Content

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. But non-citizens without work authorization sometimes have to file U.S. tax returns, too—if they have income from U.S. sources, for example, or if they are entitled to a refund of withheld money under a tax treaty. U.S. citizen taxpayers typically use Social Security numbers to identify themselves and their family members to the Internal Revenue Service, better known as the IRS. But some non-citizens who have U.S. tax obligations aren’t eligible to receive a Social Security number. Instead, they can apply for an individual taxpayer identification number, or ITIN, by submitting Form W-7 to the IRS. The IRS sends this letter to let you know that they are returning original documents, such as your passport or proof of identity . Foreigners need to apply for an ITIN from the IRS if they have a federal tax filing requirement and do not qualify for a Social Security Number .

It is provided for general informational purposes only and does not constitute advice of any kind. For convenience, this Website may contain links to third-party websites. Easy Doc Filing, LLC does not control, endorse, or assume responsibility for the nature, content, accuracy, and availability of such websites. Easy Doc Filing, LLC does not guarantee availability of the Website and is not responsible for temporary unavailability due to technical issues. Easy Doc Filing, LLC is not a law firm and does not offer legal advice or recommendations.

- If you are single and pregnant, learn about different topics related to taxes and potentially filing as Head of Household.

- Instead of using an SSN, the ITIN will be used for filing taxes with the IRS.

- If they can’t file tax returns, mixed–immigration status families with members who are eligible for health insurance under the ACA will not be able to prove that they have complied with the individual mandate.

- You must apply for an ITIN – Individual Taxpayer Identification Number – when you have a U.S. tax filing or informational reporting requirement.

You can file Form W-7, Application for IRS Individual Taxpayer Identification Number , with your federal income tax return. You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status.

What To Do Upon Receipt Of The Itin

To sum up, a tax id number, also known as the taxpayer identification number is a 9-digit number, which begins with the number “9” and is formatted like an SSN (xxx-xxx-xxx). You’ll need to read through Publication 1915, and then to complete and sign the W-7 in draft form. US Tax Help will review the preliminary W-7 you prepare, and will address any discrepancies or errors if need be.

If you are hiring an Acceptance Agent to help with your ITIN application and U.S. tax return, then they will enter their information in this section as well as sign the form. Currently, there are 13 different documents that the IRS will accept for proof of identity and proof of foreign status. However, using your passport is the easiest and most common choice. If you are a foreigner and you formed an LLC in the U.S., you will need to speak with an accountant to determine if you owe U.S. taxes. Most people who form an LLC in the U.S. will have a federal tax filing requirement in the U.S. The IRS has revised the list of documents acceptable as proof of identity and foreign status.

What Documents Are Acceptable As Proof Of Identity And Foreign Status?

If the applicant is a dependent, the document must also prove U.S. residency, unless the applicant is a dependent of U.S. military personnel who are stationed overseas, or is from Mexico or Canada. Designed specifically for tax-administration purposes, ITINs are only issued to people who are not eligible to obtain a Social Security Number from the Social Security Administration.

ITINs are issued to both resident and nonresident aliens (“alien” is the legal term for foreigner), since the IRS does not get involved with immigration. However, our team is currently experiencing unanticipated delays in processing submitted documentation. If we cannot verify your personal information, we will ask you to send us documentation in the app that confirms your identity. I know tax issues need to be handled immediately which is why I’m available 24/7.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. LLC University® is an educational company and does not offer legal, tax, or financial advice. Our step-by-step guide will make the process a breeze – and no complex legal jargon! LLC University® teaches people how to form an LLC for free in all 50 states. We hope you find our free guides and resources helpful in your business journey. If you have any questions or need to check on an ITIN application, you can call the IRS at .

Get More With These Free Tax Calculators And Money

An ITIN is issued because a US citizen, resident and nonresident alien might have to file an Income Tax Return in the US. If you are submitting your ITIN application along with your federal tax return, you may send all documents to the address provided to you by Sprintax. You can apply for an ITIN any time during the year when you have a filing or reporting requirement. At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date. If the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties. If you meet one of the exceptions listed on the form W-7 and do not need to file a tax return, apply for the ITIN as soon as you determine that you are covered by the specific exception. If you must file a U.S. tax return or you are listed on a tax return as a spouse or a dependent and you are not eligible to obtain a valid SSN, you must apply for an ITIN number.

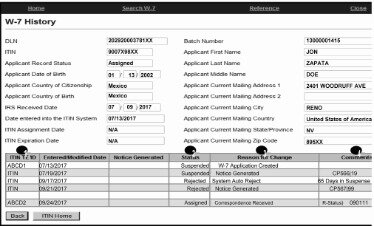

This could prevent them from being able to renew their health insurance the following year. To file for an ITIN renewal, fill out the W-7 form and check the “Renew Existing ITIN” box. If an individual has an expired ITIN but is not required to file taxes, they do not need to renew their ITIN. However, if in the future an individual with an expired ITIN is required to file a U.S. federal tax return using that ITIN , they will need to renew the ITIN at that time. Outside of peak processing times , it should take up to six weeks for an applicant to receive their ITIN. However, because most ITIN applications must be filed with tax returns, they are typically filed during peak processing times. Any original documents or certified copies submitted in support of an ITIN application will be returned within 65 days.

This article is written for non-US residents and non-US citizens (“foreigners”) who have formed an LLC in the U.S. and now need to file taxes with the U.S. Write your correct residence address on the W-7 form since both your original documents and your ITIN number will be mailed to the address you provide. Check if you have included the street address, unit number, and zip code. If your originals are not returned within 60 days call the IRS at the telephone assistance number. To be on the safe side, mail your application by insured mail so that you receive a receipt.

You will also use an EIN to open a business bank account after forming an LLC in the U.S. If you are the person applying for the ITIN (your name is in #1), then you should sign the form, enter the date, and your phone number.

To the right, you must enter the Treaty Country and the Treaty Article Number. For more information on U.S. tax treaties, please see Publication 901 and About Publication 901.

What Is Form W

office closure, students applying for an ITIN should compile all application materials listed below and send them via email to their HIO Advisor. Your HIO Advisor will review the documents and provide you a digital HIO authorization letter. You will then need to print your full ITIN application and mail it to the IRS.

People who do not receive their original and certified documents within 65 days of mailing them to the IRS may call to check on their documents’ whereabouts. In order to apply for an ITIN, Form W-7 must be completed and attached to the tax return and mailed to the IRS. It may also be filed in person at any IRS Tax Assistance Center in the United States, or through an authorized acceptance agent. The IRS advises allowing 7 weeks for processing, or 9 to 11 weeks if filing during tax season.

Easy Doc Filing, LLC does not submit the ITIN application to the IRS on behalf of their clients. Submission of the ITIN application to the IRS is the sole responsibility of the client. Any individual may obtain, prepare, and submit his or her own ITIN application at no cost directly to the IRS. Use of this website does not make you a client, or a prospective client, of Easy Doc Filing, LLC. Easy Doc Filing, LLC makes no warranties or representations, express or implied, regarding the information on this Website. Easy Doc Filing, LLC is not liable for any and all damages resulting from the use of, reference to, or reliance on information provided on this Website.

The IRS provides ITINs to people who are ineligible for an SSN so that they can comply with tax laws. Since 1996, the IRS has issued ITINs to taxpayers and their dependents who are not eligible to obtain a Social Security number . record to submit a letter from the HIO certifying the applicant’s identity. Unfortunately, some of the ITIN Operations Center adjudicators do not apply this exemption. The only solution for this is to reapply with the same materials and the HIO letter. Please follow the instructions linked above to compile your application before coming to the HIO for the certification letter.

The name on your refund check will be spelled the way it appears on your tax return. If the address label you receive is spelled wrong, do not use the label. You can also call and the IRS can correct the spelling of your name over the phone, or visit the Social Security Administration website. You might need to apply for new social security number from the the Social Security Administration website for a newborn or a adopted child or if your spouse is from a foreign country and needs a SSN. Or, you might have to correct your existing social security number with the IRS if the IRS has an incorrect SSN on file for your tax account. Immigrants will not be able to get an ITIN and file income tax returns. As a result, they won’t be able to comply with their obligations under federal tax laws.

Individual Taxpayer Identification Number (itin)

Individuals sometimes want to obtain ITINs for family members. The ITIN might be helpful in claiming state tax benefits and credits. Please review the IRS’s ITIN application instructions to determine if, or how, your dependents might qualify for an ITIN. ITINs are required for family members who do not have SSNs and are being claimed as tax dependents on a student’s or scholar’s annual state tax filing. F-1 Students receiving grants, fellowships, or scholarships from Harvard may find ITIN application instructions and guidance to complete the required IRS form below. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19.

To renew an ITIN, you will resubmit Form W-7 and you will check off “Renew an Existing ITIN” in the upper right of the form. Instead, whenever the above forms ask for an SSN or ITIN, just enter “ITIN to be requested“. As per U.S. law, a foreigner cannot have both an ITIN and an SSN. This number is issued by the Social Security Administration to identify a US Citizen, Permanent Resident, or Temporary Nonimmigrant Worker. If your ITIN Application was incomplete or missing documents, you will receive a CP-566 notice, which is the IRS telling you that they need more information in order to process your ITIN Application.