They can handle all kinds of tax situations, from simple to complex. When you connect live with an expert, you’ll see their specific certifications. To connect, just select Live help and set up a call or talk via chat. TurboTax Live is an unlimited service, so you can have as many sessions as you need to get your taxes done right. Not only that—TurboTax always double-checks your return for errors as you go, and before you file your taxes. We also guarantee our calculations are 100% accurate, or we’ll pay you any IRS penalties plus interest.

- We also reference original research from other reputable publishers where appropriate.

- It’s meant for those who want to maximize deductions and credits with a professional’s help.

- Retirement tax help and IRA tool show you how to get more money back this year and when you retire.

- It is one of the largest players in the tax preparation software industry.

Free shipping offer valid only in Continental U.S. (excludes Alaska and P.O. Box addresses). Dell reserves the right to cancel orders arising from pricing or other errors. Add the products you would like to compare, and quickly determine which is best for your needs. TurboTax® is tailored to your unique situation—it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. The Balance requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

You get one-on-one help from a TurboTax product specialist on-demand, as well as an audit assessment. TurboTax Free is the cheapest option, but it’s only for people with the simplest tax situations.

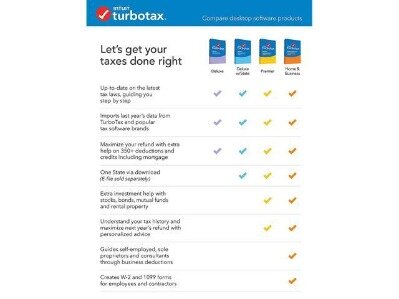

TurboTax offers four tiers of pricing in three different sets of options. The level of tax-related services and bonus features you get access to depends on which option you select. Prices range from $50 for most basic tax needs to $120 for the Home and Business package.

Turbotax Live Premier

If you’ve ever worked for yourself, you know how complicated and stressful tax time can be. TurboTax’s Self-Employed packaged helps take the stress out of the season. It includes all the features in the Premier option, as well as software-based guidance tailored to freelancers, contractors, and small business owners.

Understand your tax history and know your “tax health” with expert tips to help you get an even bigger refund next year. Reduce your chance of a tax audit with our Audit Risk Meter™. We’ll check your tax return for common audit triggers, shows whether your risk is high or low and give you valuable tips. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

While we don’t recommend going toe-to-toe with the IRS, for beginners, this is a major plus. It also guarantees the largest refund or smallest tax amount due based on your circumstances, and it offers audit support from tax professionals all year long. Discount offer valid only when you access TurboTax products and services using the link on Fidelity.com. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

Then, based on what you tell us, we’ll search for every tax credit that applies to you. Retirement tax help and IRA tool show you how to get more money back this year and when you retire. By accessing and using this page you agree to the Terms of Use. Select all that apply to find reviewers similar to you.

If You’re Getting A Refund

Learn about our independent review process and partners in our advertiser disclosure. Prices, promotions, styles and availability may vary by store & online. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you.

This should make you feel comfortable that you’re getting the right answers when you ask detailed questions about your tax situation. You can share your screen with these professionals so they can guide you to solutions faster or see what may be causing problems with your return. TurboTax Desktop Basic is for simple tax situations and costs $50 for a federal return and $45 for each state return plus an additional fee if you want to e-file the state return. TurboTax Deluxe and higher each come with one free state download, but e-filing state returns cost extra. As of December 2020, the full price for a state e-file is $25, but TurboTax anticipates price increases in March 2021. TurboTax Deluxe, which costs $60 plus $50 per state return, offers everything included in the TurboTax Free package.

TurboTax’s pricing may change throughout tax season. Expect deals early on in filing season to lure customers in. Be prepared for price increases as the tax deadline nears. It is one of the largest players in the tax preparation software industry. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers.

We believe everyone should be able to make financial decisions with confidence. Designed for all levels of investing and investment types. Automatically import thousands of transactions from hundreds of participating financial institutions, for seamless investment income reporting. All to make sure you get your maximum refund, guaranteed.

Turbotax Online Options

You meet the tax preparer on a video call before they begin working, then you’ll meet again when your return is ready for review and filing. Prices range from $130 to $290 for federal returns, depending on complexity, plus $45 to $55 per state return. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Other options include applying the refund to next year’s taxes and directing the IRS to buy U.S. Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional. TurboTax has a lot going for it, but price isn’t one of them. The list price of its software routinely is on the high end of the spectrum, especially when adding the cost of a state return.

They’ll work around your schedule to prepare, sign, and file your tax return for you. Our team of tax experts has an average of 12 years experience.

Help from real CPAs or Enrolled Agents is available for questions or troubleshooting, depending on the package you purchase. Required for product activation, software updates and optional online features. State and IRS Tax Refund & Stimulus Tracking Guide by Tina Orem Everything you need to track your stimulus check, federal tax refund and state tax refund — plus tips about timing. You have the option of paying for the software out of your refund.

Already Have This Product?

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps. Live, on-screen tax advice or review of your whole tax return by a tax pro is available if you buy the TurboTax Live version. These users also can submit written questions that a tax pro will answer within 24 hours. TurboTax imports electronic PDFs of tax returns from H&R Block, Credit Karma, Liberty Tax, TaxAct and TaxSlayer. We’ve long praised TurboTax for its design and flow.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. TurboTax’s Live lineup of products offers assistance from CPAs or EAs. These tax professionals have certifications that prove their tax knowledge.

That said, TaxAct’s pricing reflects this with overall lower prices when compared to TurboTax. However, H&R Block doesn’t offer as robust support options as TurboTax.

Thankfully, it’s easy to use and fast if you snap a photo of your W-2. Unfortunately, you get upgraded to a fee-based option if your situation goes much beyond having a W-2 or other extremely basic circumstances. The CPA and EA-assisted version of TurboTax Free is called TurboTax Live Basic, which costs $80 plus $45 per state return. TurboTax’s products are divided into online options and a desktop-based downloadable software which can also be purchased at brick-and-mortar retailers. The online options are further divided into a self-serve version and a CPA or Enrolled Agent assisted version. The self-serve and CPA or EA assisted options are the same as the online option except for the professional help.

They both focus on tax preparation software without in-person preparation options. TaxAct even offers a free option, including free state tax preparation. You can head to a local H&R Block office if you’re a brick-and-mortar kind of customer, but the pricing is different from their software. TurboTax has no in-person option, so H&R Block is a clear winner for those who’d rather have their taxes prepared face-to-face.