Content

If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000. Undoubtedly, the pandemic has upended our lives, including forcing many of us to make the transition to working remotely for the foreseeable future.

- As a result, your employer would deduct only Wisconsin state taxes from your paycheck, and none for Illinois.

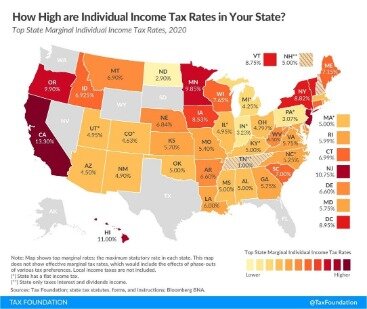

- You might consider deducting sales tax instead of the state income tax as an alternative strategy—it’s an either/or option.

- You would include all your income in Column 1 but, only your part-time Delaware income in Column 2 .

- People living and working in two different states often delegate the task of filing state income tax returns to an accountant or to a tax attorney.

Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future. With respect to countries inLatin America, the distribution of material may be restricted in certain jurisdictions. Such securities or instruments are offered and/or sold to you on a private basis only. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission–CVM is completely prohibited.

Q. My company moved its office from Delaware to Ohio last year. I had an employment contract and the company paid me according to this contract, although my employment was terminated this year. They have taken Delaware State income tax out of my payments for part of this year. I would like to know under these circumstances why they continue to take out Delaware state tax and what if any tax liability I have, considering I do not live in Delaware and have not worked in Delaware this year.

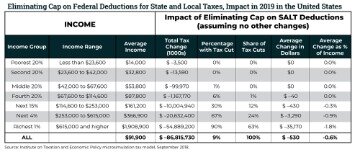

The Rich Pay All The Taxes And Then Some

If you purchased a taxable bond for more than its face value—as you might have to capture a yield higher than current market rates deliver—Uncle Sam will effectively help you pay that premium. That’s only fair, because the IRS is also going to get to tax the extra interest that the higher yield produces. Look at Box 5 on the Form 1098 you receive from your lender for the amount of premiums you paid during the year. When you buy a house, you get to deduct in one fell swoop the points paid to get your mortgage.

For items such as electronics, appliances, and furniture, you may need to pay a professional to assess the value of your donation. If you are active duty military, you can even deduct your moving expenses.

The result is that you actually pay taxes for one state, even though you must deal with the hassle of filing returns in both states. What if you live in Milwaukee but you commute every day by Amtrak to Chicago? It just so happens that Wisconsin and Illinois share what is known as a reciprocal tax agreement.

Tax Deduction Limits

See here for the coalition’s list of states and applicable filing and payment rules for nonresidents. For starters, some states have reciprocity agreements to keep workers’ income from being taxed twice. There’s a similar pact between Maryland, Pennsylvania, Virginia, West Virginia and Washington, D.C. If you work in one state, but reside elsewhere, you might be on the hook for taxes in both locations. Further, more than 7 out of 10 of the remote workers were unaware that telecommuting from a different state could affect the amount of state taxes owed, the institute found. That’s because the longer you work away from your home base, the higher the likelihood you could have tax reporting and payment obligations in your temporary location. If you worked remotely from a different state while waiting out the pandemic, you just might wind up facing a tax surprise when you file next year.

Some common myths will cost you money, and others can get you into trouble with a state taxing authority. Tonya Moreno is a tax expert who has worked as a tax accountant for numerous large muti-state corporations. She has an accounting degree from the University of Idaho, and holds an active CPA license in Idaho.

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Read our article on reporting foreign income to learn about your tax obligations when working overseas. Bank statements with copies of canceled checks or debits can prove estimated payments and after-the-fact payments of state tax.

Volunteer Firefighters Credit

For a business, having a physical presence is one of the key determinants for tax nexus. Having employees located in a state, even if they are working remotely, may result in tax nexus. Talk to your tax professional ahead of time to make sure you don’t wind up with a surprise tax obligation next spring. “Different states have different rules for when you need to file,” said Sherr. Massachusettsjoined that list this spring, when it put in place anemergency rulethat would tax out-of-state workers who used to commute to the Bay State.

For that day, Sarah worked from home out of convenience, and New York would treat the portion of her salary she earned for that day of remote work as New York source income. The age of telecommuting has blurred the line as to what it means to earn income “in” a state. If the taxpayer works remotely merely out of convenience, income will still be subject to that state’s tax. Not sure you really need this level of attention to your “working remotely” taxes? Take a quick look below at three common scenarios and their new ramifications.

The extent of taxation depends on the state’s income tax rules. For instance, employers must start withholding state taxes if an employee has been in Arizona for more than 60 days. Meanwhile, employees who work in New York even one day are required to file a return, according to the Mobile Workforce Coalition. Further complexity is ahead for people who might be staying in a state where they aren’t a resident and continue to telecommute. This is how people end up filing two or three state tax returns. That’s because the Tax Cuts and Jobs Act, which went into effect in 2018, eliminated this tax write-off, along with a package of breaks that were known as “miscellaneous itemized deductions.” Working “too long” in a given state could cause a taxpayer to be treated as a resident of that state due to a statutory day count rule.

If you didn’t pay a state where you do owe, calculate the amount of tax due and file a return with a payment. At the end of the year, you’ll have to file taxes in both your old and new state as a part-year resident. Most have a line on the return where you can mark whether you were a full or part-year resident. If you specify that you were a part-year resident, you will have to list which dates you lived where and pro-rate your income. There are two ways to fix this issue, and neither is complicated.

Please note, if your home loan is over the $750,000 (or $1 million) limit, you can still deduct the mortgage interest related to the portion of your loan up to that amount. The Optima Tax relief team has had one vision since inception – to help Americans nationwide deal with the aggressive collection policies of the State/IRS tax agencies. As we know, tax issues can create great stress, depression, and anxiety. It can seem overwhelming when an individual tries to take on these collection agencies by themselves while being at risk of garnishments or property seizures.

Had Keisha been mindful of the number of days she was spending in Minnesota and left before she became a resident, she could have avoided Minnesota tax on all income but that which she earned while working there. Because Keisha maintains a permanent place of abode in Minnesota—even though it is just a summer house—and meets the statutory day count rule, she will be treated as a Minnesota resident taxpayer in 2020. And yet, because her domicile remains in Illinois, she will also be subject to tax in Illinois on all of her income as an Illinois resident. You may be asking yourself, “If I work remotely, where do I pay taxes? To illustrate the issues many U.S. taxpayers may face with their 2020 tax bills because they’ve worked from home during the pandemic, we offer this analysis of three scenarios that are now, strangely, common.

For example, if you use an extra room to run your business, you can take a home office deduction for that extra room. The Tax Cuts and Jobs Act suspended the home office deduction for W-2 employees for tax years 2018 to 2025. In other words, the employee’s remote home could be treated as an office location, subjecting the employer to tax nexus in that state. Similarly, the employee could be subject to state income tax in the state they are remotely located.

Which Is Right For You? Standard Vs Itemized Deductions

If you live and/or work in more than one state, how do you determine your state income taxes? TurboTax can help you calculate the taxes you owe to different states. A.Yes, you need to file a Delaware Non-Resident return and report the Severance Pay as Delaware sourced income. Severance Pay is taxable, based on the years of service rendered in Delaware. If you have any questions regarding severance pay, please contact Eliott Johns at .

That doesn’t mean it can’t be done—you can still deduct donations to charity, medical expenses and mortgage interest—but it does mean you have to do some math. Finally, look at your Schedule A and report your numbers (you’ll find the state and local tax on Line 5 of Schedule A). The answer to this question comes down to whether your stimulus check increases your “provisional income.”

Note that in order to take advantage of these agreements, you must file an exemption form. In our example, you would file an exemption form in New Jersey so that your employer there doesn’t withhold state taxes from your income earned.