Content

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. TaxAct Self-Employed is part of TaxAct’s suite of tax preparation applications that are available online, or as a download that can be installed on your desktop or laptop computer. Easily save this report to your computer or print it at any time.

You can still deduct those costs as business expenses. That includes sole proprietorships, farms, and real estate rentals. The new law only eliminated the deduction for work-related expenses for traditional employees. If you typically deduct unreimbursed job expenses as an employee, get prepared for a change this tax season. All unreimbursed job expenses for traditional employees are no longer tax deductible. Here’s a breakdown of how that tax reform change may impact your 2018 return.

You can deduct your expenses for the reader as impairment-related work expenses. Use Form 4562, to claim the depreciation deduction for a computer you placed in service after 2018. Complete Form 4562, if you are claiming a section 179 deduction. You are a fee-basis state or local government official claiming expenses in performing that job. Claim most deductions as an itemized deduction on your Schedule A , or Schedule A (Form 1040-NR). If you use a part of your home regularly and exclusively to conduct business, you may be able to deduct a part of the operating expenses and depreciation of your home.

Paying electronically is quick, easy, and faster than mailing in a check or money order. Go to IRS.gov/Payments for information on how to make a payment using any of the following options. Download the official IRS2Go app to your mobile device to check your refund status. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts.

Navigating Employee Business Expenses

Go to IRS.gov/TCE, download the free IRS2Go app, or call for information on free tax return preparation. 587 for more detailed information and a worksheet for figuring the deduction.

However, the trip must be primarily related to a new job search in order for the travel expenses to be deductible. If looking for a job is not the main objective of the trip, you may still be able to deduct some travel costs. The amount of time spent on personal activity compared to the amount of time spent searching for work will determine whether the trip is primarily a personal or a job searching trip. If you’re self-employed and use part of your home for your business, you can deduct home office business expenses against your self-employment income.

Unreimbursed Employee Expenses: What Can Be Deducted?

547, Casualties, Disasters, and Thefts, for more information. You can’t reduce your gambling winnings by your gambling losses and report the difference. You must report the full amount of your winnings as income and claim your losses as an itemized deduction. Therefore, your records should show your winnings separately from your losses. You must report the full amount of your gambling winnings for the year on your Schedule 1 . You deduct your gambling losses for the year on your Schedule A . Gambling losses include the actual cost of wagers plus expenses incurred in connection with the conduct of the gambling activity, such as travel to and from a casino.

Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. The IRS doesn’t initiate contact with taxpayers by email, text messages, telephone calls, or social media channels to request personal or financial information. This includes requests for personal identification numbers , passwords, or similar information for credit cards, banks, or other financial accounts. Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. You can also download and view popular tax publications and instructions (including the Instructions for Forms 1040 and 1040-SR) on mobile devices as an eBook at IRS.gov/eBooks. Or you can go to IRS.gov/OrderForms to place an order.

What Counts As Unreimbursed Employee Expenses?

And if you have to pay a fee to cancel a business lease, that expense is deductible, too. If you spent $3,000 on caroperating expensesand used your car for business 10% of the time, your deduction would be $300. She enters her transportation expenses of $500 as a reservist and she enters the amount of her expenses for the purchase of uniforms and their cleaning, $250.

Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account.

If your standard deduction is greater than the sum of your itemized deductions, save yourself the trouble and take the flat-rate. “We know that there has been an increase in the number of people working from home due to the coronavirus,” Lisa Greene-Lewis, CPA, and tax expert with TurboTax said last year.

These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

If you use your car for business reasons, such as driving goods to a customer’s house, you can deduct the actual business mileage on the car or take a standard deduction cents per mile in 2010. Deduct property used in connection with your business.

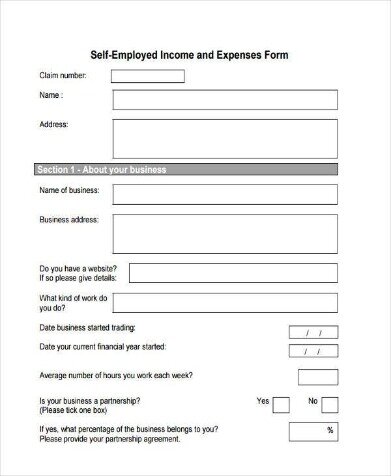

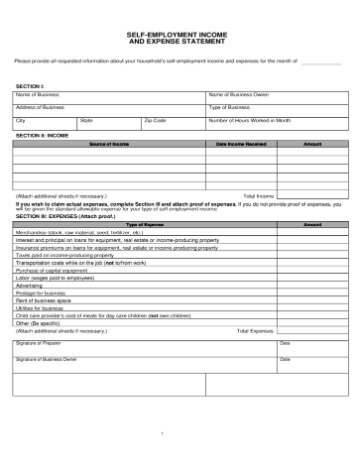

Credits & Deductions

According to the IRS website, “You can’t deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home.” The simplified option is a clear choice if you’re pressed for time or can’t pull together good records of your deductible home office expenses. However, because the simplified option is calculated as $5 per square foot, with a maximum of 300 square feet, the most you’ll be able to deduct is $1,500. If your home office occupies 15% of your home, for example, then 15% of your annual electricity bill becomes tax-deductible. Some of these deductions, such as mortgage interest and home depreciation, apply only to those who own rather than rent their home office space. Self-employed individuals determine their net income from self-employment and deductions based on their method of accounting. Before the changes in tax laws, the unreimbursed employee expenses were deducted on Schedule A , line 21, or Schedule A , line 7.

- If you have a personal checking account, you can’t deduct fees charged by the bank for the privilege of writing checks, even if the account pays interest.

- Examples of tax-deductible startup costs include market research and travel-related costs for starting your business, scoping out potential business locations, advertising, attorney fees, and accountant fees.

- Damaged or stolen property used in performing services as an employee is a miscellaneous deduction and can no longer be deducted.

- Some of it is reimbursed by the employee while others remain unpaid.

The entire expense is deductible; there are no limits depending on your adjusted gross income. Before 2018, employees who incurred job-related expenses, such as travel expenses and job-specific expenses, were able to deduct itemized deductions on their federal tax returns. Unfortunately, the new tax reforms sounded a death knell for miscellaneous itemized deductions, including unreimbursed employee expenses for the tax years 2018 to 2025. Tax reform not only eliminated this deduction for unreimbursed employee business expenses, but also eliminated all other miscellaneous itemized deductions subject to the 2% limit. One of the results of the Tax Cuts and Jobs Act was removing the deduction for un-reimbursed employee business expenses until 2026 tax returns.

You can’t deduct gambling losses that are more than your winnings. Generally, nonresident aliens can’t deduct gambling losses on your Schedule A (Form 1040-NR). You can deduct the federal estate tax attributable to income in respect of a decedent that you as a beneficiary include in your gross income. Income in respect of the decedent is gross income that the decedent would have received had death not occurred and that wasn’t properly includible in the decedent’s final income tax return.

Professional Organization Dues

Generally, if you first elected to amortize bond premium before 1998, the above treatment of the premium doesn’t apply to bonds you acquired before 1988. Repayments of more than $3,000 under a claim of right. You can’t deduct a loss based on the mere disappearance of money or property. However, an accidental loss or disappearance of property can qualify as a casualty if it results from an identifiable event that is sudden, unexpected, or unusual. The value of wages never received or lost vacation time. Losses from the sale of your home, furniture, personal car, etc.

Had adjusted gross income of $16,000 or less before deducting expenses as a performing artist. These business expenses must directly relate to your profession under one of the four previously mentioned categories.