Content

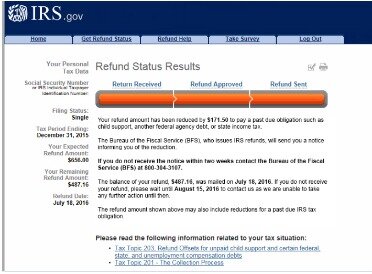

Once you enter all your information, it will tell you what is going on with your refund. Remember, if you input the wrong SSN, it could cause an IRS Error Code 9001, and might make your return be held for Identity Verification. One of the biggest areas of delays are mail returns. In 2020, we saw mail held up for months, and we expect mail delays to continue. Sending your return via mail will cause significant delays in processing. However, many tax programs do allow you to file early – and some lucky filers even get accepted into test batches with the IRS. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

In general, the IRS says that returns with refunds are processed and payments issued within 21 days. For paper filers, this can take much longer, however. The IRS and tax professionals strongly encourage electronic filing.

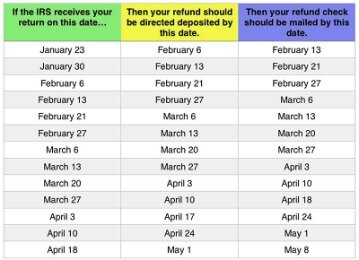

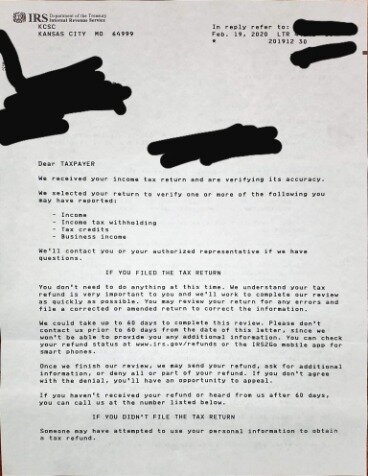

To confirm the IRS receives it, you’ll see the “accepted” message in your tracking software. If you’ve already filed your return, our assumption is there will be continued delays in processing times. If your return is under review or other information is needed, you may experience significant delays due to staffing. If you’re expecting a refund, put it to good use. Bankrate offers five smart ways to invest your tax refund. If you want a more accurate look at when you might get your tax return in 2021, check this table, based on past years and our best estimates.

I’m going to have to call back tomorrow, hopefully my issue gets resolved. I filed 2/6 and I’m still in processing too. When I call the automated system just tells me they are too busy to deal with this topic and hangs up.

Save Your Tax Return

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Filed my taxes on Feb 4th, along with my girlfriend and she receive her a couple weeks after and i have yet to even receive my state or federal. And I don’t remember the amount of my federal so I can’t call to find out where they are. However, per the IRS; a phone representative can research the status of your refund if it’s been 21 days or more since you filed electronically.

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Most refunds take about 21 days after the IRS has approved your e-filed tax return. However, there are delays that are possible due to various reasons.

Turbotax Guarantees

Also, did you have any TurboTax fees that you chose to pay out of the Federal refund? If so, the funds will go first from the IRS to the intermediary bank where the fees are subtracted. If you did use that service, we can tell you how to monitor the refund at the level of the intermediary company. If your Federal return is still processing at the IRS after all this time, and you can’t get good results from the IRS, phone the IRS Taxpayer Advocate Service. They can help tweak the IRS for you if you’re having a financial hardship. At the following IRS website, find the USA map and click on your state, and it will give you the number of your IRS Taxpayer Advocate. This is so weird but the exact same thing happened to me.

I also filed mine on February 8th and have not received my refund. So they said if I haven’t received my refund or a letter from them by April 13th then I could call again. I have no idea why it is taking so long. Just wanted to let you know that you’re not the only one stuck in this boat! I filed on 1/26/2015 and have not received anything.

the IRS cannot issue refunds that include Earned Income Tax Credit and Additional Child Tax Credit before mid-February. The PATH Act, which applies to all tax preparation methods, is intended to help detect and prevent tax fraud.

Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you. Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail. More than 90 percent of tax refunds are issued by the IRS in less than 21 days, according to the IRS. However, the exact timing depends on a range of factors, and in some cases, the process may take longer. If you filed a return with the EITC or ACTC, the IRS says you can expect your refund status to update by late February. Thank you hope to hear something back soon as possible….

Tax Refund Schedule For Extensions And Amended Tax Returns

First, it starts with your tax software, tax preparer, or your paper refund. Once you submit it, the IRS receives it.

- The tool will get you personalized refund information based on the processing of your tax return.

- However, this will likely not be as much of an issue this year due to the late start.

- Most refunds take about 21 days after the IRS has approved your e-filed tax return.

- You have to remember all the “shut down” complications.

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. And it may not be instantaneous, since ACH transactions can take up to 3 days. Turbo Tax told me my refund date would be 2/20, when the IRS said 2/22, I’m going with 2/22 since today is 2/21. I’m also experiencing a late return, I sent mines on February 6th and it says it’s being processed.

How Long Does It Take To Get My Tax Refund? 2019 Income Tax Refund Chart

Use the middle or right column to look up when you should receive your refund (depending on how you requested your refund—direct deposit or paper check). Returns are potentially delayed due to Covid-19. If you eFiled and have no issues with your tax return, you shouldn’t have any delays.

Remember, the fastest way to get your tax refund is to e-file and choose direct deposit. began accepting e-filed tax returns for the tax year 2020 on February 12, 2021 – and are wondering when you will receive your tax refund, we have the scoop. If you still haven’t received your tax refund after three weeks’ time, there may be a few reasons why. With direct deposit, you can also spread your tax refundacross as many as three accounts.

Can Turbo Tax Help Me Understand This, CAUSE A couple of friends/family filed after me and Already Received theirs back. I filed my taxes on February 8th, they were accepted the next day. It’s been a month and I recieved nothing, turbo tax says both were accepted but the IRS site that I check daily still says “processing”, what do I do? Did I do something wrong that it has taken so long. My sister filed the same day and recieved her refund 3 days later. I filed my taxes on the 22nd of January and still have yet to receive my tax refund.

If you’re approved, you should have a date and see your direct deposit in your account within a few days of that date . If you see a take action message, you may be subject to a tax offset or other issue.

There is no phone number I can find where I can speak to someone directly to find out my status but I see from these comments that I should call after 21 days. Why would TurboTax be a joke when it is actually the IRS that is slowing down everyone’s tax returns? They chose to put my refund in hiatus because I was flagged for “Identity theft”. It ended up taking me 6 weeks to get my return that I usually get in 10 days.

tool will not give you a date until your tax return is received, processed, and your tax refund is approved by the IRS. You will need your Social security number or ITIN, your filing status, and your exact refund amount.

Once you’ve filed your return, track your refund’s whereabouts with the IRS and your state. Though tracking your refund won’t actually make things move faster, it at least gives you a better idea of when to expect your money.

How Should You Request To Receive Your Refund?

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date.

You can also use Form 8888 to split your refund among up to three different bank accounts. Form 8888 allows you to use your refund to purchase U.S.

Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refund. Refunds should be processed normally after this date. Approximately 90% of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS. Most people receive their refund in an average of days. The first official day to file your 2020 tax return is February 12, 2021.

Processing of paper returns continues to be delayed due to limited staffing. Once you’ve e-filed your taxes, you will need to set up how you will receive your payment. And, if you want to make sure you get your refund as fast as possible, set up direct deposit . Speed up your refund by signing up for direct deposit when you file. That way, the money goes right into your bank account. Ask for a check, and you’re putting yourself at the mercy of the U.S.