Content

The base subindex gives a 10 percent weight to the marriage penalty, a 40 percent weight to the double taxation of taxable income, and a 50 percent weight to an accumulation of other base issues, including indexation. States with flat-rate systems score the best on this variable because their top rate kicks in at the first dollar of income . They include Illinois, Indiana, Kentucky, Massachusetts, Michigan, Pennsylvania, and Utah, among others. These include New Jersey ($5 million of taxable income), New York ($1,077,550), California ($1 million), Connecticut ($500,000), and North Dakota ($433,200 of taxable income). Job tax credits typically offer an offset against tax liability if the company creates a specified number of jobs over a specified period of time. Sometimes, the new jobs will have to be “qualified” and approved by the state’s economic development office, allegedly to prevent firms from claiming that jobs shifted were jobs added.

Thus, a state with lower tax costs will be more attractive to business investment and more likely to experience economic growth. State lawmakers are mindful of their states’ business tax climates, but they are sometimes tempted to lure business with lucrative tax incentives and subsidies instead of broad-based tax reform. This can be a dangerous proposition, as the example of Dell Computers and North Carolina illustrates. North Carolina agreed to $240 million worth of incentives to lure Dell to the state. Many of the incentives came in the form of tax credits from the state and local governments. Unfortunately, Dell announced in 2009 that it would be closing the plant after only four years of operations.

Qualifying food, drugs, medicines and medical appliances have sales tax of 1% plus local home rule tax depending on the location where purchased. Georgia has many exemptions available to specific businesses and industries, and charities and other nonprofits such as churches are exempt. To identify potential exemptions, businesses and consumers must research the laws and rules for sales and use tax and review current exemption forms. In May 2010, Florida passed a law that capped sales tax on boats or vessels to a maximum of $18,000, regardless of the purchase price. This was to encourage owners not to leave the State after purchase or to flag “offshore” which most owners were doing prior to the passing of this law.

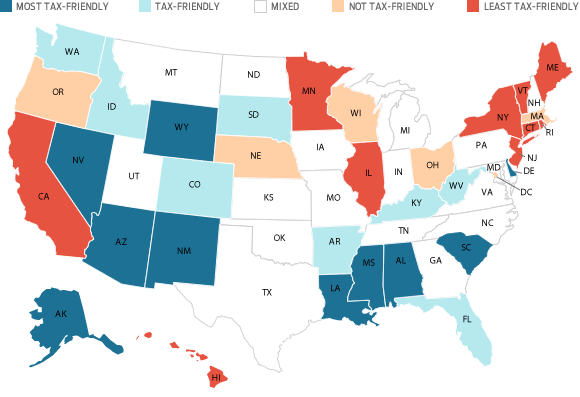

While tax rates may not be your first or even fifth consideration, sometimes they’re the tiebreaker in a close decision. But just because government officials have lots of tax dollars at their disposal doesn’t mean they’re spending them wisely. Similarly, low tax rates don’t necessarily mean that public services are lacking.

Personal And Sales Taxes

The City of Myrtle Beach states that mixed liquor drinks can have taxes added as high as 16.5%. South Carolina has a 6% state sales tax but when combined with local, county and hospitality taxes South Carolina has a maximum sales tax of 10.5%. Oregon has no statewide sales tax, although local municipalities may impose sales taxes, such as the 5% prepared food tax in Ashland. Counties and cities each have an additional sales tax which varies, but is generally up to 2% for counties and 2-5% for cities resulting in a total sales tax rate of 7.5% to 8.5%. Ohio law requires virtually every type of business to obtain an Ohio Sales Tax Certificate Number. If someone sells goods on eBay or the internet and ships them to someone in the state they reside, then they must collect sales tax from the buyer and pay the collected tax to the state on a monthly or quarterly basis. If someone sells less than $4 million in annual sales, they do not have to collect or pay sales tax on out-of-state sales.

Total sales tax on an item purchased in Falcon, Colorado, would be 5.13% (2.9% state, 1.23% county, and 1% PPRTA). Most transactions in Denver and the surrounding area are taxed at a total of about 8%. Food and beverage items total 8.00%, and rental cars total 11.25%. City taxes range from an additional 0.25% to 3.5% and county taxes could be as much as 3.25%. Including city and county taxes, the highest sales tax rate is 11.625% in the portions of Mansfield that are in Scott County. Many people consider state income taxes when deciding where to retire.

Are Low Tax Rates Always A Good Thing?

This year’s partial rollback of the surtax, yielding a top rate of 10.5 percent (down from 11.5 percent), improved New Jersey one place on the corporate tax component, from 49th to 48th. In 2018, Missouri adopted individual and corporate income tax reforms, set to phase in over time. Last year saw a significant reduction in the top rate of the individual income tax, from 5.9 to 5.4 percent, with smaller triggered reductions scheduled for future years until the rate declines to 5.1 percent. The corporate income tax reform package did, however, go into effect in 2020. The only state to make midyear rate adjustments, Indiana made another scheduled adjustment to its corporate income tax rate on July 1, 2020, the Index’s snapshot date, bringing the rate from 5.5 to 5.25 percent. The rate reduction—two more are scheduled, ultimately bringing the rate to 4.9 percent in 2022—was enough to improve Indiana’s rank from 10th to 9th overall.

The “tax-friendliness” of a state depends on the sum of income, sales and property tax paid by our hypothetical family. Connecticut income taxes for our make-believe middle-class are above average, but not sky high.

State Aid In American Rescue Plan Act Is 116 Times States Revenue Losses

These states generally have low rates of property tax, whether measured per capita or as a percentage of income. They also avoid distortionary taxes like estate, inheritance, gift, and other wealth taxes. States that score poorly on the property tax component are Connecticut, Vermont, Illinois, New Hampshire, New Jersey, and New York. These states generally have high property tax rates and levy several wealth-based taxes. Mark, McGuire, and Papke find taxes that vary from one location to another within a region could be uniquely important determinants of intraregional location decisions. They find that higher rates of two business taxes–the sales tax and the personal property tax–are associated with lower employment growth. They estimate that a tax hike on personal property of one percentage point reduces annual employment growth by 2.44 percentage points.

- States that score well with low effective tax rates are Alabama (1.44 percent), Oklahoma (1.67 percent), Arkansas (1.79 percent), Delaware (1.83 percent), Tennessee (1.95 percent), and Kentucky (2.03 percent).

- That’s the 15th-highest amount in the country for a home at that value.

- Sales taxes can’t get any lower than they are in The First State – there’s no sales tax in Delaware!

- When properly structured, property taxes exceed most other taxes in comporting with the benefit principle and can be fairly economically efficient.

- All states imposing sales taxes examine sales and use tax returns of many taxpayers each year.

Similarly, Moody and Warcholik found that in 2000, 19.9 million cases of beer, on net, moved from low- to high-tax states. This amounted to some $40 million in sales and excise tax revenue lost in high-tax states. The more riddled a tax system is with politically motivated preferences, the less likely it is that business decisions will be made in response to market forces.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns. Sales tax is one area where Californians might pay more than residents of other states. The California state sales tax rate is 7.25%, which is the highest state rate in the nation.

Property taxes matter to businesses, and the tax rate on commercial property is often higher than the tax on comparable residential property. Additionally, many localities and states levy taxes on the personal property or equipment owned by a business. They can be on assets ranging from cars to machinery and equipment to office furniture and fixtures, but are separate from real property taxes, which are taxes on land and buildings. States with the highest combined state and average local sales tax rates are Tennessee (9.55 percent), Arkansas (9.53 percent), Louisiana (9.52 percent), Washington (9.23 percent), and Alabama (9.22 percent). At the low end are Alaska (1.76 percent), Hawaii (4.44 percent), Wyoming (5.34 percent), Wisconsin (5.43 percent), and Maine (5.5 percent). Alabama and Louisiana have the highest average local option sales taxes (5.22 and 5.07 percent, respectively), and in both states the average local option sales tax is higher than the state sales tax rate. Other states with high local option sales taxes include Colorado (4.75 percent), New York (4.52 percent), and Oklahoma (4.45 percent).

People who move to these parts like to own a lot of land, and low property taxes make that dream affordable. The property tax on our hypothetical middle-class family’s $300,000 home in Wyoming would be about $1,725, which is tied the 10th-lowest property tax amount in our rankings. There’s no broad-based income tax in the Volunteer State — only interest and dividends are subject to Tennessee’s limited income tax.

States have sought to limit this sales tax competition by levying a “use tax” on goods purchased out of state and brought into the state, typically at the same rate as the sales tax. Levied on employers when a loan is taken from the federal government or when bonds are sold to pay for benefit costs, these taxes are of two general types. The second is a tax to pay the interest on the federal loan or bond issue. States are not allowed to pay interest costs directly from the state’s unemployment trust fund. Eighteen states and the District of Columbia have these taxes on the books, though they fall under several names, such as advance interest tax and bond assessment tax and temporary emergency assessment tax .

The shareholders are then responsible for paying individual income taxes on this income. Sales tax rates in Hawaii, New Mexico, North Dakota, and South Dakota are not strictly comparable to other states due to broad bases that include many services. This method does not use benefit payments in the formula but instead the variation in an employer’s payroll from quarter to quarter. This is a violation of tax neutrality since any decision by the employer or employee that would affect payroll may trigger higher UI tax rates.