Content

If you run a business in two countries in that same vein, you may not be sure if your business qualifies as based in the United States. Financial institutions may pay you interest. For instance, most savings accounts earn interest, but you can also earn interest from bonds or other accounts. Banks must produce a 1099-INT on your behalf if you earn more than $10 worth of interest. FACTA requires foreign banks to notify the U.S. government about accounts held by Americans. To comply with FATCA, foreign banks need to know the name, tax ID number, address, account number, and balance of all American account holders.

You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account.

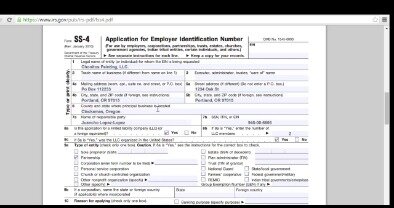

For individuals, that’s usually a Social Security number, which is issued by the Social Security Administration. People who must pay federal income tax, but aren’t eligible to get a Social Security number, can apply for an individual taxpayer identification number, or ITIN, from the IRS. For companies, the TIN is an employer identification number, which the IRS issues. Generally, the organizations that provide your income — such as an employer, a company that contracts freelance work from you, or an IRA administrator — have to share that information with the IRS too.

Filling Out Form W

Ideally, you’ll deliver it in person to limit your exposure toidentity theft, but this method often isn’t practical. Mail is considered relatively secure. If you must email the form, you should encrypt both the document and your email message and triple-check that you have the recipient’s correct email address before sending your message. Free services are available online to help you do this, but check their reputations before trusting your documents to them. Typically the business that needs to submit a W-9 to the IRS will give you one to fill out. Form W-9 tells you to cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. Form W-9 is one of the most straightforward IRS forms to complete, but if tax forms make you nervous, don’t worry.

If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only.

Reduce Your Risk Of Tax Troubles By Knowing The Answer To The Question: “what Is A W9?”

Once they have the form, businesses don’t send it to the IRS. Instead, they keep it in their files. Then, when they report information to the IRS about payments made to you, they have your tax ID number, and they can note that number on their documents. Although most payments your business makes to individuals and businesses who prepare a W-9 are not subject to withholding, the IRS may subject the payee to backup withholding.

A W-4 form is completed by employees to let employers know how much tax to withhold from their paycheck. W-9 forms are for independent contractors, also called freelancers. It’s important to fill out the form correctly—but only if you’re sure it’s the right form to submit and the request is legit. If you think the person requesting the form has no business asking for it, though, refusal is probably a good idea. If you’re concerned, ask a tax professional what you should do. If you refuse in response to a legitimate request, your client will withhold taxes from your pay at a rate of 24%.

Am I Required By Law To Obtain Form W

The W-9 differs from a W-4 Form—which is more commonly supplied by employees to direct employers—in that the W-9 does not inherently arrange for the withholding of any taxes due. Any required taxes based on gains related to the provided W-9 are the responsibility of the TIN holder listed on the document unless the taxpayer is subject to backup withholding. If backup withholding is required, this will need to be noted on the W-9, to properly inform the entity receiving the information of the need to withhold accordingly.

Just keep it with your records and use it to prepare a 1099-MISC for any individual or business to which you paid $600 or more by cash or check during the year. Every business based in the United States who has contracted a domestic independent contractor needs to collect the completed Form W-9. A domestic person is a US person defined as such for tax purposes. You don’t need to file this form to the IRS, but only keep a record of it. Every independent contractor (usually working as a sole proprietor or self-employed) in the United States needs to fill in the information return through Form W-9. Keep in mind this is only used if you are not hired as an employee.

You should expect to receive a W-9 tax form from any company or individual, other than an employer, who paid you more than $600 per year. It’s a simple form, but make sure you fill it out accurately and provide your correct taxpayer identification number and address. The requesting company may need the information to prepare and file a 1099 that will let the IRS know how much it paid you during the tax year. And failing to properly complete a W-9 could mean your payments become subject to backup withholding. Generally, if a company is required to file an information return with the IRS to report amounts of $600 or more paid to you during a tax year, it may ask you to complete a W-9 tax form. That means freelancers and independent contractors may receive a request for a W-9 from companies they do work for, but they’re not the only taxpayers who might receive a request to complete the form.

The FATCA code entered on this form indicating that I am exempt from FATCA reporting is correct. We already mentioned what FATCA means in the section above.

The form is never actually sent to the IRS, but is maintained by the individual who files the information return for verification purposes. The information on the Form W-9 and the payment made are reported on a Form 1099. If so, you need to inform the company that you are providing the W-9 to that they need to withhold taxes from the money that they pay you. Form W-9—Request for Taxpayer Identification Number and Certification—is a commonly used IRS form for business owners and independent contractors. Find out why you may be asked to complete a W-9 and how to accurately do so. You’re probably familiar with many tax forms, from the 1040 to the W-2 to the 1099.

- For additional W-9 tax form details, you can review the Form W-9 Instructions, which are included with theIRS W-9 formon its website.

- Enrolled Agents do not provide legal representation; signed Power of Attorney required.

- The IRS permits requesters to use an electronic system for receiving W-9s, but be sure you understand how the company requesting the form wants you to send it back.

- Instead, the corresponding Form W-4 and Form W-2 should be filed instead.

- OBTP# B13696 ©2018 HRB Tax Group, Inc.

Payees that are exempt from backupwithholding, such as corporations , might need to enter a code in the “Exempt payee code” box. The Form W-9 instructions list the exempt payees and their codes and the types of payments for which these codes should be used. Corporations filling out a W-9 for receipt of interest or dividend payments, for example, would enter code “5.” Even though employees are legally required to supply certain personal information to their employers, an employee’s privacy is protected by law. An employer who discloses an employee’s personal information in any unauthorized way may be subjected to civil and criminal prosecution.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

Returning Form W

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Countless assumes no liability for actions taken in reliance upon the information contained herein. On the form, there are only 2 sections – SSN or EIN.