Both methods appear very similar but are philosophically different. Depreciation is used to spread the cost of long-term assets out over their lifespans. Like amortization, you can write off an expense over a longer time period to reduce your taxable income. However, there is a key difference in amortization vs. depreciation. For individuals and businesses, understanding the amortization of loans helps in planning monthly budgets and long-term financial strategies. Knowing how much needs to be paid, when, and how much of it goes towards interest versus principal allows for better financial management and decision-making.

- Longer-term loans will generally have lower monthly payments, but result in higher total interest paid over the life of the loan.

- An agile finance team will be prepared not just for current expenses but for the future too.

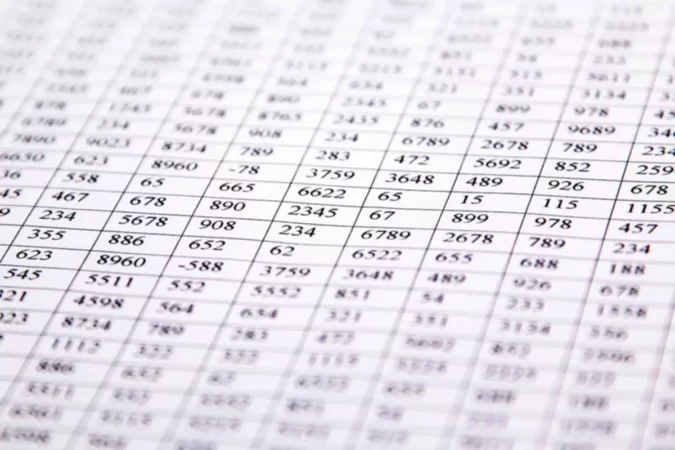

- An amortization schedule is a table or chart that outlines both loan and payment information for reducing a term loan (i.e., mortgage loan, personal loan, car loan, etc.).

- On the balance sheet, as a contra account, will be the accumulated amortization account.

- This practice aligns with the accounting principle of matching, where expenses are reported in the same period as the revenues they help to generate.

- If a borrower refinances the loan, makes extra payments, or misses payments, the original amortization schedule is modified.

It involves allocating the cost of intangible assets over their useful life, reflecting their consumption and utility in generating revenue. This article aims to explore amortization expense in-depth, covering its calculation, impact on financial statements, and relevance across various sectors. Amortization deals with intangible assets and usually employs a straight-line method, assuming no residual value. In contrast, depreciation pertains to tangible assets, offers several calculation methods, and considers salvage value. Both significantly impact a company’s financial statements and tax calculations. Amortization is important because it helps businesses and investors understand and forecast their costs over time.

Amortizing a loan

Additionally, be sure to evaluate the advantages and disadvantages of each option. Amortization and depreciation each involve spreading out the cost of an asset, but there are a few key differences between them. Subtract the residual value of the asset from its original value. If the asset has no residual value, simply divide the initial value by the lifespan. Depreciation is only used to calculate how use, wear and tear and obsolescence reduce the value of a tangible asset.

If there is a residual value, it should be subtracted from the cost of the asset to determine the amount to be amortized. Another difference is that the IRS indicates most intangible assets have a useful life of 15 years. For example, computer equipment can depreciate quickly because of rapid advancements in technology. It should be noted that computer software is an intangible asset. Early in the life of the loan, most of the monthly payment goes toward interest, while toward the end it is mostly made up of principal.

Tax and accounting regions

This is reflected in the asset’s carrying amount (original cost minus accumulated amortization). Amortization is similar to depreciation but there are some differences. Perhaps the biggest point of differentiation is that amortization expenses intangible assets while depreciation expenses tangible(physical) assets over their useful life. To assess performance, we will instead use EBITDA (earnings before interest, taxes, depreciation and amortization), which is more directly related to a company’s financial health. Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Concerning a loan, amortization focuses on spreading out loan payments over time.

The IRS has schedules that dictate the total number of years in which to expense tangible and intangible assets for tax purposes. Amortized loans feature a level payment over their lives, which helps individuals budget their cash flows over the long term. Amortized loans are also beneficial in that there is always a principal component in each payment, so that the outstanding balance of the loan is reduced incrementally over time.

Alternatively, amortization is only applicable to intangible assets. When a company acquires an asset, that asset may have a long useful life. To more accurately reflect the use of these types of assets, the cost of business assets can be expensed each year over the life of the asset. The expense amounts are then used as a tax deduction, reducing the tax liability of the business. A loan is amortized by determining the monthly payment due over the term of the loan.

Structure of an amortization schedule

As the principal decreases over time, the interest portion of each payment reduces, while the portion applied to the principal increases. If the straight-line rate is 20% (based on a 5-year useful life), the double declining balance rate would be 40%. For a $100,000 asset, the first year’s amortization would be $40,000, then 40% of the remaining book value in subsequent years.

Patriot’s online accounting software is easy-to-use and made for small business owners and their accountants. A design patent has a 14-year lifespan from the date it is granted. A business client develops a product it intends to sell and purchases a patent for the invention for $100,000. On the client’s income statement, it records an asset of $100,000 for the patent.

What is the maximum number of years for amortization?

This is also applicable to loans whose book value reduces over the years through fixed and varied interest rates. On the other hand, as we’ve already discussed, amortization applies to intangible assets. In addition, you will generally record depreciation as an expense on the income statement, whereas for amortization, you will not. You can also use it to simplify the accounting process and make reporting easier. By spreading out the payments, you can more accurately track their expenses over time and adequately recognize them on your financial statements. This allows for better accuracy and transparency when it comes to managing finances.

Usually, the amortization of intangible assets or loans can effectively help you reduce tax liability. Taxable income is reduced when amortization is dedicated; hence your end-of-the-year bill lowers. For each year, you can subtract a part of the intangible asset cost. Amortization in accounting is the process of expending an asset’s value over the period of its useful life in your balance sheet. So, the cost required to procure or manage the asset is recorded in the expense sheet rather than the income statement.

How Do I Know Whether to Amortize or Depreciate an Asset?

This practice not only aids in accurately depicting a company’s profitability and financial health but also ensures compliance with accounting standards and principles. Amortization expense is a vital element in financial accounting, reflecting the usage of intangible assets in a business. Its correct calculation and reporting are essential for presenting an accurate picture of a company’s financial health and aiding in informed decision-making. Comprehensive knowledge of amortization is thus indispensable for professionals in finance, accounting, and business management. Amortization is almost always calculated on a straight-line basis.