The head of household and qualifying widow statuses are not available since both require you to claim at least one dependent, which the 1040EZ does not allow. Form 1040 has many more income categories for items such as Social Security benefits and alimony, along with the ability to claim more deductions. By using a direct deposit instead of a paper check refund, you can usually speed up the refund process by a few weeks. The first section includes general identity information such as your name, address, social security number. Here you can also provide the name and social security number of your spouse if you are filing married filing joint status. is really simple to use and available to any who qualifies to file a Form 1040EZ.

TurboTax will select the right form for you when you prepare your federal amended return and supply instructions for mailing the correct forms to your state’s department of revenue. As complex as the US tax law can be, the Form 1040EZ is one method of simplifying tax returns for middle to low-class individuals. Many taxpayers do not have multiple sources of income or deductions to claim to this form gives them a great relief in time and money. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

We’re here for you when you need us. We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years. Jump to the front of the line with priority support via email, live chat, or phone. Please check the contact us link in your my account for the support center hours of operation. Usually, email responses can be expected within 24 to 48 hours. TaxSlayer makes it easy to prepare and e-file your state return.

If you recently became a US citizen, are a citizen of multiple countries or work in the US under a visa, our team will analyze your scenario to assist and file the appropriate US returns. If paying taxes makes you cringe, tax credits and deductions should make you smile. They can help to reduce your tax burden.

When You File With Us, You Get:

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Mail all the forms and documents to the address provided in the instructions. In Part III of Form 1040-X, you’ll need to provide a clear explanation for your reasons for filing an amended return. The process for filing an amended return is fairly straightforward.

Offer may change or end at any time without notice. Double-check your entries to be sure you entered all of your information correctly. Next, we’ll check your return for errors . This ensures your return is processed by the IRS and state without delay. We stand behind our always up-to-date calculations and guarantee 100% accuracy, or we will reimburse you any federal or state penalties and interest charges.

Turbotax Editors Picks

Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred.

- Cost-effective — the service is competitively priced and is powered by Ernst & Young LLP , an organization with more than 100 years of experience in tax preparation.

- Widowed before the first day of the tax year and not married during the tax year.

- TaxSlayer makes it easy to prepare and e-file your state return.

- Having an ITIN does not change your immigration status.

Here’s a guide to what is on these forms and what has changed from previous tax years. Finally, you will need to sign, date, and file the tax return. If you are e-filing, you will sign using an e-signature.

If you need additional time to file your federal and state returns, EY TaxChat™ can prepare and file your extension forms for you. EY tax professionals consistently work with multistate filers, to submit the proper forms, credits and state tax returns. EY tax professionals will prepare and file your individual returns including forms related to investment income, such as federal Schedules B, D and E. Proper reporting is crucial, as certain types of interest, dividends and capital gains may qualify for reduced tax rates. If you’re subject to the net investment income tax, we prepare the Form 8960, and include the tax deductions available to you. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Support

Available at participating U.S. locations. Although it might be easier, you should avoid using the Form 1040EZ if you could claim the the first time home buyer tax credit. In addition, if you paid property taxes, you’ll want to file Schedule L to take advantage of a higher standard deduction, an option is unavailable to EZ filers. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

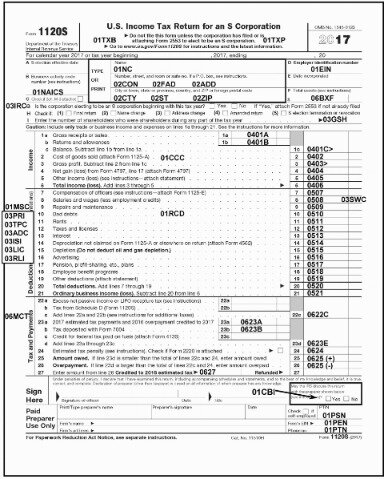

, Form 1040A, and Form 1040EZ are generally the forms US taxpayers use to file their income tax return. TaxSlayer Simply Free includes one free state tax return.

This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation. breaks down the tax due by taxable income and filing status. Simply, find the amount of your taxable income in the table and match it to your filing status to see how much tax you owe. If your tax withholding and EIC during the year are larger than the tax liability on the form, you will receive a refund. Complete this section with your routing number and account number of your savings or checking account. or be considered legally married as of the last day of the tax year, and the taxpayer’s spouse died before the return was filed. A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at P.O.

Get Your Max Refund With These H&r Block Tax Filing Options

If you’re outside of that window, you can’t claim a refund by amending your return. Use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Employers must file a Form W-2 for each employee from whom Income, social security, or Medicare tax was withheld. Used to request a taxpayer identification number for reporting on an information return the amount paid. Use this form to apply for an employer identification number . We find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. Being Disabled saved me about 28 Dollars in taxi fare to get form and as My Brother said.

Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Supporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application.

They have been replaced with new 1040 and 1040-SR forms. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. For tax years beginning with 2018, the 1040A and EZ forms are no longer available. Watch this video for more information on how to file a 1040EZ for free. You’ll get your maximum refund, guaranteed, every time you use TurboTax, and you’ll never pay until you’re ready to e-file or print your tax return.

Want To Save Time And Money?

Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.