Content

TurboTax Live is a slightly different animal, one that Intuit introduced three years ago. This service lets you connect with a tax expert via video chat. These tax professionals can then see your screen if you allow it and do a line-by-line review of your return.

You can even start it up and come back another day to finish up. Call the IRS number to find out if it went through, the website also has lets you know if you are missing anything. Overall a great way to file taxes without that high dollar charge for most places.

If You’re Getting A Refund

In our tests, we found H&R Block’s help screens and in-app guidance to be nearly as good as TurboTax’s. However, the software was also more error-prone, especially as the complexity of returns increased. We ran into a couple of problems trying to hunt down stray forms, and the automated chat help was ineffective. For those reasons, we recommend using H&R Block Free Online to save money only when you’re filing a basic return with a student loan or tuition deduction. Student loan interest and higher-education tuition and fees are valuable deductions you can take even if you file with the standard deduction. Unfortunately, our top pick, TurboTax Free Edition, doesn’t support filing those forms.

All products, including TurboTax Free, let you view TurboTax’s extensive database of FAQs and tax-related articles to help you understand potentially confusing concepts. You can get free help from their online community of TurboTax specialists and customers, too. Customers may not always provide accurate information which could cause problems with your taxes. If you need to file a state tax return, you can expect to pay $45 per state, and e-filing a state tax return will cost you an extra $25 .

In exchange, the companies have entered into an agreement with the IRS to offer a “Free File” product to most Americans — but good luck finding it. The apps are similar, though I didn’t see a real-time dollar amount representing my refund or obligation on the iOS version. The home page displays a list of the site’s main content areas so you can navigate to where you’re going easily. Internal informational and data entry screens are easy to understand and use, and an icon at the bottom of the screen takes you to a storage area where you can upload your tax documents for safekeeping. I found it more convenient to complete a tax return on my desktop, of course, but the apps are perfectly capable of doing the same. Intuit’s Tax Return App follows the same Q&A that the browser-based version does, offering help along the way.TurboTax security specialists work with the IRS and state revenue departments to prevent fraud.

These are the prices currently listed, all of which have already been slashed. I have used TurboTax for the past 9 years & have been very pleased. However, doing my 2020 taxes this year was a nightmare. I had to spend 8-10 hours on the phone with various Turbo Tax specialists trying to fix the problems I was having due to glitches in their software. I will also not get my refund this year — which is substantial — in as timely a manner as I would have if I had been able to e-file. I will definitely think long & hard about whether I want to use TurboTax again next year for my 2021 taxes. The assistance of having a live accountant readily available online or phone call is awesome.

Tax Software And Tax Preparers

I was told by their staff that they disable access to the actual tax forms in the on-line versions. It’s much more difficult to do this type of what-if analysis with online software. You can register with two different email addresses, one for filing and the other for planning, but you will have to enter your data twice and be careful to keep them in sync. You will have to remember to undo the changes you made in the planning profile to go back to the baseline before you make additional changes for planning purposes. The software download also makes it easier to access the tax forms.

It works well for projecting the federal income tax if you are familiar with the forms. It doesn’t do everything (for example calculating the Saver’s Credit). Tax software still works better but if you can’t use the tax software , it’s a good second choice for planning purposes. It’s easy to create a copy of the data file and name it something else. Then you delete that 1099 in the copy and compare the results. Besides filing your tax return, the installed software is also a powerful planning tool.

TurboTax’s Live lineup of products offers assistance from CPAs or EAs. These tax professionals have certifications that prove their tax knowledge. This should make you feel comfortable that you’re getting the right answers when you ask detailed questions about your tax situation.

- Intuit confirmed on Feb. 26, 2019 that this is in fact not a data breach, but a credential stuffing attack.

- If your AGI is higher than that, you can use Fillable Forms.

- TurboTax’s Self-Employed packaged helps take the stress out of the season.

- If you think anything is missing, you can ask to see the whole list, including Wages and Salaries, Unemployment, and Interest and Dividends.

- “You aren’t put in the position of having to respond immediately.”

- Seeing, “You can do this,” throughout the process may help to reduce some anxiety.

People with these situations who don’t feel comfortable with the tax impacts may want to consider upgrading to Live Premier for help from a CPA or EA. TurboTax Deluxe, which costs $60 plus $50 per state return, offers everything included in the TurboTax Free package. Their software searches for deductions and credits you qualify for (their website touts 350+deductions) and it also maximizes your mortgage deductions and deducts your eligible charitable contributions. Expect deals early on in filing season to lure customers in. Be prepared for price increases as the tax deadline nears. Note, however, that the tax professional can’t represent you or provide legal advice unless you upgrade to a paid service. It is one of the largest players in the tax preparation software industry.

Filing Versus Planning

H&R Block, which has traditionally been TurboTax’s closest competitor, charges $49.99 for its Deluxe Online version ($36.99 per state filing). Its Deluxe version is $24.95, but you’ll pay $44.95 per state filed. The biggest reason I’m considering TurboTax Online is for the Live feature, where a tax professional will do a one-on-one review of your return prior to filing .

The main sections of TurboTax have home pages that display the tax topics contained there.When you’re finished with one income type, you click Done to go back to the income list. The Start button next to the topic you just completed changes to Edit/Add, which allows you to go back and make changes. Once you’ve visited all the entries there, you can click Wrap up Income to move on. TurboTax has pared down its user interface considerably over the years. It looks great, yet still provides access to the tools you need. A vertical toolbar on the left side of the screen divides the site into My Info, Federal, State, Review, and File.

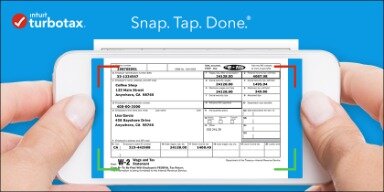

If you liked the desktop version of TurboTax, you’ll like the app even better. It uses the same card-based design, except you can tap and swipe instead of clicking. You can upload a picture of last year’s W-2 to get a headstart. TurboTax’s desktop products offer U.S. based phone support with TurboTax specialists. These specialists should be able to help you with your problems, but they’re probably not CPAs or EAs. While it’s simple enough to use, TurboTax’s software comes with a few cons.

What Is The Turbotax Free Edition?

All state filing costs $36.99 per state, with the paid plans. Most filers can get away with the Deluxe option, which costs $29.99 and includes software for maximizing tax deductions. If you do freelance work or own a small business, you’ll likely need to upgrade to the Self-Employed plan, which costs $84.99.

Unlike lots of loans you’ll see at this time of year, the interest free loan is free from gotchas . If you don’t qualify for completely free pricing from TurboTax, check out H&R Block which is supporting free filing for people with education related expenses . For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty. NerdWallet strives to keep its information accurate and up to date.

Turbotax Live Deluxe

If you buy through affiliate links, we may earn commissions, which help support our testing. TurboTax offers thorough explorations of tax forms and schedules and an outstanding user experience. It’s more expensive than the competition, but it’s worth it. Read and love your article Download/CD vs online tax preparation. However, I don’t know how to cope with the state returns if using this. One has to go online and sign in through their server to get back into one’s own desktop computer and use the “desktop” program.

The software download includes five free federal e-files for this purpose. If you need to do more than five returns, the additional returns can be printed and mailed. I think $20 for just e-filing the state return is too high when the whole software with all the complex logic for both federal and state returns is only $40. If you are willing to print and mail the state return, you can save the $20 and get the software at half the price for doing it online.