Content

A dependent’s standard deduction cannot be more than the basic standard deduction for non-dependents, or less than a certain minimum ($950 in 2010). Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

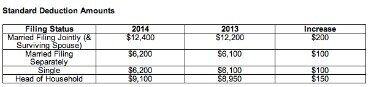

For tax year 2020, for example, the standard deduction for those filing as married filing jointly is $24,800, up $400 from the prior year. But that deduction applies to income earned in 2020, which is filed with the IRS in 2021. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020.

Additionally, this rule does not apply if the dependent makes equal to or greater than the standard deduction for their filing status. Learn more about how to file a tax return as a dependent. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. The IRS allows you to take the standard deduction if you do not itemize your deductions using Schedule A of Form 1040 to calculate taxable income. The amount of your standard deduction is based on your filing status, age, and whether you are disabled or claimed as a dependent on someone else’s tax return. Under United States tax law, the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable.

For anyone who is both 65 and blind, the additional deduction amount is doubled. Before the tax reform law, about two-thirds of all taxpayers claimed the standard deduction. That jumped to almost 90% for the 2018 tax year, which was the first year for the enhanced standard deduction. Since then, the vast majority of American taxpayers have continued to claim the standard deduction on their tax return. If you’re using tax software, it’s probably worth the time to answer all the questions about itemized deductions that might apply to you. The software can run your return both ways to see which method produces a lower tax bill.

Get More With These Free Tax Calculators And Money

For the 2020 tax year, the standard deduction was adjusted slightly for inflation. So, if you’re single, the standard deduction is now $12,400.

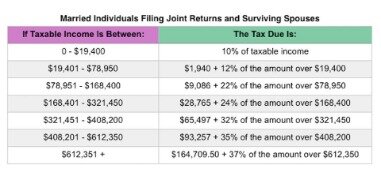

If so, your standard deduction amount can’t exceed the greater of either a) $1,100 or b) your total earned income plus $350. If you live in a state that requires you to pay income taxes, there may be a state-based standard deduction that you can claim on your state tax return. A tax deduction is a type of tax break. It reduces the amount of money you owe Uncle Sam. Tax deductions lower your tax burden by lowering your taxable income and you can either claim the standard deduction or itemize your deductions when you file. For tax year the standard deduction is $12,400 for single filers and $24,800 for joint filers.

Many costs and contributions are deductible, including charitable gifts, mortgage interest, student loan interest, some business-related costs and medical expenses. Deducting these individual expenses on your tax return is known as itemizing deductions. In order to claim these deductions, you’ll need to have some kind of evidence indicating that you are eligible to have a portion of your income exempt from taxation. Taxpayers who are age 65 and older, and individuals who are legally blind receive an additional standard deduction. It’s calculated by adding the taxpayer’s standard deduction based on their filing status, plus an additional amount.

Where’s My Refund? How To Track Your Tax Refund Status

Most taxpayers use the standard deduction to reduce their taxable incomes. Additional Standard Deduction – You’re allowed an additional deduction if you’re age 65 or older at the end of the tax year. You’re considered to be 65 on the day before your 65th birthday. You’re allowed an additional deduction for blindness if you’re blind on the last day of the tax year. For the definition of blindness, refer to Publication 501, Dependents, Standard Deduction, and Filing Information. Individual Income Tax Returnor Form 1040-SR, U.S.

It is important to note that taxable income and total income earned for the year are not the same. This is because the government allows a portion of the total income earned to be subtracted or deducted to reduce the income that will be taxed. Taxable income is usually smaller than total income due to deductions, which help to reduce your tax bill. In 2021 the standard deduction is $12,550 for singles filers and married filing separately, $25,100 for joint filers and $18,800 for head of household. Taxes shouldn’t be this complicated.

The loss of personal exemptions offset some of the gain from higher standard deductions, but the net result was a small increase in the taxable income threshold for both singles and couples. All previous tax year tax returns can no longer be e-Filed. You can calculate and estimate back taxes with the eFile.com 2018 Tax Calculators and complete, sign, and print the tax forms here on eFile.com.

Information Menu

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Rather than taking the standard deduction, taxpayers can choose to itemize their deductions. In the past, about 70 percent of taxpayers chose to take the standard deduction. As married filing separately if one spouse itemizes deductions, the other spouse can not claim the standard deduction. If one spouse itemizes deductions, then the other spouse must also itemize deductions in order to claim deductions. As married filing separately, if one spouse itemizes deductions, the other spouse can not claim the standard deduction.

- We do not include the universe of companies or financial offers that may be available to you.

- Taxpayers who are 65 or older, or who are blind, receive larger standard deduction amounts.

- Learn more about how to file a tax return as a dependent.

- The standard deduction is $1,300 higher for those who are over 65 or blind; it’s $1,650 higher if also unmarried and not a surviving spouse (in 2021, that part rises to $1,700).

Normally, if the total value of itemized deductions is higher than the standard deduction, you would itemize. Otherwise, you should opt for the standard deduction. The amount of your standard deduction is based on your filing status, age, and other criteria. The standard deduction is $1,300 higher for those who are over 65 or blind; it’s $1,650 higher if also unmarried and not a surviving spouse (in 2021, that part rises to $1,700). The IRS lets you choose to deduct either your state and local sales tax or income tax, along with some foreign taxes.

Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. It also limited the mortgage interest deduction on properties bought after Dec. 15, 2017 to loans of $750,000 (it was $1 million under previous rules).

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Taxpayers can claim a standard deduction when filing their tax returns, thereby reducing their taxable income and the taxes they owe.

You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state.