Learn about our independent review process and partners in our advertiser disclosure. Prices, promotions, styles and availability may vary by store & online. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. No matter how you file, you can choose to receive your refund several ways. You can automatically import W-2 information from your employer if it’s partnered with TurboTax, but you can also take a picture of your W-2 and upload it to transfer the data to your return.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. TaxAct does provide phone-based support, but they don’t have an option for help or tax return review by a CPA or EA. Which software you select comes down to your priorities. If you need assistance when completing your return, TurboTax’s support options provide a better experience. TurboTax Self-Employed is the version self-employed individuals need. If you’ve ever worked for yourself, you know how complicated and stressful tax time can be.

A banner running along the side keeps track of where you stand in the process and flags areas you still need to complete. This is the Deluxe version with added capability for reporting investments and rental income (Schedules D and E, and K-1s). We also offer full audit representation for an additional fee with TurboTax Audit Defense. Then, based on what you tell us, we’ll search for every tax credit that applies to you. Retirement tax help and IRA tool show you how to get more money back this year and when you retire.

TurboTax Desktop Basic is for simple tax situations and costs $50 for a federal return and $45 for each state return plus an additional fee if you want to e-file the state return. TurboTax Deluxe and higher each come with one free state download, but e-filing state returns cost extra. As of December 2020, the full price for a state e-file is $25, but TurboTax anticipates price increases in March 2021.

Why Use Turbotax Live Premier?

Your expert will go over your return with you and make sure you have no unanswered questions. Then they’ll file your return and guarantee it’s done right. Simply and securely upload your tax documents to your expert and let them handle the rest. With Full Service, your own tax expert or CPA will do your taxes and guarantee they’re done right. For more complex tax situations you may need additional documents, like mortgage statements or other detailed financial information.

We find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. We’ll show you who qualifies as your dependent, and find tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit , and child tax credit. With our detailed guides and FAQs, it’s never been easier to do your taxes on your own.

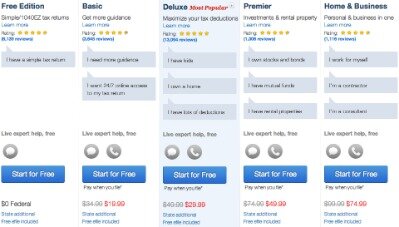

TurboTax Deluxe, which costs $60 plus $50 per state return, offers everything included in the TurboTax Free package. TurboTax offers four tiers of pricing in three different sets of options. The level of tax-related services and bonus features you get access to depends on which option you select. Prices range from $50 for most basic tax needs to $120 for the Home and Business package. If you are self-employed or own rental property, you will probably need one of the mid-range packages, which cost between $80 and $110.

Turbotax Vs E

The software lures you in at a cheaper level and often upsells you to a higher tier if you aren’t careful. This product is covered by the Sam’s Club Member Satisfaction Guarantee. The third-party trademarks and service marks appearing herein are the property of their respective owners. Fast refunds with e-file and easily direct deposit right to your Fidelity account. If the item details above aren’t accurate or complete, we want to know about it. All users have access to TurboTax Assistant, a chatbot, or a contact form.

Designed for every level of investor, TurboTax Premier automatically imports investment income from financial institutions and gives you step-by-step guidance online on reporting rental income. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. We’ll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS.

Understand your tax history and know your “tax health” with expert tips to help you get an even bigger refund next year. Reduce your chance of a tax audit with our Audit Risk Meter™. We’ll check your tax return for common audit triggers, shows whether your risk is high or low and give you valuable tips. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Do your taxes on your own time, not someone else’s. No appointment necessary—work at your own pace, any time, on any device.

Audit defense, on the other hand, gets you full representation before the IRS from a tax professional. TurboTax has a lot going for it, but price isn’t one of them. The list price of its software routinely is on the high end of the spectrum, especially when adding the cost of a state return. And if you want access to human help, it costs even more. We’ll search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund,guaranteed. Homeowners get step-by-step guidance to help turn their biggest investment into their biggest tax break. Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

New! Turbotax Live Premier With Full Service

Software products are provided as a convenience to you, and Fidelity bears no responsibility for your use of, and output associated with, such products. The information and products made available to you are not intended to be, and should not be construed as, legal or tax advice or a legal opinion. A direct deposit to a bank account is the fastest option. You can also have it loaded onto a Turbo Visa Debit Card (if you’re getting a refund on your state taxes, see if your state offers a prepaid card option as well) or sent as a paper check.

- TurboTax uses encryption technology, so your tax data is protected while it?

- Some desktop packages come with one state tax software but not e-filing.

- And if you want access to human help, it costs even more.

- No appointment necessary—work at your own pace, any time, on any device.

- That’s likely because H&R Block offers in-person preparation for customers who prefer more help.

But since we save your return as you go, you can finish anytime. A tax expert can explain what things like buying a home, having a baby, or getting a new job will mean for your taxes. Look for the option to deduct TurboTax preparation fees from your federal tax refund, and have the rest deposited directly into your bank account.

It provides quick support wait times and a running tally of your expected tax refund or tax owed amount, too. Filing your taxes with TurboTax feels more like a conversation with an understanding financial advisor. While the wait time was minimal, it’s likely that the wait times increase as the tax deadline approaches. TurboTax offers Audit Defense, in case you’re audited. In collaboration with TaxResources, Inc., an agency of tax experts, you’ll be walked through the audit, and they even prepare documents and represent you in IRS meetings. TurboTax’s desktop products offer U.S. based phone support with TurboTax specialists. These specialists should be able to help you with your problems, but they’re probably not CPAs or EAs.

TurboTax offers support in many ways depending on the product you use to file your return. All products, including TurboTax Free, let you view TurboTax’s extensive database of FAQs and tax-related articles to help you understand potentially confusing concepts. You can get free help from their online community of TurboTax specialists and customers, too. Customers may not always provide accurate information which could cause problems with your taxes. it will search for the deductions and credits you deserve, so you?

TurboTax coaches you every step of the way and double checks your return as you go to handle even the toughest tax situations, so you can be confident you? As a returning customer, TurboTax will automatically transfer last year? s data to help ensure accuracy and save you time Up-to-date with the latest tax laws?

Intuit is solely responsible for the information, content and software products provided by Intuit. Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use.

Live, on-screen tax advice or review of your whole tax return by a tax pro is available if you buy the TurboTax Live version. These users also can submit written questions that a tax pro will answer within 24 hours. TurboTax imports electronic PDFs of tax returns from H&R Block, Credit Karma, Liberty Tax, TaxAct and TaxSlayer.

Thankfully, it’s easy to use and fast if you snap a photo of your W-2. Unfortunately, you get upgraded to a fee-based option if your situation goes much beyond having a W-2 or other extremely basic circumstances. The CPA and EA-assisted version of TurboTax Free is called TurboTax Live Basic, which costs $80 plus $45 per state return.

This version lets you itemize and claim several other tax deductions and tax credits. And if you have business income but no expenses, this might work for you, too. This is essentially the free version but with on-demand video access to a tax pro for help, advice and a final review. “The TurboTax program is super easy to use, and being able to live chat with a CPA is helpful. The review of my tax return provides peace of mind. Get unlimited tax advice and answers as you do your taxes. “Whether you are a beginner or a tax pro, TurboTax will ask the right questions, give you the best advice, and minimize the time you spend on taxes each year.” Finish your tax return in one visit or do a little at a time.