Rehabilitation expenses also increase basis, but you must subtract any rehabilitation credit allowed for these expenses before you add them to your basis. Increase your basis by the recaptured amount if you have to recapture any of the credit. Discover how the tax landscape can affect your ability to achieve desired growth. Impairment ― A long-lived asset is not reviewed for impairment if circumstances indicate the carrying value may not be reasonable, whereas such a review is required by GAAP. Rental income and expense ― Rental revenue is reflected in income in the year accrued or collected. In contrast, under GAAP, rental income and expense accrue ratably over the term of the respective leases, inclusive of leases which provide for scheduled rent increases or rental concessions (straight-line rent). The most common way homeowners increase their basis is to make home improvements.

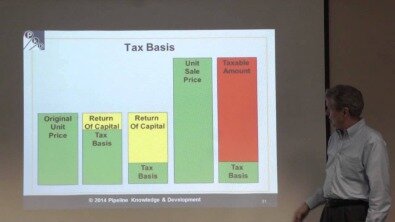

According to CCH Capital Changes, a leading authority in helping the IRS and investors track cost basis for corporate actions, there are more than one million corporate action activities each year. For example, let’s assume Lawrence purchased 100 shares of XYZ for $20 per share in June and then makes an additional purchase of 50 XYZ shares in September for $15 per share. Basis has many meanings in finance, but most frequently refers to the difference between the price and expenses in a transaction when calculating taxes. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Reduce your basis by the amount of any “return of capital” distributions that you receive from the mutual fund.

When Cost Is Not The Basis

Increase the basis of property by all items that have been properly added to a capital account. These include the cost of any improvements that are expected to have a useful life of more than one year. But you must recapture any tax deductions that you previously took for the property by subtracting them from your basis after you’ve added in the above costs. This would be the case if you’ve been depreciating the property on your tax returns since you’ve owned it. This new basis is called the adjusted basis because it reflects adjustments from your starting basis.

As the delivery date approaches, the price of futures and the spot price shift closer together. The local spot price represents the prevailing price for the underlying asset, while the price listed in a futures contract refers to a rate that would be given at a specified point in the future. Futures prices vary from contract to contract depending on the month when they are set to expire. If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Set up a separate file for each fund you invest in—either on paper or electronically on your computer—and faithfully keep it up to date.

These kinds of distributions are shown in Box 3 of Form 1099-DIV. They are not the same as capital gain distributions or exempt-interest dividends. When you purchase shares using reinvested dividends, it’s as if the dividends were paid to you in cash, and then you immediately used that cash to purchase new shares. One area that’s easy to overlook when figuring your basis—particularly if you sell all your shares in a fund at once—is shares that you’ve acquired through automatic reinvestment. This discussion focuses on the single-category method, which is the easiest and most-used. The double-category method, which involves dividing shares based upon how long they have been owned, is rarely used and almost always more trouble than it’s worth.

Basis

Note that it is allowable to include the cost of a trade, such as a stock-trade commission, which can also be used to reduce the eventual sales price. The investor would have a capital gain of $5,670 using the average cost basis method. No wonder you need to keep a running tally of your investment in the fund, from your first acquisition of shares to your final disposal of your last holding. By keeping track of all those dividend reinvestments, you’ll be sure not to pay more tax than you owe. An exception applies only when an estate is large enough for a federal estate tax return to be filed. The exception can set the basis of inherited property at its value six months after the owner died, or when it was sold if during that six month period. Using this exception, called the alternate valuation date, may make sense if the value of the estate’s assets has fallen during the six months following the owner’s death.

The US Department of the Treasury estimated that, together with raising the capital gains rate to 28 percent, this proposal would raise $210 billion over 10 years. Ninety-nine percent of the revenue raised would come from the top 1 percent of households ranked by income. Keep separate accounts for each project if you make additions or improvements to a business property. You must also depreciate the basis of each according to the depreciation rules that would apply to the underlying property if you placed it in service at the same time you placed the addition or improvement in service. Calculating your adjusted basis in an asset begins with its original purchase price. You can increase your basis from there by adding the amount of money you’ve spent improving the asset, as well as any amounts you might have paid for legal fees or the costs of sale. Tax basis financial statements cost less for accountants to prepare than accrual basis statements.

The single-category method is gaining more and more converts because an increasing number of funds are actually doing the work for shareholders. The funds often send out an extra statement each year—a copy of which currently does not go to the IRS —showing the single-category average basis of shares redeemed during the year. If you direct the fund to sell specific shares—such as the 100 shares purchased July 3, 1997 for $27.85 a share—it’s the basis of those shares that determines the tax consequences of the sale. Tom bought his shares through an advisor who got the shares for him without the regular 5% load . So he paid exactly $2,500 for his 100 shares and his tax basis for each share is $25. When a survivor can’t prove his or her contribution, the IRS generally assumes the deceased owner provided all of it.

- For example, if a taxpayer purchases a parcel of land for $500,000, and no deductions apply to that parcel of land, the taxpayer’s basis is $500,000.

- In 2020, generally the maximum tax on the sale of the first stock would be $2,000 (20% of the $10,000 gain), assuming the stock had been held for more than one year.

- The investor would have a capital gain of $5,670 using the average cost basis method.

- For inheritances, the basis is the fair market value of the asset at the time of the donor’s death .

The sum of these amounts listed above must equal the amount reported on the line for ending a capital account, which may be negative. Since then he’s researched and written newspaper and magazine stories on city government, court cases, business, real estate and finance, the uses of new technologies and film history. Start-up costs ― Organizational, startup and syndication costs are generally capitalized, rather than expensed as under GAAP. Depreciation ― Depreciable assets are depreciated over periods specified in the Internal Revenue Code, rather than over the estimated useful lives as under GAAP.

For mutual funds, gains must be paid out annually to shareholders, which triggers a taxable event in taxable accounts. All amounts will be tracked by a custodian or guidance will be provided by the mutual fund firm. Cost basis is used to calculate the capital gains tax rate, which is the difference between the asset’s cost basis and current market value. If you sell only some of your shares, your record keeping can pay off handsomely. In choosing which shares to sell, you can pick the ones with the basis and holding period combination that produces the best tax result.

This is referred to as “step-up in basis” (or “stepped-up basis”) because the previous basis is stepped up to market value. If you build your home yourself, your starting basis is the cost of construction. However, you may not add the cost of your own labor to the property’s basis. Add the interest you pay on construction loans during the construction period, but deduct interest you pay before and after construction as an operating expense. Adjusted basis has several applications in finance, each of which refer to changing the initial cost of something for accounting purposes.

Understanding Cost Basis

If a partner receives cash or other consideration that is in excess of his tax basis, then he should recognize a gain on the sale of his partnership interest on his individual income tax return. When the partnership is formed, each partner should contribute cash or noncash property to the partnership, thus creating basis in the partnership.

It’s important to keep good records and simplify the investment strategy where possible. The easiest way to track and calculate cost basis is through brokerage firms. Whether an investor has an online or traditional brokerage account, firms have very sophisticated systems that maintain records of transactions and corporate actions related to stocks. However, it’s always wise for investors to maintain their own records by self-tracking to ensure accuracy of the brokerage firm’s reports. Self-tracking will also alleviate any future problems if investors switch firms, gift stock, or leave stocks to a beneficiary as an inheritance.

If the executor of the estate chooses to value assets using the alternate valuation date for estate tax purposes, the value on that date becomes your basis in the inherited stock. The tax basis of an asset subject to cost recovery must be reduced by deductions allowed for such cost recovery. For example, if Joe claimed $25,000 of depreciation deductions on his building, his adjusted basis would be the $90,000 as above less $25,000, or $65,000. Cost recovery deductions may include depreciation, amortization, and deducted losses or declines in value. Some jurisdictions (e.g., Germany) allow a deduction for decline in value of certain assets, which reduces tax basis.

Using the correct cost basis, also referred to as the tax basis, is important especially if you reinvested dividends and capital gains distributions instead of taking the earnings in cash. Reinvesting distributions increases the tax basis of your investment, which you must account for to report a lower capital gain and therefore pay less tax. If you don’t use the higher tax basis, you could end up paying taxes twice on the reinvested distributions. Determining the correct cost basis is also the first step when calculating gains and losses after a stock is sold. Several methods can help minimize the paperwork and time needed to track cost basis.

Determining the initial cost basis of securities and financial assets for only one initial purchase is very straightforward. In reality, there can be subsequent purchases and sales as an investor makes decisions to implement specific trading strategies and maximize profit potential to impact an overall portfolio. With all of the various types of investments, including stocks, bonds, and options, calculating cost basis accurately for tax purposes, can get complicated. Cost basis is used to determine the capital gains tax rate, which is equal to the difference between the asset’s cost basis and the current market value. Of course, this rate is triggered when an asset is sold, or the gain or loss is realized. Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together.

Topic No 703 Basis Of Assets

For example, if Joe acquires a building for $10,000 cash and assumes a mortgage for $80,000 , Joe’s basis in the building is $90,000. If multiple items of property are acquired together in a single transaction, the tax basis must generally be allocated to the items in proportion to their values at the time of acquisition.

However, it is important to begin the process of transitioning to accounting for partners’ tax basis as early as possible. Other reporting differences exist for inventory, pensions, leases, start-up costs and accounting for changes and errors.

Conversely, tax-basis entities report gross income, deductions, and taxable income. Their nontaxable items typically appear as separate line items or are disclosed in a footnote. GAAP is the most common financial reporting standard in the United States. The Securities and Exchange Commission requires public companies to follow it — they don’t have a choice. Many lenders expect large private borrowers to follow suit because GAAP is familiar and consistent. GTIL is a nonpracticing umbrella entity organized as a private company limited by guarantee incorporated in England and Wales.

For appreciated assets (those with date-of-death fair market value in excess of the decedent’s basis), a limited basis step-up rule can be used at the discretion of the estate’s executor. Under the limited basis step-up rule, the maximum allowable total basis step-up is generally $1.3 million, but a surviving spouse is granted an additional step-up allowance of up to $3 million. There are still unanswered questions about the new partnership basis reporting rules. Though the IRS anticipates guidance will be released in the coming year, practitioners should begin planning now. GBQ is a tax, consulting and accounting firm operating out of Columbus, Cincinnati, Toledo and Indianapolis. So some companies would prefer tax-basis reporting if it’s appropriate for financial statement users. Enthusiasm about these investments should be tempered with proper financial and tax structuring and preparation.

This value is used to determine the capital gain, which is equal to the difference between the asset’s cost basis and the current market value. The term can also be used to describe the difference between the cash price and the futures price of a given commodity. The adjusted basis of an asset is its cost after you’ve taken various tax provisions into the calculation. You’ll pay capital gains tax or have a capital loss based on the difference between your adjusted basis and the amount for which you eventually sell the asset. Such income may arise from services performed in exchange for the partnership interest.

How To Get Your Adjusted Basis

If the taxpayer later sells the property for $550,000, the amount of gain realized by the transaction is the sale price ($550,000) less the adjusted basis ($500,000), or $50,000. As we commence the filing season for 2019 returns, partnerships and tax preparers are permitted to rely upon the 2018 Form 1065 instructions and rules when preparing partnership returns. The IRS promises guidance on the new rules during 2020, so partnerships and tax preparers will be ready to implement them during the filing season for 2020 tax returns.

Cost basis starts as the original cost of an asset for tax purposes, which is initially the first purchase price. But the initial purchase price is only one part of the overall cost of an investment. As time moves forward, this cost basis will be adjusted for financial and corporate developments such as stock splits, dividends, and return of capital distributions. The latter is common with certain investments such as Master Limited Partnerships . It’s the starting point from which you figure depreciation, capital gains on sales and losses from theft or fire, among other things. Over time, however, you may have to adjust your tax basis until it’s quite distinct from the original cost.