Content

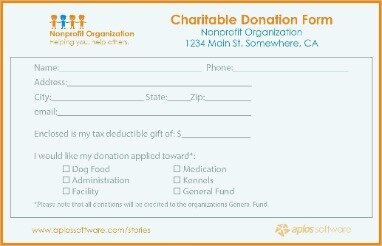

The donation cannot exceed 60% of your Adjusted Gross Income in order to qualify as a tax deduction. You must obtain a receipt for any amount of money you donate in order for your contribution to be qualified.

The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required.

Preparing Form 8283

For more information, refer to Publication 526, Charitable Contributions. For information on determining the value of your noncash contributions, refer to Publication 561, Determining the Value of Donated Property. Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage.

There is no fixed method for determining the value of donated items, but if you need guidance, please see IRS Publication Determining the Value of Donated Property. Goodwill Central Coast information for tax return with address of your donation center. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers.

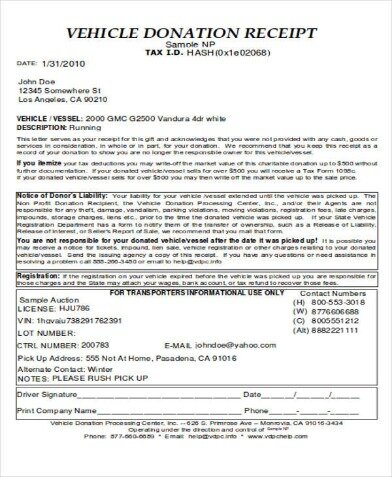

Donation Receipt Template

If so, you must show the amount you’re claiming as a deduction for the year as a result of the donation. If you don’t know whether the organization you’re donating to is IRS-approved, ask for the organization’s tax ID number. Then, check for a list of qualified organizations. The party making the donation to the recipient Organization will also need to be defined.

IRS Links for Forms and Instructions— opens in a new window IRS Tax Form 8283is used to report information about noncash charitable contributions. opens in a new window Form 8282is used to report information to the IRS and donors about dispositions of certain charitable deduction property made within 3 years after the donor contributed the property. Form 8283 if you’ll deduct at least $500 in donated items. Additionally, you must attach an appraisal of your items to the form if they’re worth more than $5,000 total. Tax deductible donations must meet certain guidelines, or you won’t get the extra cash to accompany your good deed. Here’s how to make your tax year a little sweeter.

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. H&R Block has easy ways to file your taxes, including filing online, using professional tax software or at our tax office locations. You can’t write off the value of services or time you donate. You must keep the records required under the rules for donations of more than $500 but less than $5,000. The organization can give you a separate statement for each donation. They could also give you periodic statements proving your donations.

- The donation must be made voluntarily and with no expectation of any substantial reward or benefit.

- he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

- For more information, refer to Publication 526, Charitable Contributions.

- Not only that, but you are also helping a local child’s wish come true.

Timing is based on an e-filed return with direct deposit to your Card Account. If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale.

What Is The Best Organization To Donate A Car?

This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing not available in NJ, NY, RI, VT and WY.

This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

Tax Bracket Calculator

When you donate property to a charity, the IRS allows you to deduct its fair market value. It’s your responsibility to determine the value of your property donations. There are many ways you can do this, but regardless of the valuation method you choose, your estimated value must always relate to a realistic price that a buyer would pay for the item in the open market. Generally, you can deduct contributions up to 30% or 60% of your adjusted gross income, depending on the nature and tax-exempt status of the charity to which you’re giving.

US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Fees apply to Emerald Card bill pay service.

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. You can claim a deduction for food and groceries, too. You can deduct the cost if you donate groceries to a charity. The schedule isn’t just for claiming charitable donations. It includes and calculates all itemized deductions you’re eligible for.

Excess contributions can be carried over for a maximum of five years. You can list up to five donations to five different organization on Form 8283, and if you had more donations, you can attach as many Form 8283s to your 1040 as you need. Thank you so much for your generous donation. Your February statement will show your donations and can be used for tax purposes. This should arrive by the end of February.