Content

In addition to this core software, Intuit and other companies offer other integrated tools to help you work efficiently and collaborate with your clients or saff from whatever you all are. Some states, including Oregon, California, Maryland and New York, have their own certification or registration requirements for professional tax preparers. Check with your state to find out if they have any additional regulations. If you’re unsure about the best model for you and your practice, talk to one of our experts for tips and advice.

Let the strength of Intuit help you safeguard against threats, with built-in layers of security including multifactor authentication, password protection, data encryption, service monitoring, and more. Make a smooth transition to ProSeries with our Easy Start program. You’ll get automated data conversion, specialized customer support, personalized training, and more. Get any document signed securely from any online device, so you can move faster and give your clients the convenience they expect. Get all the convenience of the cloud, plus save on server costs and skip the IT headaches, with the only hosting service backed by Intuit security. Choose packaged bundles for significant savings on every individual return.

We Do Your Taxes For You

Another option is to form a limited liability company or corporation for your business, which automatically registers your business with the state. Contact your state government to find more information about registering with your state. Scratch off anything on the list that doesn’t apply to your tax situation (it’s organized with the most common items on the first page). As you receive or locate tax documents, place them in the folder and check them off the list. Place the checklist in a file folder, or attach it to the outside of the folder. Not all tax preparers are Federally Authorized Tax Practitioners .

Non-credentialed tax preparers, those who are not attorneys, CPAs, or EAs, often do not meet the IRS requirements for representing clients before the IRS. If you continue in the process, the recruiter will then email you an online link via HireVue to complete an assessment and video interview. Once you apply online, you will be contacted by a recruiter who will then complete a phone screen. Training is approximately 1 full week to complete training, a mix of self-led and live sessions. At any point, whether it’s before, during, or after training, there will always be support available for you. By accessing and using this page you agree to the Terms and Conditions. Access free webinars, videos, workshops, and other resources to improve your software proficiency and keep you updated on the topics that matter most to you.

Tax attorneys are individuals licensed to practice law who specialize in tax matters. They are especially helpful if you have a dispute with the IRS and are looking to have it resolved in court. Tax attorneys are experts at handling audits and appeals and in negotiating with the IRS over payment and collection issues especially when you need to go to court. Tax attorneys can also help clients evaluate and minimize their tax liability and manage their assets by drawing up the appropriate legal documents.

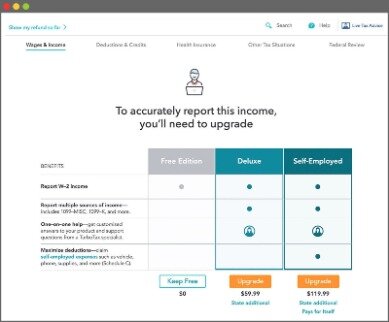

Unlike CPAs, EAs, and tax attorneys, many non-credentialed tax preparers only provide tax preparation assistance for a few months of the year during tax season. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If you’re not being paid for tax preparation services, you are not required to have a PTIN, even if someone pays you to file or e-file their return. To further help your business clients and generate another revenue stream, consider adding accounting and bookkeeping services to your practice’s offerings when you’re ready. Intuit’s QuickBooks Online Accountants portfolio has many tools to help you grow your client base, sharpen your skills and become more efficient.

File 100% Free With Unlimited Live Tax Advice And An Expert Review

Customize a solution that’s the right fit for your practice and pay for only what you need. COVID-19 resources Navigate the road ahead for your clients and business with the most recent and relevant COVID-19 resources. EasyACCT Gain a proven solution for write-up, A/P, A/R, payroll, bank reconciliation, asset-depreciation and financial reporting. QuickBooks Accountant Desktop Get all the power of QuickBooks in a one-time purchase accounting software installed on your office computer. Tax Pro Center Stay in the know with daily articles on what’s important and what’s trending in tax and accounting. Resources for starting a tax practice Read articles curated especially for pros establishing a new practice. COVID-19 Resources Navigate the road ahead for your clients and business with the most recent and relevant COVID-19 resources.

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). A non-credentialed tax preparer is an individual who prepares taxes without any professional credentials or certifications from an external organization such as the IRS, AICPA, or a Bar Association. This often includes seasonal tax preparers that work in tax stores and IRS Volunteer Income Tax Assistance Program volunteers. An enrolled agent is a person who is trained in federal tax matters and is licensed by the IRS. The IRS grants EAs the right to represent any kind of client—individual or business—on any tax matter before any IRS office.

It’s important to make decisions on these elements of your business model now so that you can choose the right professional tax software and tools as well as marketing tools for your practice. Estimated tax payments made during the year, prior year refund applied to current year, and any amount paid with an extension to file. As you review the report, highlight information you will need to prepare your tax return or make notes to remind yourself of something later. Your expert will share your tax outcome with you and answer any questions. If you’reself-employed or you receive income from other sources, you’ll need to report that information on your tax return. If you’ve received any of the following IRS forms in the mail, share them with your tax preparer.

By getting certified as a QuickBooks ProAdvisor, you earn perks like a free listing in the Find-A-ProAdvisor directory, free or discounted products for you and your clients, and preferential support. Intuit® is the industry leader providing professional tax solutions for every budget and every style of practice.

Company with a method for everyone to prepare their own income taxes. Intuit is hiring for a number of credentialed and non-credentialed accounting positions—from tax associate to tax expert. 23-minute timesavings based on an Intuit survey of ProSeries customers who reported using this feature; conducted in September 2019, in comparison to their previous method for preparing returns.

Ready To Try Turbotax?

They also provide advice for reducing tax liabilities on future returns by taking advantage of IRS programs such as Health Savings Plans, college and school tuition savings accounts, and retirement accounts. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. You’ll pay absolutely nothing to file your federal and state taxes if you have asimple tax return only. Start by easily importing your W-2, answer simple non-taxy questions about your life, and we’ll get you your maximum refund,guaranteed. Based on the results of calculating a return, a tax preparer can also offer advice about the best steps to take to reduce their tax liability in the coming year. A tax preparer is an individual who prepares, calculates, and files income tax returns on behalf of individuals and businesses. There are several different types of tax preparers, with some having credentials issued by third-party organizations while others are non-credentialed preparers.

The application is comprehensive, but you can save the information, take a break and continue to fill out the application when convenient. When your application has been approved, the IRS will send an acceptance letter and your EFIN. The IRS needs to know exactly who’s filing and who is covered in your tax return. To do this, you will need Social Security numbers and dates of birth for you, your spouse and dependents. Your expert will prepare your return from start to finish, making sure you get every deduction you qualify for. If you’re self-employed, many business expenses are also tax deductible. To document both personal and business expenses, make sure you have all your receipts, invoices, medical bills, and mileage logs.

The IRS requires that all tax preparers or firms filing 11 or more returns must electronically file. Before you can electronically file tax returns, you or your firm must apply to become an Authorized e-File Provider with the IRS and obtain an electronic filing identification number . You will need to complete a separate EFIN application for each location from which your business will electronically file returns. Once you have submitted your application to become an Authorized e-File Provider, you will need to send a fingerprint set to the IRS so they can administer a suitability check. This may include a credit check, a criminal background check, a tax compliance check and a check for previous non-compliance with IRS e-File requirements.

To do another return log out of your account and set up a new account and new user name and pay any fees again. The Desktop program can do more than 1 return and efile 5 for free. All states require CPAs to take continuing education courses to remain up-to-date on change on accounting and tax laws.

- Once you have submitted your application to become an Authorized e-File Provider, you will need to send a fingerprint set to the IRS so they can administer a suitability check.

- At any point, whether it’s before, during, or after training, there will always be support available for you.

- Intuit® is the industry leader providing professional tax solutions for every budget and every style of practice.

- Tax Pro Center Stay in the know with daily articles on what’s important and what’s trending in tax and accounting.

- By accessing and using this page you agree to the Terms and Conditions.

It’s important to note that some states require e-File providers to submit a separate enrollment application for authorization to e-File individual or business tax returns. Check with relevant state tax agencies to understand state-level e-file requirements. Before you begin to prepare your income tax return, go through the following checklist. Not every category will apply to you, so just pick those that do, and make sure you have that information available. When you’re ready to prepare your tax return using TurboTax software, you’ll be surprised at how much time you’ll save by organizing your information beforehand.

TurboTax Live offers real tax experts and CPAs to help with your taxes—or even do them for you. You can get a final review of your tax return before you file to ensure your taxes are done right, or you can even have a dedicated tax expert do your taxes for you, from start to finish, with TurboTax Live Full Service. You get unlimited tax advice year round year, so you can be 100% confident your return is done right, guaranteed. TurboTax Live experts are highly knowledgeable, with an average 12 years experience in professional tax preparation. Their tax advice, final reviews, and filed returns are guaranteed 100% accurate. An IRS Preparer Tax Identification Number is a number issued by the IRS to professional tax preparers, such as Certified Public Accountants and Enrolled Agents , who are paid for federal tax preparation services.

It’s also a good idea to have a copy of your latest tax return on hand. Your tax return will serve not only as a roadmap to your typical income and deductions, but also point out any major changes that may have occurred in the last year and any possible discrepancies between your returns. A tax professional is a person with the knowledge, credentials, and hands-on experience to assist you with your tax preparation. A tax professional stays up to date on tax laws, rules, and regulations, which can change every year and have a big impact on how much you owe or get back in your tax refund. Tax professionals can be authorized by the IRS to represent you on tax and payment matters. Such professionals are known as a Federally Authorized Tax Practitioners . File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted.

By Accessing And Using This Page You Agree To The Terms And Conditions

Connect these productivity upgrades to your ProSeries software for a customized experience that covers the needs of your entire practice, whether you want to work remotely or in the office. Rest assured that your returns are done right with comprehensive diagnostics that instantly pinpoint errors and show you exactly where to go to fix them with a click. Get more time back on every return with timesavers built into your workflow.

EAs can prepare and sign tax returns and offer advice on how to reduce future tax liability. Many former IRS employees become EAs and have worked with tax returns for many years. Many states require that CPAs also have additional classes that often lead to a master’s degree. CPAs can prepare tax returns and represent their clients before the IRS on all tax matters. They are specially trained to prepare both business and individual tax returns, so they are experts at identifying ways to save clients money at tax time.