Content

We have you covered and are here to share some information regarding Recovery Rebate Credits so you can feel more informed and possibly save money on your 2020 taxes. Of course it’s always a little more complicated than this and I recommend using a tax accountant this year even if you normally file them yourself, just to make sure everything is done right, but that’s the basic idea. Suppose your taxable income in 2020 comes out to $70,000. And suppose from there that your tax owed is $10,000, and $11,000 was withheld by your employer, meaning you already ‘paid’ it.

The Federal Solar Tax Credit is a credit you can claim for installing solar powered equipment in your home, which can ultimately reduce the amount of tax you need to pay to good old Uncle Sam. Most appliances, including refrigerators and stoves, no longer apply for a tax credit. The energy tax credit mainly applies to major installations that are used to generate alternative energy, such as solar or wind. Due to the popularity of solar panels in many parts of the country, the IRS has a special solar energy tax credit available for taxpayers who install them. The energy tax credit is designed for people who want to improve their homes to make them more energy-efficient. One example of this may be installing solar panels to generate energy from the sun.

You are not allowed to claim the Federal residential solar credit for installing solar powered units in your rental properties. The only exception is if you live in one of your rental properties for at least part of the year. The tax program will automatically send Form 5695 alongside your tax return. They guarantee 100% accuracy and give you access to professional tax preparers who will personally review your tax return.

Add Credit To Schedule 3

You are eligible for the Federal ITC as long as you own your solar energy system, rather than lease it. If you sign a lease agreement, the third-party owner gets the solar tax credit associated with the system. This is also true for the vast majority of state and local incentives for solar, although in some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates . You are also eligible even if the solar energy system is not on your primary residence – as long as you own the property and live in it for part of the year, you can claim the solar tax credit. Governments often use tax laws to encourage, or discourage, certain activities. The federal tax code includes a variety of tax credits designed to promote different types of investment.

I never received the first nor the second stimulus check. Katharina Reekmans is an Enrolled Agent and a contributor to the TurboTax Blog team.

Under the eligibility rules by the IRS, the child must be under the age of 17 at the end of the year for the tax return on which the IRS bases the payment in order to receive the additional payment. Any dependent who is over age 17 and claimed on someone else’s tax return is not be eligible for the additional stimulus check. The IRS is responsible for determining taxpayer eligibility for receiving a stimulus and, if a taxpayer is eligible, how and when the stimulus payments will be delivered to them. According to the IRS, they will issue payments using the most recent information they have on file, likely from your 2019 tax return.

in order to add up your credits and determine how much you’re eligible to claim from Uncle Sam. With solar leasing, you can still save money on your bills, but you won’t be able to claim any tax incentives. This is a massive blow to the ROI of installing the system in the first place.

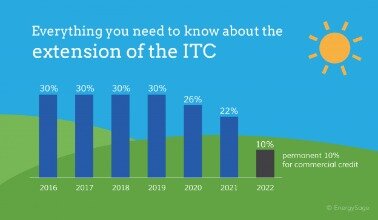

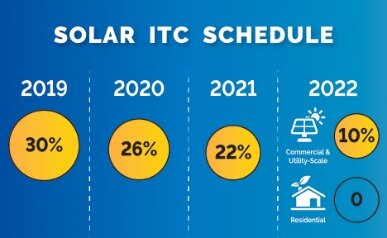

The full value of the credit was only available through to the end of 2019. Every year, afterward, the value of the credit decreased in increments, before stopping at the end of 2021. This means you do not have long before it expires completely. Frank Ellis is a Traverse City Tax Preparation Planner and published author. He has written tax and finance related articles for twelve years and has published over 1000 articles on leading financial websites.

Information in the many web pages that are linked to TaxSlayer’s Website comes from a variety of sources. Some of this information comes from official TaxSlayer licensees, but much of it comes from unofficial or unaffiliated organizations and individuals, both internal and external to TaxSlayer. TaxSlayer does not author, edit, or monitor these unofficial pages or links.

How Much Money Can Be Saved With This Tax Credit?

Making use of renewable energy in your home could be a significant tax move for you. Claiming either of the tax credits requires you to reduce the tax basis of your home by an amount equal to the total of both credits you claim. The tax basis of your home is essentially the price you paid for it or the cost to construct it.

Determine if you are eligibleMake sure you have enough tax appetite to use the federal ITC against your total taxes. The percentage of the credit you can claim is directly correlated with the amount of time you spend there. For example, if you have a vacation home you spend three months at, you can only claim 25% of the total value of the credit.

You’ll be expected to prove your expenditure if you get audited. You agree not to hold TaxSlayer liable for any loss or damage of any sort incurred as a result of any such dealings with any merchant or information or service provider through the Site. You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current. The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred.

In fact, TaxSlayer offers highly affordable pricing for filers with basic and more complicated returns. Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021.

Failure to Comply With Terms and Conditions and Termination. TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. TaxSlayer reserves the right to refuse to post or to remove any information or materials, in whole or in part, that, in its sole discretion, are unacceptable, undesirable, inappropriate or in violation of these Terms of Service. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records.

Us Tax News

Turbotax says we’ve gotten everything already from the 1st payment and won’t let me file the rebate credit. It only lists the information from the 1st payment. second stimulus payment ($600 single, $1,200 married filing jointly) plus $600 for each qualifying child. If that is the case, you do not need to complete any information on your 2020 taxes. The steps above outline all you need to do to have 26% of the cost of your solar panel system credited back to you! If you did energy efficiency improvements to your home in the same year, you may also need to complete page 2 of Form 5695. Either way, be sure to include Form 5695 when you submit your taxes to the IRS.

Now you need to calculate if you will have enough tax liability to get the full 26% credit in one year. First, you will need to know the qualified solar electric property costs. That is the total gross cost of your solar energy system after any cash rebates.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Enter your income and we’ll guide you through the rest of your return to maximize your refund.

- The credit is only available for improvements you make to your residence.

- If you sign a lease agreement, the third-party owner gets the solar tax credit associated with the system.

- These taxpayers should receive information from the business telling them what to put on the form to claim their portion.

- Frank Ellis is a Traverse City Tax Preparation Planner and published author.

In order to get the credit, you must actually own the solar energy system. If you simply lease it from the solar company, then it is not owned by you and you won’t get the credit. If you’re looking for a cost-friendly online tax filing software, TaxSlayer doesn’t disappoint. It’s possible to file both your state and federal return for free and the paid versions are priced lower than some of TaxSlayer’s main competitors.

Complete IRS Form 5695This form validates your qualification for renewable energy credits, and can be obtained online. If you have questions you can connect live via one-way video to a TurboTax tax expert or CPA. TurboTax Live tax experts and CPAs are available in English and Spanish and can also review, sign, and file your tax return. Since it is a tax credit not a tax deduction, the value of the credit can be taken off your tax payment directly.

We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges. You are responsible for paying any additional tax owed. Our Simply Free Edition is excluded from this guarantee. To qualify for the guarantee, the larger refund or smaller tax due cannot be attributed to variations in data you provided TaxSlayer for tax preparation, or for positions taken by you or your preparer that are contrary to the law.

You get all forms, all credits, and all deductions for less than The Other Guys. Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket. Based on the information you provided, when you file your taxes for the 2020 return year you will be able to use the rebate recovery credit for the second stimulus payment. The maximum adjusted gross income for a single taxpayer is $75,000 and the information for the first stimulus payment was based on information from 2019 tax return.

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. We’ll use the national average gross cost of a solar energy system as an example.

There is no maximum on the amount of credit you can claim. To claim the credit, you must file IRS Form 5695 as part of your tax return; you calculate the credit on the form, and then enter the result on your 1040. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If you didn’t receive a full stimulus payment then you can claim the Recovery Rebate Credit for any recovery rebate amount that is more than the stimulus payment you received. This also means you may be able to increase your tax refund or lower what you owe.

Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer. Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund. TaxSlayer is proud to offer qualified customers with a completely Free Federal tax return. Available to all U.S. residents and resident aliens with an AGI $69,000 or less and age 51 or younger. All prices here, and on all outward facing TaxSlayer.com sites, are subject to change at any time without notice. Price is determined at the time of print and/or e-file.

so you use the correct forms and don’t make any mistakes. Claiming the Solar Investment Tax Credit is worth 30% of the system cost. This applies to paying contractors and the cost of the parts. To be eligible for the credit you must own the system outright by either purchasing . If you haven’t purchased the solar powered equipment yet, don’t worry.