Content

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, it’s also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year.

If you received a large refund last year, you should also adjust your withholdings and claim fewer exemptions, since this means you had too much in taxes withheld from your earnings. Let’s say you take on a second job or side gig to earn some extra money this year. That’s because a second job will likely increase your income, which will then increase the amount you’ll owe in taxes.

The old W-4 form and instructions didn’t mention income from self-employment. But if you have a side job as an independent contractor (i.e., not an “employee”), you can use the new W-4 form to have taxes taken out of your regular job’s paycheck to cover your side job, too. (This would be instead of making estimated tax payments for your second job.) You’ll definitely want to use the IRS’s Tax Withholding Estimator tool for this. You can also pay self-employment taxes through withholding from your regular-job wages. When new hires are handed a W-4 starting in 2020, “they may need to call their accountant to ask questions, or have their spouse look up information from their last tax return,” Isberg points out. They’ll need to know what their total deductions were last year, if they still qualify for the child tax credit, how much non-wage income they reported on their last return, and similar tax-related things.

(Remember, a large refund just means you gave the IRS an interest-free loan.) We recommend an annual check using the IRS’s Tax Withholding Estimator to make sure you’re on track as far as your withholding goes . If your tax withholding is off kilter, go ahead and submit a new W-4 as soon as possible. This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home.

Figuring out how many allowances to claim was a big headscratcher for a lot of employees, so they probably won’t be missed. Step 4 accounts for deductions and unearned income, such as from interest, dividends and Social Security. A deductions worksheet for Step 4 on the form factors in itemized deductions, including mortgage interest, charitable contributions, medical expenses and state and local taxes. If you are taking the standard deduction, you can add such deductions as student loan interest and deductible IRA contributions on the worksheet. However, do not add the actual standard deduction amount to the total as this will result in an error.

The Tax Cuts And Jobs Act May Affect Your Taxes

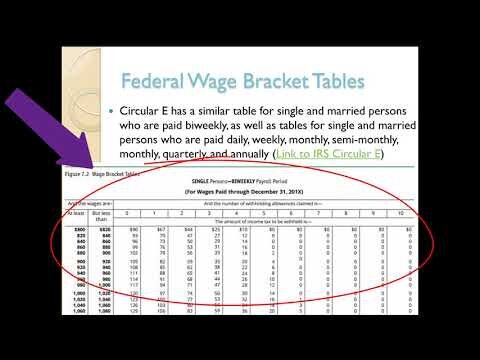

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute thecurrent tax ratesand income brackets. Calculate your income and deductions based on what you expect for this year and use the current tax rates to determine your projected tax. You must specify the dollar amount of State tax you want withheld from your monthly payments. The minimum amount we can withhold for State income tax is $5. Use Services Online to start, change, or stop the State tax withheld from your annuity payment.

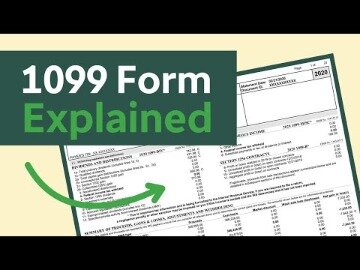

If you need more information about tax withholding, read IRS Publication 554, Tax Guide for Seniors, and Publication 915, Social Security and Equivalent Railroad Retirement Benefits. When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Use the new PAYucator so you can see what the actual paycheck withholding is. When you complete your new 2021 W-4 Form here on eFile.com, you should also estimate your tax return for the given tax year.

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. Get a better understanding of your personal tax situation before you get your taxes done with eFile.com. As soon as you start a new wage earning job, you will have to submit this form to your employer, not IRS.

To ensure accuracy, use your combined income to figure out the appropriate withholding. If you count on a big tax refund every year, you should also pay attention to your withholding because how much you have withheld directly impacts your refund. Avoid a surprise at tax time and check your withholding amount. Too much can mean you won’t have use of the money until you receive a tax refund. To make the best use of your money, try to pay the right amount of tax throughout the year by having the correct amount withheld.

Understand Your Tax Refund

Married persons filing jointly qualify for a lower tax rate and other deductions than filing as single. Getting a divorce can take you back to single or head of household status and reverse many tax benefits. If you fail to account for these events on your W-4, your withholdings could be inaccurate. Every time you earn income, you’ll most likely owe income taxes. How much your employer sets aside to pay on your behalf is determined by the information you submit on your Form W-4. To change their tax withholding, employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer.

Use TurboTax’s W-4 Withholding Calculator to determine the amount of withholding you should state on you and your spouse’s W-4s. The goal is to reduce the potential for a tax bill and have a tax refund at zero or close to it. Taxpayers with more complex situations may need to use Publication 505 instead of the Tax Withholding Estimator. This includes employees who owe, the alternative minimum tax or tax on unearned income from dependents. It can also help those who receive non-wage income such as dividends, capital gains, rents and royalties.

You Can Set Up Withholding For A Side Job

However, that likely means you’re not making the best use of your paycheck. If you need more information or assistance in determining whether or you are not having the right amount of Federal income tax withheld, see the Internal Revenue Service website at If you write, your letter should include your claim number and the monthly amount in dollars you want withheld. We will send you a Form W-4P-A, “Election of Federal Income Tax Withholding,” and instructions for making the change. The change in your withholdings will be made after we receive your Form W-4P-A. The information entered will be used to calculate your federal or state withholding tax on future payrolls. If you’ve updated your federal withholdings, a new Form W-4 will be created and you’ll be prompted to e-sign.

Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t.

Generally, unless you specify a monthly withholding rate or amount, we withhold Federal income tax as if you are married and claiming three allowances. Use Services Online to start, change, or stop the Federal tax withheld from your annuity payment or specify the dollar amount withheld. An employee may change the number of withholding exemptions and/or allowances he or she claims on Form W-4, Employee’s Withholding Allowance Certificate. It is generally advisable for an employee to change his or her withholding so that it matches his or her projected federal tax liability as closely as possible. If an employer overwithholds through Form W-4 instructions, then the employee has essentially provided the IRS with an interest-free loan.

Ensuring you have the right amount of tax withheld from your paycheck can make a big difference in your tax outcome next year. To calculate the precise amount they withhold, employers rely on the information all new employees fill out on their Form W-4 forms. If too much taxes are withheld, employees may receive refunds. Taxpayers may change the number of withholding allowances they claim based on their estimated and anticipated deductions, credits, and losses for the year. The tax refund you may receive at the end of a tax year is not free money. When you receive a check or your direct deposited refund, you are receiving money that was rightfully yours to begin with.

To make withholding more accurate, as of January 1, 2020, the IRS has a new Form W-4. While you cannot claim the same allowances as your spouse, you can split them up as needed. According to the IRS, two-income households and individuals who work multiple jobs are vulnerable to withholding disparities. When your children grow up and move out, you must readjust your withholding. Sign the form and return it to your local Social Security office by mail or in person.

If you receive a tax refund in 2021 for your 2020 Tax Return, you had withheld too much. A refund in 2022 would mean you would give your money to the IRS during 2021 through too much paycheck tax withholding just to get it back in 2022. Submit or resubmit anytime you want to balance your taxes due to life changing events. Use the Taxometer and pick a tax balance goal for your next tax return. If you were faced with hardship that affected you financially during 2020, you may want to adjust your withholding in 2021 so you can keep more of your money each paycheck. Be warned, though, that if you claim an exemption, you’ll have no income tax withheld from your paycheck and you may owe taxes when you file your return.

You may also need to call us for special or complex cases, or because we directed you to. Your claim number will start with “CSA” or just “A”, or with “CSF” or just “F”; have 7 numbers in the middle; and end with 1 number or 1 letter. Before sharing sensitive information, make sure you’re on a federal government site. Gusto’s mission is to create a world where work empowers a better life.

- Use the Taxometer and pick a tax balance goal for your next tax return.

- A lot of people who got tax refunds in previous years were shocked to discover that they had to pay taxes when they filed their 2018 tax return.

- The IRS had plenty of unhappy customers during the 2019 filing season.

- If you received a large refund last year, you should also adjust your withholdings and claim fewer exemptions, since this means you had too much in taxes withheld from your earnings.

- The old-fashioned way is to walk through the worksheets on the W-4 form.

In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes. At the same time, some taxpayers don’t want to risk having a tax bill at the end of the year – no matter how small. If that’s how you feel, adjust accordingly, provide your revised W-4 form to your employer, and plan for a small tax refund. You generally have less Federal taxes withheld when you check the “Married” box. That’s because the withholding tables assume you are married filing jointly with a non-working spouse.

How To Check Withholding

The more allowances you claim on your Form W-4, the less income tax will be withheld from each paycheck. The right amount or balanced amount of tax withholding per pay period for the tax year is good because it keeps you from paying all your taxes at once when you file your tax return. Too much tax withholding will result in a tax refund – some argue it’s a form of financially self imposed penalty. Clearly, the trick is to balance your withholding and thus your taxes so you don’t owe nor get a too big of a tax refund. Choosing to have too much tax withheld may feel safer and easier than figuring out how much you should withhold and how to complete the form. However, there’s nothing safe about letting the IRS hold your money for a year or more completely interest-free. The small investment of time to make sure your income tax withholding is correct is well worth it.