on stored inventory. Generally, it can also be referred to broadly as something that helps to lower an annual tax bill.

A variation on the write off concept is a write down, where part of the value of an asset is charged to expense, leaving a reduced asset still on the books. For example, a settlement with a customer might allow for a 50% reduction of the amount of an invoice that the customer will pay. This represents a write down on one-half of the amount of the original invoice. It’s up to the company to credit back the amount of a discount to the consumer when that customer pays full price for a product on credit terms, then is given a discount after a payment is made.

Write-Offs vs. Write-Downs

A bad debt write-off can occur when a customer who has purchased a product or service on credit fails to pay the bill and is deemed to have defaulted on that debt. When that happens, the accounts receivable on the company’s balance sheet will written off by the amount of the bad debt, which reduces the accounts receivable balance by the amount of the write-off. Generally Accepted Accounting Principles (GAAP) detail the accounting entries required for a write-off. The two most common business accounting methods for write-offs include the direct write-off method and the allowance method. The entries used will usually vary depending on each individual scenario.