Instead, they reallocate a portion of the RE to common stock and additional paid-in capital accounts. This allocation does not impact the overall size of the company’s balance sheet, but it does decrease the value of stocks per share. On the other hand, though stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock.

While the calculation might seem complex at first, by breaking it down into steps and understanding the various components, it becomes a manageable task. As a business owner, your ability to calculate and interpret retained earnings can provide you with a powerful tool for making informed business decisions and planning for the future. Stock dividends, on the other hand, are the dividends that are paid out as additional shares as fractions per existing shares to the stockholders.

Retained Earnings Formula and Calculation

Since Meow Bots has $95,000 in retained earnings to date, Herbert should hold off on hiring more than one developer. As you can see, once you have all the data you need, it’s a pretty simple calculation—no trigonometry class flashbacks required. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

This represents capital that the company has made in income during its history and chose to hold onto rather than paying out dividends. On the other hand, when a company generates surplus income, a portion of the long-term shareholders may expect some regular income in the form of dividends as a reward for putting their money in the company. Traders who look for short-term gains may also prefer dividend payments that offer instant gains. Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company. This statement is vital for assessing a company’s liquidity, solvency, and its ability to alter cash flows in the future.

Explanation of the earnings statement

This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes. The retained earnings are recorded under the shareholder’s equity section on the balance as on a specific date. Thus, retained earnings appearing on the balance sheet are the profits of the business that remain after distributing dividends since its inception.

- Being better informed about the market and the company’s business, the management may have a high-growth project in view, which they may perceive as a candidate for generating substantial returns in the future.

- Dividends refer to the share of profits that a company distributes to its shareholders.

- Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion.

- Paying off high-interest debt also may be preferred by both management and shareholders, instead of dividend payments.

As mentioned earlier, management knows that shareholders prefer receiving dividends. This is because it is confident that if such surplus income is reinvested in the business, it can create more value for the stockholders by generating higher returns. These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested by them in your company.

How retained earnings reflect business performance and financial health

Now that we’re clear on what retained earnings are and why they’re important, let’s get into the math. To calculate your retained earnings, you’ll need three key pieces of information handy. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective. Before Statement of Retained Earnings is created, an Income Statement should have been created first. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Step 3: Add Net Income From the Income Statement

As we’ve seen, calculating retained earnings is an integral part of understanding a company’s financial health. It not only provides insights into how much of the company’s earnings are being reinvested back into the business but also indicates how much buffer the company has to sustain financial shocks. As shown, retained earnings are a powerful reflection of a company’s long-term profitability and its ability to generate value for shareholders.

Thus, if the company had a market value of $2 million before the stock dividend declaration, it’s market value still is $2 million after the stock dividend is declared. This is because due to the increase in the number of shares, dilution of the shareholding takes place, which reduces the book value per share. And this reduction in book value per share reduces the market price of the share accordingly. In human terms, retained earnings are the portion of profits set aside to be reinvested in your business.

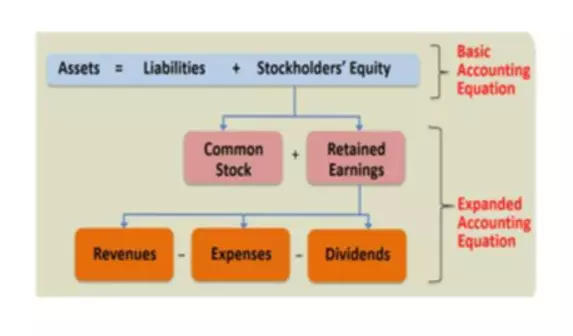

From there, the company’s net income – the “bottom line” of the income statement – is added to the prior period balance. In simple words, the retained earnings metric reflects the cumulative net income of the company post-adjustments for the distribution of any dividends to shareholders. On the balance sheet, the “Retained Earnings” line item is recognized within the shareholders’ equity section.