Content

The company calls the truly free version the Freedom Edition. Finish your tax return in one visit or do a little at a time. We automatically save your progress as you go, so you can always pick up where you left off. We’ll guide you through life changes and their impact on your taxes, so you get every tax deduction and credit. To find out what state tax forms are available for completing your tax returns you can see them on our State Income Tax Forms pages. Learn where to file state income taxes, even if you’re in the military, or earned money in multiple states. TurboTax will calculate how much you owe to the different states where you have earned income.

Here’s a look at the various ways you can find answers and get guidance when filing your return with TurboTax. You can automatically import W-2 information from your employer if it’s partnered with TurboTax, but you can also take a picture of your W-2 and upload it to transfer the data to your return. You can import certain 1099s, and the Self-Employed version also lets you upload 1099-NECs from clients via photo, as well as import income and expenses from Square, Uber and Lyft. Live, on-screen support option offers human help at extra cost. Many or all of the products featured here are from our partners who compensate us.

New this year is TurboTax Full Service, which does away with tax software altogether. Instead, you upload your tax documents and a human puts together your tax return. You meet the tax preparer on a video call before they begin working, then you’ll meet again when your return is ready for review and filing. Prices range from $130 to $290 for federal returns, depending on complexity, plus $45 to $55 per state return. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

Reduce your chance of a tax audit when we check your return for audit triggers and show your risk level. Second, if your situation is not as clear cut as the Resident and Nonresident information above, you may be a Part-year Resident. Continue reading to determine your filing status and what to file. Residency is the location of your home where you intend to live when you return from a vacation or temporary business trip.

Youre Our First Priority Every Time.

That’s useful whether you’ve never filed taxes or whether you’ve been filing for decades. H&R Block currently offers four digital filing options. You can see the options and pricing in the table below.

However, it’s not available if you’re self-employed, you itemize deductions, or you have 1099 income. If you’re entitled to a refund, TurboTax lets you track it. feature, which enables you to track your refund from filing through receipt. You’ll be asked to provide the information for medical expenses, mortgage interest paid, state and local taxes, and charitable deductions, if you have any. Even if you don’t know anything about income tax preparation, this sequence can easily guide you through the process. One major benefit of TurboTax is its user-friendly and intuitive user experience. Once you purchase the software and start the process, you’ll mostly follow a simple question and answer format.

Once your tax return is complete, it’s reviewed by a tax expert. If any changes are needed before filing, the CPA or EA will make them for you. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

In most instances, all you have to do is enter a few keywords, and you’ll get the information you need. This feature can help you get your tax questions answered while you’re in the midst of finishing your return.

That means both you and the tax expert will be working on your return at the same time, which can create a significantly more personalized experience. Currently, this discount allows active duty and military reservists to file their federal and state taxes for free. This discount doesn’t apply to TurboTax Live products. TurboTax added a feature that can help make filing your taxes considerably easier, called TurboTax Live. With TurboTax Live, you’ll pay more for your software program upfront, yet real tax experts are available to answer questions and help you figure out problems as they arise. With its intuitive design and experience and variety of support options, TurboTax is in many ways the standard for the do-it-yourself tax-prep industry. Its products come at a price, however, and similar offerings from competitors this year may provide a better value elsewhere.

Why Take Advantage Of This Offer With Fidelity

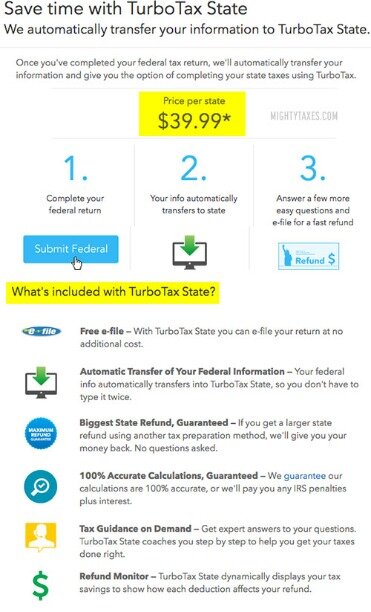

However, the free option only supports simple returns with form 1040. If you want to itemize your deductions with schedule A , you will need to upgrade to a paid plan. There are three paid plans that run from $60 to $120 for federal filing. State filing is always $45 per state, with paid plans.

This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. We believe everyone should be able to make financial decisions with confidence. Justin Elliott is a ProPublica reporter covering politics and government accountability. To securely send Justin documents or other files online, visit our SecureDrop page. If you made less than $34,000, you were eligible to file for free with TurboTax.

- TurboTax will upload your photo and take all of the required information directly from it.

- First, it promises to get you the largest tax refund that’s legally possible.

- And if you want access to human help, it costs even more.

- The Premier option can help you with stocks, bonds, employee stock plans, and other investment income.

- The text in the bill codifying the Free File program has long been sought by lobbyists for Intuit.

If you made less than $66,000 last year, you should have been able to prepare and file your taxes for free with one of the companies participating in the IRS’ Free File program. But each company has its own distinct eligibility requirements. It’s not clear if the other companies would offer refunds. We’ll automatically import your information from last year’s TurboTax return to help save time and increase accuracy.

Learn More About The Turbotax Deluxe + State 2020 Pc Download

Seeing, “You can do this,” throughout the process may help to reduce some anxiety. If price is your primary concern, you may want to consider a cheaper service like TaxAct.

For more information, please check out our full disclaimer and complete list of partners. All users have access to TurboTax Assistant, a chatbot, or a contact form. Embedded links throughout the process offer tips, explainers and other resources. And help buttons can connect you to the searchable knowledge base, on-screen help and more. TurboTax’s interface is like a chat with a tax preparer, and you can skip around if you need to. A banner running along the side keeps track of where you stand in the process and flags areas you still need to complete.

Meanwhile, your friend will get 20% off the edition they buy. If you do want direct representation in an audit, TurboTax offers its Audit Defense program. It’s an add-on service that costs an additional fee, and it’ll be like having a CPA or EA represent you for an audit. The cost of the plan is $39.99, and it must be purchased before you file your return. The protection is available for as long as your return can be audited. Other tax changes will come into play this year to account for inflation, deduction and credit phaseout adjustments, and planned changes to the alternative minimum tax.

So, it is often more important to show your intent to leave a state than it is to show your intent to become a resident in a new one. If you end up with both states wanting to claim taxes on your income, your evidence of intent will be crucial. You have to decide whether the time you spent in each state was permanent or temporary. The answer to this question determines which tax forms you need to fill out for each state, and how you calculate your state taxes.

Turbotax’s Ease Of Use

This is an excellent option for someone who wants to have the highest level of tax preparation expertise but doesn’t want to pay the high cost of engaging a CPA to do the entire job. Just remember that, for TurboTax Live, you’ll pay about twice as much as you normally would for the software. Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps. A direct deposit to a bank account is the fastest option.

In order to file Schedule C with H&R Block, you’ll need to upgrade to the Self-Employed option, which costs $104.99 for a federal filing. Cost is always a consideration when you choose a tax filing service. H&R Block and TurboTax are the two most comprehensive online services available and likewise they are also the most expensive.