Content

Find where you originally entered it and delete it. If you can’t find it, contact TurboTax support. I used it last year and it worked out great. I have a different situation this year. I made my IRA contribution in April to be applied to 2012 then did the “back door” Roth conversion.

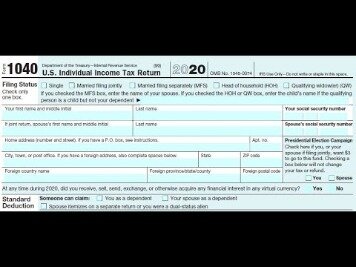

Educating yourself before the tax return deadlinecould save you a significant amount of money. Where is there a place on my 1040 to show the reduced taxable amount. IRA contributions would be recorded in the IRA section, but a rollover is not a contribution. Be sure to note that you are only permitted one such rollover in a 12-month period; rolling over more than one distribution made in a 12-month period would create an excess contribution. Also be aware that if the IRA is an inherited IRA, a non-spouse beneficiary is not permitted to roll the money back into the account. You are also not permitted to roll over any portion of the distribution that is an RMD. You have made it very difficult to impossible to enter the “roll over” amount in my return.

How To Report Backdoor Roth In Turbotax: A Walkthrough

If you also used TurboTax last year, I don’t know why it didn’t put the number there for you automatically. Making it do what it should is not tricking it.

Mike – For each year you made non-deductible contributions, you were supposed to do the steps in the first part of this article. That will give you a basis to carry over from year to year. If you didn’t do that in those years, you can fill out a Form 8606 now for each year by hand. You can find the previous years’ Form 8606 on IRS’ website. Just Google “2011 form 8606” for example. @kimc – TurboTax is able to figure out as much as you tell it. You can lump all contributions together as one entry.

- Anyone who is 72 and older (or aged 70½ if prior to Dec. 31, 2019) must take required minimum distributions from the account each year.

- Turbo Tax is less than helpful with reporting a backdoor Roth.

- Molunat – You didn’t make a mistake for 2012.

- Form 5498’s title is IRA Contribution Information, and it’s usually sent by your IRA trustee to report your IRA activity to the IRS.

- When you save for retirement with an individual retirement arrangement, you probably receive a Form 5498 each year.

I made a non-deductible Traditional IRA contribution of $5,500 in February 2014 for 2013 and converted it to a Roth IRA before the end of 2014. I will be making a Traditional IRA contribution of $5,500 in March 2015 for 2014 . Enter or verify the value of all of your traditional IRA accounts on December 31, 2014. This information is sent by mail on Form 5498.

I made $4000 contribution to Roth in 2012. At the beginning of 2013 I realized I needed to recharacterize my Roth as I exceeded the income limit in 2012. When you withdrew your contribution, you also had to withdraw some earnings. See IRS Publication 590, p. 33, “Contributions Returned Before Due Date of Return.” I have no idea how to do it in TurboTax though.

How To Read Form 5498: Ira Contribution Information

You can contribute in 2014 and convert in 2014. If you choose to do so, you report them in 2015. I used to have problems with reporting backdoor Roth conversions , but your blog helped me this year. I am only paying a small tax rather than showing the entire $5,000 contribution as taxable income.

It looked like at least 33 other people were having the same problem, judging by the TT question board. in Jan 2013, I contributed to a non-ded IRA, $5k, and then backdoored it within a week. Turbo Tax is less than helpful with reporting a backdoor Roth. Their online help is full of incorrect advice from “super-users” who seem to be under the impression the online version doesn’t allow you to do this.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS. As Wells Fargo Advisors is not a legal or tax advisor, we encourage you to speak to your chosen tax advisor regarding your specific situation.

Contribute for both the previous year and the current year, then convert the sum during the same year. SeeMake Backdoor Roth Easy On Your Tax Return. An inherited IRA is an account that must be opened by the beneficiary of a deceased person’s IRA. An individual retirement account is a tax-advantaged account that individuals use to save and invest for retirement. A required minimum distribution is a specific amount of money a retiree must withdraw from a tax-deferred retirement account each year after age 72.

I reported the initial IRA contribution on my 2012 tax return, and this year for 2013 am attempting to report the conversion. However, the 1099-R I received has a distribution code of “R – Recharacterization”, which gave me trouble in Turbo Tax (it won’t let me indicate the distribution went into a Roth IRA). After entering the form, TurboTax never asks me what I did with the money, so I have no chance to say I converted it to a Roth. If I enter the amount as a Roth IRA contribution in the Retirement section under Deductions and Credits, TurboTax tells me I make too much and have to pay a penalty .

Do I Need To Send Elevations A Copy Of My Tax Bill?

My question is with the part where TT asks for the total value of ALL your traditional IRAs as of 12/31/2013. IN 2013, I opened a traditional IRA for the sole purpose of doing a $5,500 backdoor Roth conversion for the first time. I also open a second traditional IRA to receive rollover funds from 2 former employers’ 401Ks. At the end of the year, account A had zero and account B has a $200K balance.

I would have not done it correctly without you. I only opened it for full conversion purposes.

I guess that defeats the purpose of backdoor Roth. Once you enter in your contributions to the traditional IRA under “Deductions & Credits”, the refund tracker will go back up.

No number on line 14 to be carried over to the next year. I’m confident I’m messing this up… any hints as to what I need to do differently from your instructions in order lower this tax burden for 2013? (I’m not overly confident that I’ve done 2012 amended properly). I thought I’d have to go to an accountant to figure this out – you saved me a trip and a few bucks, which I’ll be happy to contribute to the tip jar.

Then your basis will carry over to that “as of December 31, 2012” field. Harry, as you suggested, I put $5,500 for the contribution and $5,000 for the total basis but line 14 of my form 8606 from 2013 is 0! For this current 2013 tax filing, I need to report a $5,500 non-deductible trad IRA contribution AND $5,000 Roth IRA conversion. I am having hard time to contribute to the tip jar. Or maybe she actually qualifies for a deduction because she isn’t covered by an employer plan. When you enter her contribution, the tax is lowered. After the you import her 1099-R, the tax is raised back up, but you are just back to even.