Content

Therefore, Form 8949 is used to reflect information about transactions recorded on Form 1099-B, as well as those recorded on your own tax filings. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section 1256. Generally, these gains or losses are allocated 60% to long-term capital gains and 40% to short-term regardless of the holding period. Special rules also apply to foreign currency contracts subject to these US tax provisions. In some cases, Form 1099-B will not report the cost basis of the assets. If this is the case, the taxpayer must determine the basis amount to calculate the gain or loss from a capital asset using a separate Form 8949.

Once you have created your reports, you can download your TurboTax files. If you have transactions where basis was not reported, these transactions go on a separate Form 8949. And if you had capital asset transactions for which you did not received Form 1099-B , you must list these transactions on a another Form 8949. Therefore, if you had all three situations, you would filed three Forms 8949.

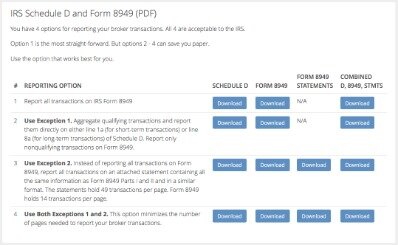

Follow the prompts to select the details about your income. Users can e-file through TurboTax® and mail the Form 8949 documentation along with Form 8453 . This method is available for 2013 tax year or later, using the Premier version of TurboTax®, which was used in the instructions below. Other higher versions of TurboTax® may support this method as well, please consult TurboTax® for guidance using those versions. If an exception applies you can still voluntarily report your transactions on Form 8949 which might be easier if you have some transactions that meet the exception requirements and some that don’t.

These can be downloaded from the Download Results page in the app. If you chose to print and mail your return, simply attach the Form 8949 from TradeLog and mail with your return. Scan your TradeLog generated Form 8949 to confirm the code you need to enter. elect the types of sales that correspond to the types listed on yourSchedule D Instruction Sheet. In TurboTax®, follow the prompts to select the details of the TradeLog Form 8949.

Turbotax Online And Premium Upload

Before completing the next steps, you’ll need to identify the sale categories you have for Form 8949. To do this, use theSchedule D Instruction Sheet generated with your Form 8949 by TradeLog. This page can be printed after running the Form 8949 report, but is not included when saving the report as PDF. If the Stocks, Mutual Funds, Bonds, Other section does not appear under Your Income, then click the Add more income button. At the Wages and income summary page, click the Start button next to Stocks, Mutual Funds, Bonds, Other. Once you have selected all details, press Continue to move on.

Form 8949 doesn’t change how your stock sales are taxed, but it does require a little more time to get your tax return done, especially if you’re more than just a casual investor. The rules surrounding transactions for special gain and loss recognition treatment under section 1256 are complex. For more information, please refer to IRS Publication 550, Investment Income and Expenses, and the Instructions to IRS Form 6781.

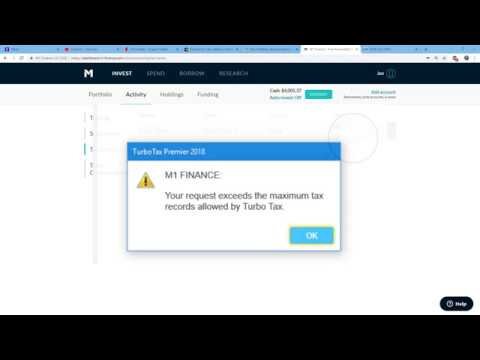

If TurboTax rejects your file for being above the 2251 transaction limit, see instructions below. If you have another sales category to enter, select Add another summary, and repeat steps. If one of the exceptions applies, then the transactions can be summarized into short-term and long-term and reported directly on Schedule D without using Form 8949. Also, just like the Schedule D, there are two sections that cover your long-term and short-term transactions on Form 8949. You then compute the total gain or loss for each category and transfer those amounts to your Schedule D and then to your 1040. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

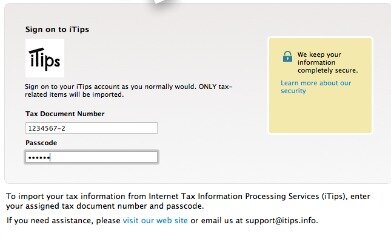

You will also need to include the totals from 8949 in your Schedule D. The values are shown underneath the download link. It can take a few minutes so you can close window and come back to it later. In your TokenTax Documents screen, create and download a Form 8949 TXF.

Schedule D And Form 8949

Taxpayers can attach a separate statement with the transaction details in a format that meets the requirements of Form 8949. Any year that you have to report a capital asset transaction, you’ll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Just click on “Download TurboTax files” and you will get a zip file. If you received the property as an inheritance, its basis is generally its value on the day the previous owner passed away. At the top of each Form 8949 you have to file, you’ll need to check box A, B or C, based on what is indicated in box 3 of the Form 1099-B. Investopedia requires writers to use primary sources to support their work.

Capital gains from trading Section 1256 contracts are reported on the consolidated 1099, specifically on the Form 1099-B for noncovered securities, discussed above. Taxpayers must use the form to report short- and long-term capital gains and losses from sales or investment exchanges.

Note that TurboTax’s CD / Desktop edition does not officially support cryptocurrency. We recommend you use the web version for the best cryptocurrency tax support. Open TurboTax and navigate to File and select “From Accounting Software” under the Import option. Replace them with the Schedule D and Forms generated by Form8949.com.

For your TurboTax tax return, you can upload a summary of your capital gains / losses. To get a summary capital gains file for TurboTax, contact our live chat support and ask for an aggregated TurboTax CSV. If you had gains and losses from capital transactions that were not reported to you on Form 1099-B, you would have to prepare another Form 8949 to report such transactions. The IRS requires taxpayers to report their income from any capital gains in order to collect the proper amount of income tax. They’ll also allow taxpayers to take a tax deduction on specified types of capital losses. Schedule D is a tax form attached to Form 1040 that reports the gains or losses you realize from the sale of your capital assets. IRS Form 8949 is used to report capital gains and losses from investments for tax purposes.

- Any year that you have to report a capital asset transaction, you’ll need to prepare Form 8949 before filling out Schedule D unless an exception applies.

- If you have a deductible loss on the sale of a capital asset, you might be eligible to use the losses you incur to offset other current and future capital gains.

- Therefore, if you had all three situations, you would filed three Forms 8949.

- Form 8949, Sales and Other Dispositions of Capital Assets (i.e. stocks, bonds, mutual fund shares) was introduced in 2011.

- For example, when you enter stock sales reported on Form 1099-B, TurboTax will generate the 8949.

You will also need to download and print Form 8453 to send in with your statement. This will download a file you can import directly into TaxACT. If you enter your name and SSN, we will print them onto the form with all your other information. Or you can leave them blank, but you will then need to write them in yourself onto the printed forms. This will allow you to import just your summarized short and long term gain / loss to TurboTax. Only use this option if you are mailing in the complete 8949 separately with the Form 8453.

How To Import Crypto Into Turbotax Cd

We also strongly recommend that you consult your tax advisor for this area of law. The sale or exchange of a capital asset not reported on another form or schedule. You must complete a separate Form 8949 to cover each of the three situations described above. In other words, if you have transactions where basis was reported, these transactions go on one Form 8949. If the cost or other basis of the securities being sold is not reported on Form 1099-B, in other words, box 3 is blank, you must use a separate Form 8949 to list these types of transactions. Pace a checkmark in Box A if the broker reported the basis of your capital asset transaction. The reason for Form 8949 is that, the IRS is having brokers report the cost or other basis for capital asset transactions, such as the sale of stocks, bond, or mutual fund shares.

If you have a deductible loss on the sale of a capital asset, you might be eligible to use the losses you incur to offset other current and future capital gains. The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. While Schedule D is typically used to report capital gain or loss transactions, Form 8949 must be completed first. The transactions you report on Form 8949 are reported by brokerages every year to the IRS, and will be reported to you on Form 1099-B. Form 1099-B reports the cost basis of your buy and sell transactions.

Form 4797 is used to report gains made from the sale or exchange of business property, including but not limited to property used to generate rental income. Anyone filing a joint return must complete as many copies of the form necessary to report their transactions along with those of their spouse. The forms may be combined or separate, but the totals from every completed Form 8949 must be transferred to Schedule D for both spouses. Once your capital gains have all been calculated you will need to include them in your taxes. It is possible to include your crypto with your tax return via the TurboTax desktop / CD / downloaded edition. Note that the transaction limit in this case is higher than the their web version, at 3,000 transactions. Our app will generate for you the required PDF statementsshowing your transaction details.

You will need to select and enter your totals for report category C and F. C is for short-term capital gains and F is long-term capital gains. Open the file you have downloaded and you will see two sections, Part 1 and Part 2 . At the bottom of each of these are the totals you require. The gains you report are subject to income tax, but the rate of tax you’ll pay depends on how long you hold the asset before selling.

Irs Form 8949: Sales And Other Dispositions Of Capital Assets Definition

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). After you list every stock sale for the year, you’ll be able to calculate your total gain or loss to report on Schedule D. The first is for your short-term stock sales and the second part is for your long-term sales. This is important because short-term and long-term sales are taxed at different rates. Form 8949 tells the IRS all of the details about each stock trade you make during the year, not just the total gain or loss that you report on Schedule D.

When you use TurboTax to prepare your taxes, we’ll do these calculations and fill in all the right forms for you. We can even directly import stock transactions from many brokerages and financial institutions, right into your tax return. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money you gained and report it on a Schedule D. Depending on your situation, you may also need to use Form 8949. Capital assets held for personal use that are sold at a loss generally do not need to be reported on your taxes. To use TurboTax Online and import your form 8949, first login to ZenLedger.

Turbotax Guarantees

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. As of 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Form 8949, Sales and Other Dispositions of Capital Assets (i.e. stocks, bonds, mutual fund shares) was introduced in 2011. Up until 2011, you could total your transactions on Schedule D; these days, you may be required to list them separately using Form 8949. With a few key instructions, you can easily report your capital gains and losses in your next tax filing. If you must report capital gains and losses from an investment in the past year, you’ll need to file Form 8949.