Content

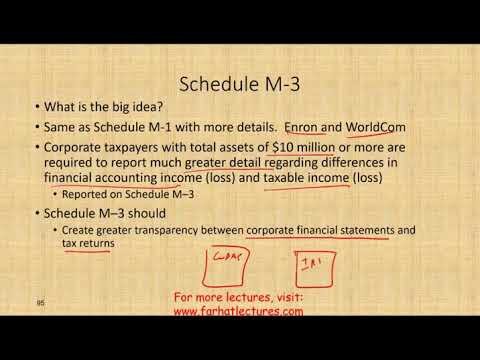

Information as to the number of contributions of that type of property, the value of the contribution, as well as the method used to determine the property’s value, is detailed. If the total assets at the end of the corporation’s tax year equal or exceed $10 million, the corporation must file Schedule M-3. The end result reported on Schedule M-3, Part I, line 4a, should match the net income amount reported on the corporation’s worldwide consolidated net income statement. If you use TurboTax, it can automatically calculate the making work pay credit and make sure you’ve received everything you’re entitled to, based on your W-2 and other tax information. During 2010, the federal government provided some taxpayers with a $250 economic recovery payment. If you receive this payment during the year, you must reduce your allowable credit amount by $250.

Yet, the Schedule M-1 still needs to be created and included in the return. Line 4, “Income included on Schedule K, lines 1, 2, 3c, 4, 5a, 6, 7, 8a, 9, and 10, not recorded on books this year” – Certain credit forms require that the amount of credit be included in other income. The increased income is a tax item only and is not generally included in book income. The increased income amount flows to this line automatically. Additional income items reported for tax purposes, but not included in book income, are entered on the M1 screen, line 2. The comparable uncontrolled method (“CUT”) is analogous to the CUP method used for transfers of tangible property. In order for the intangible involved in the controlled transaction, both intangibles must be used in connection with similar products or processes within the same general industry or market and must have similar profit potential.

A step by step guide on how to fill in Schedule M, the Making Work Pay Credit form. Tax forms change every year. Ensure you have the most up to date form available from the IRS. Don’t get lost in the fog of legislative changes, developing tax issues, and newly evolving tax planning strategies.

These Guaranteed Payments do not automatically pull from either the Deductions or Schedule K sections of the Form 1065. The partnership is not filing or required to file Schedule M-3. The taxpayer is not required to file Schedule C , Schedule B or Form 8916-A. If the return does not meet the criteria to file an M-3, check for entries made on any of the Schedule M-3 screens which should not be there.

Below is a list of common book-tax differences found on the Schedule M-1. The list is not all-inclusive. Schedule M must be completed by Category 4 filers of the Form 5471 to report the transactions that occurred during the CFC’s annual accounting period ending with or within the U.S. person’s tax year. A question on Form 990 Part IV Checklist of Required Schedules asks the preparer if they have received noncash property greater than $25,000. If the answer is yes, Schedule M is required to be completed and attached and submitted as a supporting schedule of the 990. The sum of all the property reported on Schedule M should correspond to the amount recorded on Federal Form 990 Part VIII Statement of Revenue line 1f. The schedule lists different types of categories to describe the donated property.

This amount is entered on screen K – Shareholders’ Pro Rata Share Items, on the AMT and Basistab, line 16a. Certain nondeductible expenses, such as penalties and fines, and officer life insurance premiums, can be entered on screenK – Shareholders’ Pro Rata Share Items, on theAMT and Basis tab, line 16c – Nondeductible Expenses. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Organizations that file Form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions. The Making Work Pay Credit is a nice benefit that many people simply forget to claim.

Who Can Claim The Credit?

Other indicators are not precluded from use if they would profit an accurate estimate of profits. The appropriate profit level indicator depends upon the characteristics the tested party and the comparable party share. On the M-1 reconciliation there are two separate lines to enter the differences in depreciation. In this section the depreciation adjustment amount entered would represent the assets where the amount of depreciation taken is greater on the books of the partnership than what is being claimed on the tax return. Depreciation – This is a common adjustment item on the M-1 because a taxpayer is allowed to utilize acceleration depreciation methods, special and/or bonus depreciation. However, this difference in methodology will produce a greater amount of depreciation expense in the initial and early years when claiming depreciation on the tax return and a lesser amount on the business records. This trend will reverse in the later years, and eventually , the depreciation taken will be the same on both the tax return and the books of the business.

Each annual premium includes $1,500 of cost of insurance and $8,500 of investment. At the end of the fifth year, the basis of the policy is $42,500, and the investment in the contract is $50,000. At that five-year anniversary, the corporation surrenders the policy and receives $55,000 from the insurance company.

In TaxSlayer Pro, the total of these items would be entered from the main menu of the 1065 return by selecting ‘Schedule K- Distributive Share Items’, then ‘Other’, then ‘Other Tax Exempt Income’. Line 5 – Includes other income reported on the corporation’s books for the year but excluded from the tax return.

TaxHow’s mission is to provide simple and clear solutions to all taxpayers, making tax preparation easy and almost fun. We strive to translate IRS-speak into simple and relevant articles that provide you with the information you need – when you need it. Find out how to file your federal and state taxes easily, quickly and most importantly – accurately. On Line 10 you have to say whether you have received any form of economic recovery payment during 2010. If you didn’t, just enter zero and go to Line 11. If you did, write down the total, but not more than $250 (or $500 if married filing jointly). Now take your adjusted gross income from your 1040 form , or your 1040A and write it down on Line 5.

Category 4 filers are U.S. persons who had “control” of a foreign corporation for an uninterrupted period of at least 30 days during the foreign corporation’s annual accounting period. Control is defined as more than 50 percent of voting power or value, with Section 958 of the Internal Revenue Code attribution rules applying. U.S. persons who are officers or directors of a foreign corporation in which, since the last time Form 5471 was filed, a U.S. person has acquired a ten percent or greater ownership or acquired an additional ten percent or greater ownership. U.S. persons who are officers, directors or ten percent or greater shareholders in a CFC. Category 1 includes U.S. shareholders of a Section 965 “specified foreign corporation” at any tax year of the foreign corporation, and who owned that stock on the last day in that year. The purpose of this schedule is to provide information about the contributions the Organization has received during the year that consist of property other than money.

Looking For More Information?

Income Subject to Tax Not Reported on the Books – In this section the user will enter any income that was included on the tax return but not included on the books of the business. This is not a common item on a partnership return, particularly for any entity that operates on a Cash Basis for accounting and tax reporting. Occasionally, due to the timing of gains or other income items, an entry may be required in this menu. If the partnership doesNOT meet the four requirements set forth in Schedule B , Line 6, the partnership is required to reconcile any differences between the book income of the partnership to the income being reported on the tax return.

Stock in trade refers to any merchandise or equipment kept on hand and used in carrying on a business. It includes the collection of goods, inventories and merchandise, maintained by a business entity for the purpose of using them for processing, making salable goods or for selling to the customers with an intention to make profit from such deals. The reliability of a pricing method is determined by the degree of comparability between the controlled and uncontrolled transactions, as well as the quality of the data and the assumptions used in the analysis.

amount of total assets at the end of the tax year reported on Schedule L, line 14, column , is equal to $10 million or more. Line 5a, “Tax-exempt interest” – This includes interest, such as interest received on state or local bonds, and is excluded from gross income.

Schedule M-3 is required when the corporation’s total assets at the end of the year are $10 million or more. The calculation for Schedule M-3 is done in reverse from the form itself.

Turbotax Cd

So you have one less thing to gather at year-end, keep a folder to hold all supporting documentation regarding the noncash contribution. If the Organization did not report a value for one of the donated items listed on the schedule. If the Organization hires or uses a third party to solicit or process the sale of noncash contributions. Schedule M is required to be completed if the Organization has received noncash contributions, in the aggregate, greater than $25,000.

Wks M1S explains the adjustments flowing to Schedules M-1 and M-3 for the 1120S. Wks M1C explains the adjustments flowing to Schedules M-1 and M-3 for the 1120. amount of total receipts for the tax year is equal to $35 million or more. amount of adjusted total assets for the tax year is equal to $10 million or more. Line 3b, “Travel and entertainment” – Meals and entertainment limitations are carried from amounts entered on the DED screen. Try TurboTax software.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. After calculating your credit amount on Schedule M, you must transfer the credit to your personal tax return.

Schedule M requires the CFC shareholder or related party to disclose a number of different transactions. We will next through the questions asked on each line of the schedule. To this end, the regulations under Internal Revenue Code Section 482 adopt an arm’s length standard for evaluating the appropriateness of each transaction under the transfer pricing rules. This article will apply these regulations to the relevant questions listed on Schedule M. This way the parties involved in the controlled transaction have a reference point as to how to report these transactions on Schedule M. Travel and Entertainment- The IRS limits the amount that a business can take as a deduction for Meals, and Entertainment to 50% or in certain situations to 80%. These deductions are limited on the tax return but on the books of the business, there is no such limitation and the financial records of the business will expense 100% of these expenditures to determine book income . The excluded amounts on the tax return will be automatically pulled by TaxSlayer Pro based on the entries made under Deductions for Meal and Entertainment expenses.

Tax Section membership will help you stay up to date and make your practice more efficient. Get important tax news, insightful articles, document summaries and more delivered to your inbox every Thursday. This article discusses some procedural and administrative quirks that have emerged with the new tax legislative, regulatory, and procedural guidance related to COVID-19. Search for comparable companies and obtain their financial data- the key factors in assessing the comparability of the tested party to comparable companies are the resources employed and the risks involved.

Third, the columns of Schedule M separately identify transactions between the CFC and various related entities including the U.S. person filing the return and any domestic corporation or partnership controlled by the U.S. person filing the return. Finally, the regulations of Internal Revenue Code Section 482 should apply to value inflows and outflows of the CFC for purposes of Schedule M reporting.

The facts are the same as in Example 1, except that the corporation sells the policy at the fifth anniversary for $55,000. The gain recognized upon the sale is $12,500. If the cost of insurance had been charged against AAA as the premiums were paid, the net effect of the insurance transactions would be an increase in AAA of $5,000, which is arguably the real economic gain. In this instance, it may actually make more sense to charge the annual insurance cost to OAA. In that case, AAA would increase by the $5,000 gain realized on the surrender, which should be the correct result. Note that the aggregate decrease of $7,500 in OAA is benign, since OAA has no significance to any other calculation. The effect of the mismatch is also felt in the shareholders’ basis.

- Enter any other decreases in Line 6.

- Amounts entered on the M1 screen, line 5 – Other adjust those amounts carried from the K1P screen, line 18, codeB.

- This article will go column by column and line by line through the attachment to Form 5471.

- This credit is available for you if you worked during 2010 and earned at least $6,451 ($12,903 if you’re married and file jointly).

- In this case, it would make no sense to have charged the insurance cost to OAA; doing so would result in a net increase in AAA of $12,500, which would be an illogical windfall.

- The fourth is the “comparable profits method” (“CPM”).

These include certain officer life insurance proceeds, and gains on certain installment sales. Amounts entered on the M1 screen, line 5 – Other adjust those amounts carried from the K1P screen, line 18, codeB. Other Deductions on Sch K – In this section the deduction items that are reflected on the partnership records but are not included on the tax return are entered. Upon entering this field, the user will be required to itemize these deduction items. This will be repeated for each adjusting deduction item reported on the books of the partnership but not deducted on the tax return.

10 Percent or More U.S. Shareholder of Controlled Foreign Corporation (other than the U.S. person filing this return). I joined Hawkins Ash CPAs in 2001 and am a partner in the firm’s La Crosse office. I have extensive experience providing audit services to nonprofits and educational agencies. I am chair of the firm’s nonprofit service group and a member of the firm’s Audit and Accounting Committee. If you have any questions regarding Schedule M or any of the other schedules, please contact your Hawkins Ash CPAs representative. If you receive noncash property during the year, take the time to keep a list of the type of property received, the date and value of the property.

To qualify to the making work pay tax credit, you must have earnings from work-related activities during the year, such as employment. If you are self-employed or only receive investment income such as interest and dividends, you will not qualify. Additionally, your Adjusted Gross Income , which is your gross wages minus specific IRS adjustments to income such as student loan interest and the IRA contribution deduction, must not be $95,000 or more, or $190,000 or more if filing a joint return. In practice, uncertainty surrounding the accounting for the cost of insurance could make it impossible to correctly characterize distributions from S corporations with E&P. Perhaps more important, a failure to recognize the correct amount of nondeductible insurance costs will result in cumulative miscalculations of the shareholders’ basis.