Content

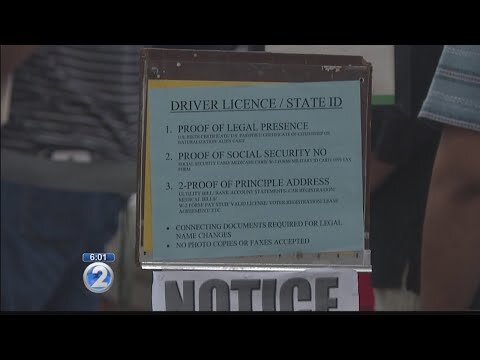

Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. Don’t want to mail your documents? You may be eligible to use an IRS authorized Certifying Acceptance Agent or make an appointment at a designated IRS Taxpayer Assistance Center. That way, you can hand-deliver your documents to the IRS. To find a local CAA in your area, go to the IRS’s CAA program webpage. You can also find a Taxpayer Assistance Center near you on the IRS website.

However, taxpayers must still note a reason for needing an ITIN on the Form W-7. In 2019, ITINs with the middle digits 83, 84, 85, 86, or 87 expired, so if your number includes any of those, it needs to be renewed (if it hasn’t already). Those with the middle digits 73, 74, 75, 76, 77, 81, or 82 expired in 2018; those with the middle numbers 70, 71, 72, and 80 expired in 2017; and those with 78 and 79 expired in 2016. Work with Certified Acceptance Agents authorized by the IRS to help taxpayers apply for an ITIN.

The IRS continues to urge affected taxpayers to submit their renewal applications early to avoid refund delays next year. Any ITIN with middle digits 88 (e.g., 9NN-88-NNNN) expires in 2020, as does any ITIN not used on a tax return in the past three years. In addition, ITINs with middle digits 90, 91, 92, 94, 95, 96, 97, 98 or 99 that were assigned before 2013 and have not already been renewed will also expire at the end of the year. You can also renew ITINs with middle digits 70 through 87 that expired in 2016 to 2019 if you expect to have a filing requirement in 2021. To renew an ITIN, a taxpayer must complete Form W-7 and submit all required documentation. Taxpayers submitting a Form W-7 to renew their ITIN are not required to attach a federal tax return.

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. To file for an ITIN renewal, fill out the W-7 form and check the “Renew Existing ITIN” box.

So, in this case, the whole family can apply at the same time. Also indicate the reason for applying. There are eight different options, including an “Other” option. If Reason B is marked (non-resident alien filing a U.S. federal tax return), you must also include a complete foreign address. The IRS will process renewal applications in order of receipt.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

It’s Itin Renewal Time!

Please note that a tax return is not required with a renewal application. Individual Taxpayer Identification Numbers are issued by the Internal Revenue Service to those individuals who are not eligible to obtain a Social Security Number, but need to satisfy U.S. tax obligations and file U.S. tax returns. Those requiring ITINs include foreign individuals who reside outside of the U.S. and have income effectively connected with a trade or business in the U.S., investors in U.S. Partnerships, spouses of Foreign Workers residing in the U.S., among others. The IRS has mailednoticesto inform these categories of ITIN holders above that they must renew an ITIN if they plan to file a tax return in 2021.

Outside of peak processing times , it should take up to six weeks for an applicant to receive their ITIN. However, because most ITIN applications must be filed with tax returns, they are typically filed during peak processing times. As a result, it can take 8 to 10 weeks to receive an ITIN. Any original documents or certified copies submitted in support of an ITIN application will be returned within 65 days. People who do not receive their original and certified documents within 65 days of mailing them to the IRS may call to check on their documents’ whereabouts. Under the Protecting Americans from Tax Hikes Act, ITINs that have not been used on a federal tax return at least once in the last three consecutive years and those issued before 2013 will expire. This year ITINs with middle digits 88 will expire December 31, 2020.

Consult your attorney for legal advice. Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply. What if I receive another tax form after I’ve filed my return?

Taxpayers who file tax returns with an expired ITIN will be sent a notice advising them of the renewal requirement. They will experience processing delays until they renew their ITIN. Refunds for some tax credits like theChild Tax Creditand theAmerican Opportunity Tax Creditwill be held until the ITIN is renewed. In these instances, a federal return must be attached to the Form W-7 renewal application. Anybody who needs and wants an ITIN to file their taxes and whose ITIN expired on January 1, 2017, must apply to renew their ITIN. If the middle digits of your ITIN are 70 through 82, and you have not renewed already, your ITIN is expired. You can renew any time if you need to file a tax return.

You Are Leaving H&r Block® And Going To Another Website

Applicants who apply for an ITIN by mail directly with the IRS must submit either the original of each supporting document or a certified copy of each supporting document. Applicants who do not want or are unable to mail their original documents or certified copies to the IRS may take them in person to a TAC or CAA to have the documents verified and immediately returned to them.

The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number from the Social Security Administration . You have three consecutive years to use your ITIN at least once on a federal tax return—as a filer or as a dependent—before it expires due to nonuse. An Individual Taxpayer Identification Number is a tax processing number issued by the U.S. An ITIN consists of nine digits, beginning with the number nine (i.e., 9XX-XX-XXXX). The IRS issues ITINs to taxpayers and their dependents who are not eligible to obtain a Social Security number so that they can comply with tax laws. An ITIN does not authorize a person to work in the U.S. or provide eligibility for Social Security benefits.

In 2010, over 3 million federal tax returns were filed with ITINs, which accounted for over $870 million in income taxes. In the same year, over 3 million unauthorized workers, including ITIN-filers, paid over $13 billion into Social Security. In advance, call and make an appointment at a designated IRS Taxpayer Assistance Center to have each applicant’s identity authenticated in person instead of mailing original identification documents to the IRS. Each family member applying for an ITIN or renewal must be present at the appointment and must have a completed Form W-7 and required identification documents. See the TAC ITIN authentication page for more details. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Using An Itin? How The Path Act May Affect Its Expiration Date

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

Since the last time you logged in our privacy statement has been updated. We want to ensure that you are kept up to date with any changes and as such would ask that you take a moment to review the changes. You will not continue to receive KPMG subscriptions until you accept the changes. I know tax issues need to be handled immediately which is why I’m available 24/7. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. This three-year rule of expiration for nonuse affects ITINs regardless of when they were issued.

Year-round access may require an Emerald Savings®account. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts .

You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

An applicant who resides outside the U.S. may apply by mail or in person to an IRS employee or a designated U.S. diplomatic mission or consular post. The IRS will accept only a combination of the 13 documents listed in the table below as proof of identity and/or foreign nationality status. Applicants who can present a passport have to present only one document. Otherwise, they will need to present at least two documents or certified copies of at least two documents. Immigrant workers who receive settlement payments as a result of an employment-related dispute will be subject to the maximum tax withholding rate, unless they have an ITIN. For example, for a worker with an ITIN, the withholding on back wages paid to the worker because of a settlement will be based on the worker’s family status and the number of exemptions the worker can claim.

U.S. school records, rental statements, bank statements, U.S. state identification card, U.S. driver’s license or utility bills, if the applicant is age 18 or older. Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. You need to paste it into a form later.

- Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

- If H&R Block makes an error on your return, we’ll pay resulting penalties and interest.

- ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

- The student will be required to return all course materials, which may be non-refundable.

- Additional feed may apply from SNHU.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only.

In advance, call and make an appointment at a designated IRS Taxpayer Assistance Center to have each applicant’s identity authenticated in person instead of mailing original identification documents to the IRS. As a reminder, ITINs with middle digits 83 through 87 expired last year. Middle digits 73 through 77, 81 and 82 expired in 2018. Middle digits 70, 71, 72, and 80 expired in 2017, and 78 and 79 expired in 2016. Taxpayers with these ITIN numbers who expect to have a filing requirement in 2021 can renew at any time. An Individual Taxpayer Identification Number is a tax processing number issued by the Internal Revenue Service.

If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Do other members of your family have ITINs, too? If so, the IRS will accept W-7 forms from everyone in the family if at least one family member listed on a tax return has an ITIN expiring at the end of this year.

H&R Block Emerald Advance® line of credit, H&R Block Emerald Savings® and H&R Block Emerald Prepaid Mastercard® are offered by MetaBank®, N.A., Member FDIC. Cards issued pursuant to license by Mastercard International Incorporated. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. OBTP# B13696 ©2020 HRB Tax Group, Inc.

With more than 9,000 bilingual tax professionals, we can offer a helping hand for your ITIN needs. In the past, passports were used as a standalone identification document for dependents from Canada and Mexico. An ITIN application requires documents proving your identity and foreign status. You can still use passports with an entry stamp to continue proving these things. To aid taxpayer in the renewal process, the IRS made Form W-7 also available in Spanish, Traditional Chinese, Russian, Vietnamese, Korean, and Haitian/Creole. If you submit a Form W-7 before the end of the year, allow seven weeks for the IRS to notify you of your ITIN application status. You’ll have to wait nine to 11 weeks if you mail the form in 2020 or if you’re filing from overseas.