Content

This 1040 is different from the one that was in use for the 2018 tax year, so the lines won’t be the same. The type of income you earn also determines the way underwriters evaluate it. For example, there are different factors that determine how self-employment income is calculated such as the business structure , percent ownership, and how long the business has been owned. Typically a mortgage underwriter averages two years of the business’s net income less depreciation to determine an average monthly income.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Your origination points can be claimed as a depreciation expense in the year you borrow the loan or over the lifespan of the loan, depending on how the points are paid. Be aware that the points are non-deductible on non-rental properties. For example, George borrows a $100,000 mortgage with a 5% interest rate, making his monthly payment $537. When he purchases three discount points, his interest rate goes down to 4.25%, making his new monthly payment $492. The money you use to buy the points is paid directly to the lender . The funds you provided before or at closing were at least as much as the points charged.

- Fees apply if you have us file an amended return.

- No cash value and void if transferred or where prohibited.

- For example, George borrows a $100,000 mortgage with a 5% interest rate, making his monthly payment $537.

- There, you can add Text and/or Sign the PDF.

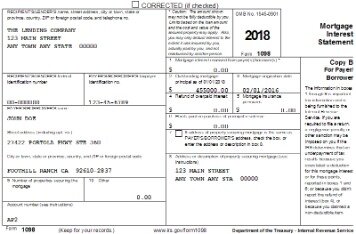

936from the IRS, which covers the rules and guidelines for the mortgage interest tax deduction in the 2020 tax year. Interest accrued on areverse mortgage. Since you don’t pay interest until the loan comes due, you can’t get a deduction on something you aren’t paying yet. Whatever mortgage interest you’re deducting and whatever form you’re using, it’s important to know what qualifies as interest and what isn’t deductible. If you are itemizing your deductions, read on. Your lender or mortgage servicer will provide the form for you at the beginning of the year, before your taxes are due.

Turbotax Guarantees

Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state.

When a consumer considers purchasing or selling a home, they should consider the fact that there are many tax benefits that could potentially make owning a home quite profitable. By far, the buying of a home can be one of a consumers biggest investments. Due to various tax benefits put in place by the government to encourage consumers to purchase homes, buying a home could be a very wise decision.

Year-round access may require an Emerald Savings®account. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy.

Fees for other optional products or product features may apply. Limited time offer at participating locations. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

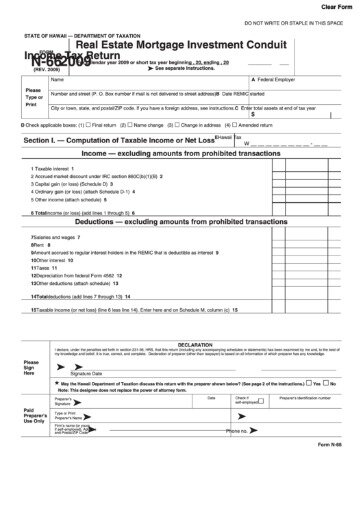

All of these benefits are worth more to taxpayers in higher-income tax brackets than to those in lower brackets. A citizen’s guide to the fascinating elements of the US tax system. Real estate investors also have numerous tax-advantaged options including programs like the IRC 1031 like-kind exchange. If ownership of the primary residence was joint between the consumer and a single taxpayer. It is also important to consider that there are different rules that could apply if circumstances are different. Each of the above issues are explained in detail beneath our homeownership tax benefits calculator. Use Form to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an individual, including a sole proprietor.

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

Refinance Your Mortgage

They do not have to count the rental value of their homes as taxable income, even though that value is just as much a return on investment as are stock dividends or interest on a savings account. It is a form of income that is not taxed. If you do rent out your second residence, and you use it personally, additional rules may impact the deductibility of mortgage interest and real property taxes.

A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Emerald Cash RewardsTMare credited on a monthly basis.

While the typical loan is a mortgage, a home equity loan, line of credit or second mortgage may also qualify. You can also use the mortgage interest deduction after refinancing your home. Just make sure the loan meets the previously listed qualifications and that the home in question is used to secure the loan. Before the TCJA, the mortgage interest deduction limit was $1 million. And for homeowners who have a mortgage, there are additional deductions they can include. The mortgage interest deduction is one of severalhomeowner tax deductionsprovided by the IRS.

At the same time, it is quite important to note that the costs associated with maintaining a home cannot be considered to be home improvements and thus cannot be claimed as a tax deduction. If repairs made become extensive thus becoming a remodel, the work performed could potentially be considered a home improvement and eligible for tax deduction. Some locations also offer benefits for improving the energy efficiency of your home. Speak with your accountaint or tax planner in advance to make sure your project is classified correctly and you use the right kind of funding to qualify for any eligible deductions.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. If you made improved your home’s energy efficiency this year, you may qualify to claim one of two different energy property credits. Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. Finally, homeowners may exclude, up to a limit, the capital gain they realize from the sale of a home.

Paying Mortgage Interest Can Still Reduce Your Taxable Income

The Home Mortgage Interest Tax Deduction is an itemized deduction you can claim on your tax return for home mortgage interest you paid during the Tax Year. Home mortgage interest is interest you pay on a qualified residence loan for a main or second home. A qualified residence loan is a mortgage you use to buy a home, a second mortgage, a line of credit, a home equity loan, or a home equity line of credit.

Since the total of both mortgages do not exceed $750,000, all the interest they paid on both mortgages can be claimed as a tax deduction. If you filed your 2019 Tax Return and want to claim your mortgage insurance premiums, you will need to prepare and file an amended tax return. Find 2019 and other previous year tax forms. You can deduct the mortgage interest you paid up to a certain amount of your total qualified residence loan amount.

You have to use the money from the home equity loan to buy, build or “substantially improve” your home. If you get a nontaxable housing allowance from the military or through the ministry, you can still deduct your home mortgage interest. NerdWallet gives you a complete view of your money, bills, debts and spending — all in one place. Remember to keep records of your spending on home improvement projects in case you get audited.

Mortgage Interest Deduction: What Qualifies In 2021

The Urban-Brookings Tax Policy Center estimates that only about 8 percent of tax units benefited from the deduction in 2018, compared to about 20 percent in 2017, prior to the TCJA. Buying a home is an investment, part of the returns being the opportunity to live in the home rent free.

A mortgage that you get in order to “buy out” your ex’s half of the house in a divorce counts. Bankrate.com is an independent, advertising-supported publisher and comparison service.

It can take the IRS 3 to 8 weeks to process your taxes, depending on how you file. Keep in mind that certain tax deductions may also decrease your income for loan purposes.

No Matter How You File, Block Has Your Back

Self-employed people pay self-employment taxes, which had them paying both halves of the tax. The above rates are separate from Federal Insurance Contributions Act taxes which fund Social Security and Medicare. Employees and employers typically pay half of the 12.4% Social Security & 1.45% Medicare benefit each, for a total of 15.3%.

These include mortgage interest, student loan interest, charitable contributions, medical expenses and more. To itemize your deductions, you’ll need to fill out additional forms to list each one and provide records, receipts and other documents that validate them. Signed in 2017, the Tax Cuts and Jobs Act changed individual income tax by lowering the mortgage deduction limit and putting a limit on what you can deduct from your home equity loan debt. Mortgage discount points, also known as prepaid interest, are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. These costs are usually deductible in the year that you purchase the home; but if not, you can deduct them ratably over the repayment period. For example, if you pay $3,000 in points to obtain a lower interest rate on your mortgage, you can increase your mortgage interest deduction by $3,000 in the tax year you close on the home.