Content

An example is an error is made in calculation of credit, such as the property tax credit or the education expense credit. Another example is if you failed to claim a subtraction on your Form IL-1040 for retirement income shown on lines 4b, 5b, and 6b of your original federal Form 1040, Page 1. It sounds like double the work, right?

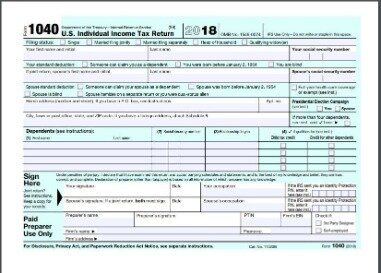

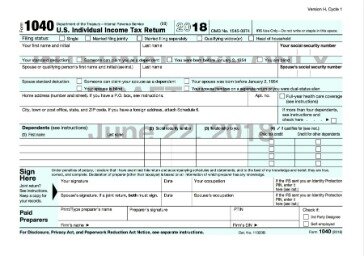

But since not all tax filers make adjustments, this section was removed from the 1040 and spread across Schedules 1 through 6. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Rapid Reload not available in VT and WY. Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000.

What Is Form 1040?

An automatic extension until October 15 to file Form 1040 can be obtained by filing Form 4868. Some people may not have to file any of these schedules.

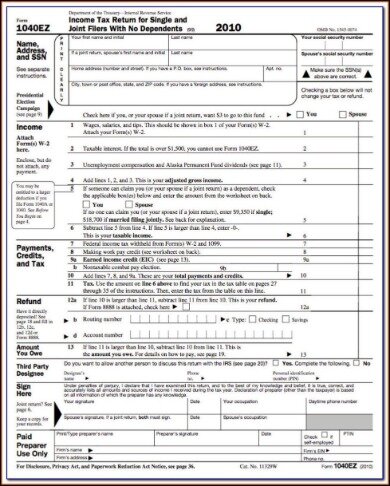

Form 1040-A of the Internal Revenue Service was a simplified version of current Form 1040, and used by U.S. taxpayers to file an annual income tax return. Form 1040 is used by U.S. taxpayers to file an annual income tax return. The tax return deadline was original set at March 1. This was changed to March 15 in the Revenue Act of 1918, and in the Internal Revenue Code of 1954, the tax return deadline was changed to April 15 from March 15, as part of a large-scale overhaul of the tax code. The reason for March 1 was not explained in the law, but was presumably to give time after the end of the tax year to prepare tax returns.

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. In the rest of the refund section, enter the bank details for the checking or savings account in which you want to receive your refund. If you want your refund as a paper check or you want to use it to buy savings bonds, you will need to indicate this on Form 8888. The next section is all about your refund. If the number on Line 19 is greater than the number on Line 16 then you have overpaid the government and are due a refund. Subtract Line 16 from Line 19 to get the amount by which you overpaid and enter it on Line 20.

How To Get Form 1040

The descriptions above were prepared by each vendor. The SCDOR neither endorses nor guarantees the truthfulness of the statements made by online software providers. Learn more about the history of taxes in the United States. Some people might have to use Worksheet 2, “Recoveries of Itemized Deductions,” found in Publication 525 provided by the IRS.

- If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

- Bench assumes no liability for actions taken in reliance upon the information contained herein.

- It’s also used if you received reimbursements for any other itemized deductions you took in previous years.

- Otherwise, most tax prep software and tax professionals are authorized to electronically file Form 1040.

- There used to be three varieties that covered simple to complex tax situations.

- With the ratification of the 16th Amendment, which allows the collection of income tax, IRS Form 1040 became commonplace.

” Here’s a rundown of forms you may need to file your federal tax return. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two.

Is Your State Tax Refund Taxable? Answer These 3 Questions

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well.

But that’s because many of the lines from the old 1040A and 1040 have been moved off the main form and onto additional schedules. So it’s possible that taxpayers may find they need to include even more forms with their tax returns from now on. Form 1040 is the tax form you will out every year when you do your federal income taxes. Prior to the 2018 tax year, there were multiple versions of the 1040, but for 2019 and beyond, the form has been consolidated into one version. While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill our the 1040.

The IRS will accept payment without the 1040V form. However including the 1040-V allows the IRS to process payments more efficiently. Form 1040-NR is used by taxpayers who are considered “non-resident aliens” for tax purposes.

If you own a business, you may also benefit from the qualified business income deduction. Your total income, less all available deductions, equals your taxable income. Whichever method you choose, the form is divided into sections where you can report your income and deductions to determine the amount of tax you owe or the refund you’ll receive. The IRS offers a PDF version of Form 1040 that you can download and fill out manually, but your best bet is probably using one of the popular tax software programs. The software will walk you through filling out the form, any necessary schedules that go with it, and help with the math.

Key IRS Forms, Schedules & Tax Publications for 2021 by Tina Orem Here are some major IRS forms, schedules and publications everyone should know. Child Tax Credit and any other tax credit you would take if you were using the regular 1040 tax form.

What Do I Need To Fill Out Form 1040 Or Form 1040

From staying ahead of the deadlines to year-round tax advice, our streamlined support has got you covered. S corporations file Form 1120S to report the income and expenses of the corporation. Your share of the corporation’s taxable income will be reported on Schedule K-1 of Form 1120S, and you’ll need that K-1 to complete your Form 1040. Partnerships and multi-member LLCs file Form 1065 to report the income and expenses of the partnership.

One state program can be downloaded at no additional cost from within the program. The IRS releases a Dirty Dozen list of tax scams every year. Learn more about these Dirty Dozen tax scams and stay protected during tax season with H&R Block. You qualify to exclude income from sources in Puerto Rico or American Samoa since you were a bona fide resident of either. You have a loss attributable to a federally declared disaster area.

New Forms You May Need To Submit

Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only.