Content

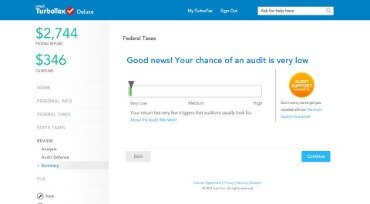

After all, they seem to be easier and cheaper, and you can do it yourself. There are no hard and fast answers when it comes to hiring an accountant or using TurboTax. Your familiarity and comfort with tax rules will play a big role in helping you decide which is best for your business. Those with few investments and a single employer may benefit from TurboTax. On the other hand, business owners with a complicated income likely require a CPA.

Get started with TurboTax Live and connect with tax experts on-demand for help and advice. At any time, you can hand off your taxes to a tax expert or CPA who’ll prepare, sign, and file your return for anadditional fee. Have a dedicated expert do your taxes for you start to finish—They can prepare, sign, and file your return for an additional fee. You can choose to hand off your taxes at any time. You want all your tax documents on hand, in one place.

Turbotax Will Likely Be More Cost Efficient

If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. H&R Block prices are ultimately determined at the time of print or e-file.

- We wasted more time on the phone than she would have spent printing out the forms.

- You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose.

- Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return .

- Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com.

- Skipping around comes in handy when, for example, you want to start working on deductions because you’ve not yet received all your income statements.

Tell you what, genius-with-a-website-to-steal-money -from-innocents – I’m going top start an experiment on your services and write up the results on my blog. I was curious when you might post the results of your experiment. I find myself in the same predicament and have been using accountants the past 4-5 years but was thinking about switching to Turbotax to save $500.

I feel exactly the same way about Turbo Tax. I’m always a little skeptical when it comes time to take some of the more obscure deductions. I’m also wary that the software may have bugs from time to time. The good thing though is that the IRS and Intuit seem to work together. If TurboTax has bugs, then the IRS provides a bit of leeway as well. I remember a few years back, Intuit was having server problems so the IRS gave the affected people more time to file and pay their taxes. I thought it was too complicated for me to do.

Should I Use An Accountant Or Turbotax?

TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work. TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work. All prices here, and on all outward facing TaxSlayer.com sites, are subject to change at any time without notice. Price is determined at the time of print and/or e-file. Published prices are meant only as a guide and are not a guarantee.

Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment.

H&R Block is similar to TurboTax in that with this solution you can fill out your own return. However, where TurboTax vs H&R Block differs is that H&R Block also offers you the option to have your tax returned completed and filed by one of their staff.

Biden Moves Up Vaccine Timeline, Announces Johnson & Johnson, Merck Covid Vaccine Collaboration In Wartime Effort

Never having to leave the comfort of your home to send out your tax documents. The software is highly intelligent, but I would not go as far to say it is artificially intelligent. Finding an accountant you can trust is also a challenge. You have to do your research, look up testimonials, etc. And when you finally find one you want to work with, their office is far away.

Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations.

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

Your tax returns might seem simple enough for you to look after, but don’t count on it. By contrast, an accountant may take several days or a few weeks to complete your paperwork and file your returns. TurboTax can complete your tax return calculation quickly if you have all the necessary documents.

They’ll look after the detail , leaving you free to look at the bigger picture of the way your business is growing. Another problem is you really don’t have any idea if your doing it correctly. If you have an LLC, a Corp, an S-Corp and your doing your own accounting and taxes and not paying a CPA to do them you are flat out crazy! I guarantee your doing your accounting and taxes wrong. TurboTax makes you “feel safe.” In reality you have no idea if you answered the questions properly or if you forgot to put info somewhere you didn’t know it needed to go. One of my clients messed up so bad they owed $13,000 until I reviewed their return, amended it by putting numbers in the proper places.

By most accounts (reviews.com&Kiplinger, for example) it’s about the best of what’s available. TaxAct, H&R Block, and Tax Slayer all have competing products, which I’m sure get the job done just fine. But even though they’re easy to use, Turbotax and others are still software programs that have limitations just like any other robot.

In other words, you have complete visibility over your taxes and it’s dirt cheap. I was also under the impression that our accountant was responsible for filing our taxes correctly.