Content

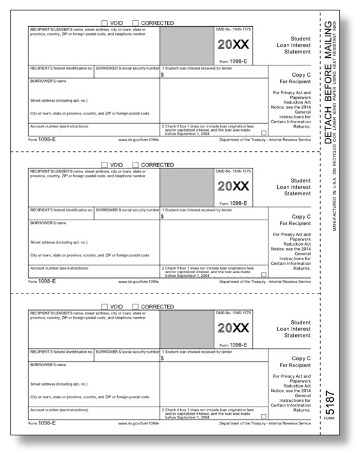

The student loan interest deduction is taken as an adjustment when calculating your adjusted gross income, or AGI. This means you don’t have to itemize your deductions to take it. The 1098-T, Tuition Statement form reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit.

1098-E and 1098-T are the gathering of the info returns. If you qualify, you can still report the interest and receive tax credit for it if you paid less than $600. The threshold just means the institution doesn’t have to bother sending you the tax form. You can find out exactly how much you paid the institution by contacting your loan servicer if you don’t receive a form. Ask for the information in writing so you have a tangible record of it to support your tax return. If you paid less than $600 in student loan interest, you might not receive Form 1098-E. However, you are still entitled to deduct this interest on your taxes.

You should receive these forms by the end of January if you’ve paid enough interest to warrant one or more. You might receive them through the U.S.

Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns.

The IRS will also get a copy of the form from the loan servicer. The IRS provides tax benefits for education. They can be used on tuition or loan interest or to maximize your college savings. If you donate a vehicle to a charitable organization , you’ll receive a 1098-C from the charity. These vehicles are frequently given to needy individuals, or sold to them at below-market rates. This form confirms that you weren’t part of that transaction. However, if the car’s value is less than $500, you may not receive one of these forms.

What If You Dont Receive A Form 1098

Your lenders have to report how much interest you pay annually. Student loan interest can be deductible on federal tax returns, but receiving a 1098-E doesn’t always mean you’re eligible to take the deduction.

Consult with your tax advisor to figure out which interest is tax deductible. The student loan interest deduction is an adjustment of your gross income. So if you paid $2500 in student loan interest, and you earned $60,000, you’ll only pay taxes on $57,500. IRS tax varieties are used for taxpayers and tax-exempt establishments to report financial info to the Internal Revenue Service of the United States.

How Do I Know If I Qualify For The Student Loan Interest Deduction?

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, we charge a $3 withdrawal fee.

The group that transmits your scholar mortgage ought to ship you a replica of Form 1098-E by January 31 must you paid not lower than $600 in focus. 1098-E experiences curiosity you paid on a scholar mortgage all through the sooner 12 months whereas 1098-t tells you methods loads you paid in tuition for post-secondary education.

- Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

- The amounts on the form encompass all money you paid to the school, even if you paid in advance – the payment appears on the tax form for the year in which it was actually paid.

- They can be used on tuition or loan interest or to maximize your college savings.

- Rapid Reload not available in VT and WY.

- One personal state program and unlimited business state program downloads are included with the purchase of this software.

Dividing the origination fee by the number of years you have to pay off the loan gives you the amount you can treat as student loan interest each year. And if the lender capitalized for unpaid accrued interest, you calculate the portion that’s deductible each year in the same way as the origination fee. When you use TurboTax to prepare and file your taxes, you don’t need to do any of these calculations on your own.

Our expert guides, reviews, and more are designed to help you achieve your financial goals. When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings.

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

Best New Bank Account Promotions & Offers

The amount you can claim for the deduction depends on your income and is subject to a cap, as discussed in a later section. If you paid interest on a qualified student loan, you may be able to deduct some or even all of that interest on your federal income tax return. Student loan companies use IRS Form 1098-E to report how much you paid in interest. Borrowers get a copy of this form, and so does the IRS. If you’re currently paying off a student loan, you may get Form 1098-E in the mail from each of your lenders.

All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

Refinancing Private Student Loans: Worth It Or Not?

You will have to look up your interest amount with your loan servicer instead. If you do not receive a 1098-E in the mail, you should be able to access the same information by logging into your loan servicer’s website. You may also choose to call or otherwise contact the servicer to ask why you never received the form. Note that you should receive a 1098-E from any company servicing your federal student loans or any private student loan lender you paid interest to. When it comes time to file your taxes, you will use this information if you are eligible to claim a student loan interest tax deduction. It’s important to note that the amount of interest paid shown on your 1098-E is not necessarily the amount of your deduction.

Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. A former student can still take this deduction even if the actual student loan payment was made by either a nonprofit where the individual works or a parent. If you don’t receive a form, contact your loan servicer directly.

It is a deduction with a “phase out period” which means as your income grows, you may have a lower deduction. For the purposes of the deduction, it doesn’t matter whether your loans are federal loans or private student loans. Both qualify for the deduction.

If you pay for home insurance directly, it will not be listed and you will need to keep track of the amounts you paid. A form 1098-E, Student Loan Interest Statement, is used to report interest of $600 or more paid to a lender for a student loan. Each year about this time, mailboxes across America are filled with tax forms. Sometimes, those tax forms go straight to a tax professional, unopened. Other times, taxpayers may dutifully open those forms and type the information, box for box, into tax preparation software.

A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc.

It is for the particulars tuition and related costs all through the 12 months. Form 1098-T moreover experiences any scholarships or grants you conformist by way of the varsity which can diminish your allowable deduction or credit score rating. You can take a deduction up to $2,500 or total interest paid, whichever is less. Enter the deduction on line 20 of Schedule 1 of the Form 1040.

Married borrowers must opt to file taxes as married filing jointly if they want to qualify for the deduction. Next year, people receiving their 1098-E Student Loan Interest Statement will still qualify to deduct student loan interest.

You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

We also get your email address to automatically create an account for you in our website. Once your account is created, you’ll be logged-in to this account. Please add difference.wiki to your ad blocking whitelist or disable your adblocking software. We need money to operate the site, and almost all of it comes from our online advertising. We’ve detected that you are using AdBlock Plus or some other adblocking software which is preventing the page from fully loading. Up to $2,500 in interest can be deducted if you meet income requirements. Don’t expect a form if the total interest is less than $600.

Most state programs are available in January. Release dates vary by state.

In this case, your current federal loan servicer will provide you with a copy of your 1098-E if you paid interest of $600 or more in 2018. That depends on how much you paid in interest, how many federal loan servicers you had, and some other factors. Read through the scenarios below to find where you fit and learn how many E’s you should expect.