Content

A 1099 Form reports income from self employment earnings, interest and dividends, government payments, and more. “I’m a single mom with 2 kids and have personal and business income, and TurboTax walked me through both of them. So incredibly helpful and easy.” A portion of your living space can also be deductible, so long as it’s dedicated exclusively to business purposes, Hall said. Simply divide the square footage of your business space by your overall living space and use that ratio to determine what you pay each month for work space.

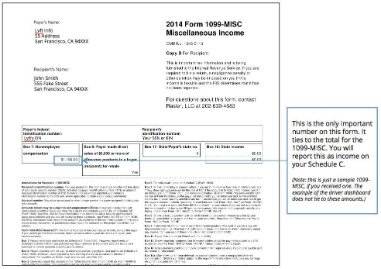

You report instances where these payments equal $600 or more during the year. You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under backup withholding rules, regardless of amount withheld or the amount that you paid them. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

Tax Forms Included With Turbotax Cd

You may use either Form 1099-MISC or Form 1099-NEC to report direct sales of $5,000 or more made by the payer. If you are involved in a trade or business and either make a payment to other people or entities, you will likely need to report these transactions to the IRS if they total more than certain amounts during the tax year. Form 1099-MISC reports payments other than nonemployee compensation made by a trade or business to others.

You must also file Form 1099-MISC for each person from whom you’ve withheld any federal income tax under backup withholding rules, regardless of the payment amount. Other than the change for nonemployee compensation, the use of Form 1099-MISC remains mostly the same for payment reporting. As a self-employed individual, you must pay Social Security and Medicare taxes.

Get More With These Free Tax Calculators And Money

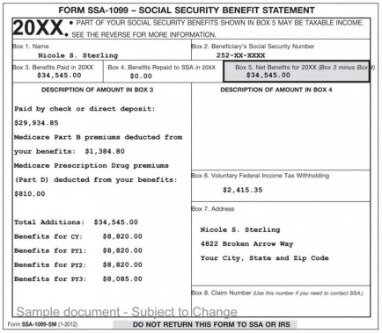

The form also shows your tax withholdings for the year, including federal and state taxes. The Internal Revenue Service requires most payments of interest income to be reported on tax form 1099-INT by the person or entity that makes the payments. This is most commonly a bank, other financial institution or government agency. If you receive a 1099-INT, you may not have to pay income tax on the interest it reports, but you may still need to report it on your return.

- Form 1099-MISC reports payments other than nonemployee compensation made by a trade or business to others.

- Besides the payments you’ve made or received, the 1099-MISC also includes some of your personal information such as your name, address and either your Social Security number or employer identification number.

- Beginning with the 2012 tax year, if you are self-employed, report your 1099-K payments on Schedule C on a separate revenue line.

- One Form 1099-MISC should be filed for each person or non-incorporated entity to whom the business has paid at least $10 in royalties or at least $600 for items such as rent and medical or health care payments.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

However, this form recently changed, and it no longer includes nonemployee compensation the way it did in the past. You may have looked in Box 7 of Form 1099-MISC to see how much a business or client reported that they paid you. However, you can still use Form 1099-MISC for reporting nonemployee compensation for tax years prior to 2020. In tax year 2020, the IRS reintroduced Form 1099-NEC for reporting independent contractor income, otherwise known as nonemployee compensation. If you’re self-employed, income you receive during the year might be reported on the 1099-NEC, but Form 1099-MISC is still used to report certain payments of $600 or more you made to other businesses and people. This article covers the 1099-MISC instructions to help you navigate this updated form.

Earnings such as investment income are not subject to Social Security and Medicare taxes. Essentially, the W-2 will give you a sense of how much you were paid and how much you’ve already submitted to the IRS and your state in taxes. One of the benefits of being self-employed are the many deductions you can qualify for depending on your line of work. Learn more about which expenses you can deduct with our Self-Employed Expense Estimator above or browse the articles below for more details on how to get a tax break. If box 3 of your 1099-INT includes interest from U.S. savings bonds that were issued after 1989, you may be eligible to exclude those amounts from tax if you use the proceeds to pay qualified higher education expenses. In order to do so, you’ll need to report the excludable amount on Schedule B and prepare Form 8815. You must prepare a Schedule B with the name of each payer and the amount of interest received when the combined total of taxable interest reported on all 1099-INTs exceeds $1,500.

The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

What Is An Irs 1099 Form?

If you’re stuck, the back of the form provides a brief description of the types of payments to be reported in each box. For example, Box 5 covers the individual’s share of all proceeds from the sale of a catch or the fair market value of a distribution in kind to each crew member of a fishing boat. If you withheld taxes for a person who has not furnished a taxpayer identification number or who is subject to backup withholding, report this figure here. In Box 3, include any other income of $600 or more which cannot be reported in any of the other boxes on the form.

As a business owner, you have many tax rules to follow to properly report your revenues and expenses. If you are an online retailer and accept credit card payments over the Internet, you may also have to deal with reporting any 1099-K forms that you receive from credit card or third party processors. Accounting for these forms accurately is important to ensure that you do not pay too much or too little tax. Boxes 4, 10a, 10b and 11 report information about the federal, state and local income taxes withheld from any government payments you received. When you prepare your 2020 tax return, you’ll need to report the $1,500 refund as income since you took a deduction for the full $5,000 but then got $1,500 back in 2020. Form 1099-MISC, for Miscellaneous Income, is a tax form that businesses complete to report various payments made throughout the year.

When you use TurboTax Self-Employed, we’ll ask you simple questions about your life and fill out all the right forms for your tax situation. The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax. When you own a portfolio of stock investments or mutual funds, you may receive a Form 1099-DIV to report the dividends and other distributions you receive during the year. Rather, it is a payment of the corporation’s earnings directly to shareholders.

Here are some tips to decode these two forms and what to expect when preparing your taxes. When you use TurboTax to prepare your taxes, you’ll just need to answer some simple questions about your income and 1099-INT forms. It is also important to report all federal tax withheld reported in box 4 in the “payments” section of your return. Doing so will either reduce the amount of tax you’ll owe with your return or will increase your refund. All amounts reported in box 1 must be reported on the “taxable interest” line of your tax return and are taxed in the same way as the other income you report on the return.

This article answers the question, “What is the 1099-MISC form?” after the reintroduction of the 1099-NEC. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

For example, if your credit card company no longer requires you to pay your outstanding balance, it may send you Form 1099-C to report the amount of debt it cancels and you may need to report this amount on your tax return. For example, if you are a freelance writer, consultant or artist, you hire yourself out to individuals or companies on a contract basis. The income you receive from each job you take should be reported to you on Form 1099-MISC. When you prepare your tax return, the IRS requires you to report all of this income and pay income tax on it. Your are still required to report all of your income even if you do not receive a 1099-MISC. Organize them by type and in the order they go in the tax return ; that will make entering them on your return easier. After you’ve gotten organized, Beyrer suggests taking time to make sure you’ve received every 1099 that should be coming to you to avoid facing penalties from the IRS for failure to report income.

Therefore, if you accept credit card payments online, you may end up with a 1099-K at the end of the year that summarizes all of your sales transactions with each processor. If you use TurboTax to prepare your taxes, we’ll ask straightforward questions about your income and fill in all the appropriate tax forms for you. If a business fails to issue a form by the 1099-NEC or 1099-MISC deadline, the penalty varies from $50 to $270 per form, depending on how long past the deadline the business issues the form. If a business intentionally disregards the requirement to provide a correct payee statement, it’s subject to a minimum penalty of $550 per form or 10% of the income reported on the form, with no maximum. Beginning with tax year 2020, Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. However, since January 31, 2021 is a Sunday, the 2020 tax year deadline is moved to Monday, February 1, 2021. This means the business owner must send all copies of Form-NEC Copy A to the IRS by that date and send Copy B and Copy 2 to any nonemployees for whom a form was completed.

However, since your 1099-NEC income is not subject to employment-tax withholding, you’re required to pay these taxes yourself. As a result, your 1099 form won’t show the taxes you’ve already paid to the government—just your income from each client. Depending on your money-making activities, you may receive a few different 1099 forms to track your income. For example, you might receive a 1099-K form, which is used for payments via settlement entities to record your business transactions for the year. Use the sum total of your 1099 forms to calculate your total income and AGI.

A Closer Look At Irs Form 1099

These interest payments are also taxable and are usually reported to you on Form 1099-INT. Commonly, taxpayers receive this form from banks where they have interest bearing accounts. Get unlimited advice as you do your taxes, or now even have everything done for you from start to finish. The table titled “Where To Report Certain Items From 2020 Forms W-2, 1097, 1098, and 1099” shows that for returns involving income reported on most versions of Form 1099, the use of Form 1040 is required. There are many types of deductions to consider if you receive a Form 1099-NEC, which is typically received by self-employed individuals and small-business owners. Keith Hall, a tax adviser for the Annapolis Junction, Maryland-based National Association for the Self-Employed, suggests keeping meticulous track of every single business expense, no matter how small. It also includes expenses that are easy to miss, even if you have a separate business account, including mileage of car trips to the office supplies store and restaurants.

You’ll need to file the 1099 with the IRS by the end of February, although you’ll have until March 31st if you file it electronically. If you ever need to pay a lawsuit settlement other than those to compensate an individual for physical injuries or medical expenses, that’s a 1099-MISC as well.