Content

They can even patch into your computer screen to provide you with the most specific information. feature, which enables you to track your refund from filing through receipt. But, before you do, you should know that TurboTax offers a few very important guarantees. It gets a little more complicated when you have to enter stock transactions. But it’s also possible to import the capital transactions schedule from your online brokerage account.

There’s a pop-up that reminds you that help is available, which is less annoying than your usual pop-up since let’s face it, filing taxes is hard. If you have a PDF of last year’s return , TurboTax automatically populates your address, previous year’s income, AGI, and applicable tax breaks. But if you don’t, you can select the manual option, which allows you to type in your information. TurboTax offers desktop versions of their software that can be downloaded or purchased on a CD-ROM, too. These options are slightly different than their online counterparts, but pretty much match up with an online offering for the most part. TurboTax Free is the cheapest option, but it’s only for people with the simplest tax situations.

But the more complicated your taxes become, the pricier the software gets and you might be better off with another option. You can head to a local H&R Block office if you’re a brick-and-mortar kind of customer, but the pricing is different from their software. TurboTax has no in-person option, so H&R Block is a clear winner for those who’d rather have their taxes prepared face-to-face. However, H&R Block doesn’t offer as robust support options as TurboTax. That’s likely because H&R Block offers in-person preparation for customers who prefer more help. Throughout the tax filing process via TurboTax, there’s an option to get support via a small blue button in the top right-hand corner of the screen.

A tax expert can make sure you don’t miss out on any of the 350+ tax deductions and credits you are entitled to. Have a tax expert help make sure you get every homeowner tax deduction available, including mortgage interest, property taxes, and more. Work with a tax expert to uncover 350+ tax deductions and credits you may qualify for.

Jackson Hewitt Online 2021 (tax Year

Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit.

If you’re confused when it comes to doing your taxes, even if they’re fairly straightforward, then using TurboTax is a solid DIY option. It is one of the largest players in the tax preparation software industry. Software products are provided as a convenience to you, and Fidelity bears no responsibility for your use of, and output associated with, such products. The information and products made available to you are not intended to be, and should not be construed as, legal or tax advice or a legal opinion. We’ll search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund,guaranteed. Homeowners get step-by-step guidance to help turn their biggest investment into their biggest tax break. Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

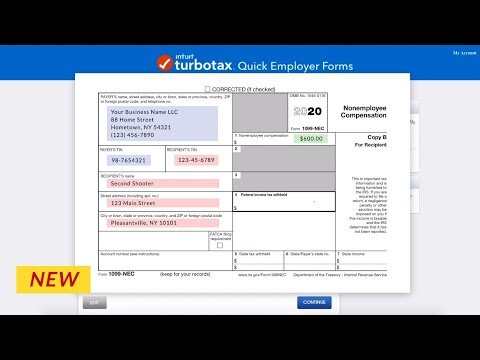

Automatically import thousands of transactions from hundreds of participating financial institutions, for seamless investment income reporting. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. No matter how you file, you can choose to receive your refund several ways. You can automatically import W-2 information from your employer if it’s partnered with TurboTax, but you can also take a picture of your W-2 and upload it to transfer the data to your return. You can import certain 1099s, and the Self-Employed version also lets you upload 1099-NECs from clients via photo, as well as import income and expenses from Square, Uber and Lyft.

The customer service is horrible and they do not advertise all of the hidden fees. If you’d like to get more information, or if you’d like to sign up for the service, visit the TurboTax website. This tool automatically determines if you should use the standard mileage deduction or actual expenses. It gives you the biggest possible deduction for your vehicle expense. Similar to what you can do with a W2, you can also take photos of business receipts on your mobile device and import them directly into TurboTax through QuickBooks Self-Employed. TurboTax makes it easy to directly import your ridesharing income and data directly from Uber or Lyft.

If you’re undecided about how to prepare your 2020 taxes, TurboTax is the first option you should consider. If you’ve been using a different service to prepare your taxes, there’s something to be said for sticking with what’s familiar. Learning to use a new tax solution can take time you don’t want to spend. It won’t cost you anything to create an account and run your return through its paces.

Turbotax Review: An Industry Standard For Diy Tax Prep

This link is also available on the main screen, similar to the bookmarks in TaxAct Deluxe. I expected to see these featured more prominently since they’re important tools, and since the site’s primary navigation tools are minimal. As it is, you have to click the Tax Tools link at the bottom of the left vertical pane and then click the barely visible Tools button beneath it. We also offer full audit representation for an additional fee with TurboTax Audit Defense. Overall a very good, concise, detailed, and with explanations of different areas of the tax code. Then, based on what you tell us, we’ll search for every tax credit that applies to you. We can import tax data from over a million employers and financial institutions to make things faster and easier for you.

Intuit’s TurboTax family of personal tax preparation software and services has a history of excellence that goes back more than 25 years. Always known for an outstanding user experience, TurboTax packs a lot of substance as well as style. It offers thorough coverage of tax topics in an easy-to-follow interview format, and its support is top-notch as well.

Just answer some basic questions about yourself, your life, and your family, and we’ll fill out the right tax forms for you.

Live, on-screen tax advice or review of your whole tax return by a tax pro is available if you buy the TurboTax Live version. These users also can submit written questions that a tax pro will answer within 24 hours. TurboTax imports electronic PDFs of tax returns from H&R Block, Credit Karma, Liberty Tax, TaxAct and TaxSlayer. This version lets you itemize and claim several other tax deductions and tax credits.

Getting Your Maximum Refund Starts Here, Choose Your Product

Your biggest investment might also be your biggest tax break—mortgage interest, property taxes, and more. Reduce your chance of a tax audit when we check your return for audit triggers and show your risk level.

Often, there’s a question mark or Learn More link that opens context-sensitive help in the right vertical pane. Sometimes, TurboTax even guesses at a question you might have and provides related FAQs.

In 2001, TurboTax saved financial institution passwords entered by users to servers at Intuit and the home computer. The programming error was reportedly fixed, but as of 2012 TurboTax offers no option to download a data file directly from the financial institution. Instead, it prompts the user for their login name and password at the financial institution or permits the data to be entered by hand. Free shipping offer valid only in Continental U.S. (excludes Alaska and P.O. Box addresses). Dell reserves the right to cancel orders arising from pricing or other errors. Add the products you would like to compare, and quickly determine which is best for your needs. I had to stop and fill out paper returns for Federal and State.

Get unlimited access to the helpful TurboTax community if you have questions about doing your taxes. Use the app ItsDeductible™ to calculate the value of items you donate, and know exactly what qualifies as a charitable donation on your taxes. We’ll help you determine who qualifies as your dependent, and then we’ll get you tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit , and child tax credit. The 2003 version of the TurboTax software contained digital rights management that tracked whether it had previously been installed on a computer by writing to sector 33 on the hard drive.

For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 1-3 of the 1040. Generally, it works only for people who don’t plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit. TurboTax Live Full Service ($200 for the Deluxe version and $55 state) is another option. You upload your tax documents to a secure location and let a tax expert or CPA prepare your return. He or she will go over it with you when it’s done and answer any questions, then sign and file your return. Here, too, H&R Block provides a similar option Like the online tax prep websites themselves, H&R Block’s virtual professional services are less expensive than those offered by TurboTax.

You can choose to pay for your tax preparation costs right out of your federal tax refund . If your business has employees or contractors, it lets you prepare an unlimited number of either W2s for employees or 1099s for contractors. If you use a third-party payroll service, this feature isn’t necessary, if you don’t, it’s one of the better small-business tools it has available. If you used TurboTax to prepare your return last year, your information is automatically transferred to this year’s return. You can also import a PDF of last year’s return from other major tax-prep services. If you can’t find what you’re looking for in the information database, you can get answers online from a tax specialist.

- TurboTax has a lot going for it, but price isn’t one of them.

- Similar to what you can do with a W2, you can also take photos of business receipts on your mobile device and import them directly into TurboTax through QuickBooks Self-Employed.

- That means you can split the cost between multiple returns if you have a big family.

- Whatever level of expertise you have in tax preparation, TurboTax can help you prepare your return quickly and easily — and without having to leave your home.

- However, W2s from many large employers are available for direct import, making the task even easier.

Thankfully, it’s easy to use and fast if you snap a photo of your W-2. Unfortunately, you get upgraded to a fee-based option if your situation goes much beyond having a W-2 or other extremely basic circumstances. The CPA and EA-assisted version of TurboTax Free is called TurboTax Live Basic, which costs $80 plus $45 per state return. Read on to find out if TurboTax is the best choice for you, and make sure to check out our other picks when it comes to the best tax software programs to use before you file.

Get Your Maximum Tax Refund

The apps are similar, though I didn’t see a real-time dollar amount representing my refund or obligation on the iOS version. The home page displays a list of the site’s main content areas so you can navigate to where you’re going easily. Internal informational and data entry screens are easy to understand and use, and an icon at the bottom of the screen takes you to a storage area where you can upload your tax documents for safekeeping. I found it more convenient to complete a tax return on my desktop, of course, but the apps are perfectly capable of doing the same. When you’ve come to the end of your data-entry chores, TurboTax Deluxe’s final review, CompleteCheck, examines your return for accuracy. TurboTax Deluxe also transfers pertinent data into your state return and tell you about any additional entries you need to make there. Personal tax preparation websites couldn’t be expected to be so all encompassing.