Content

You agree that all information you provide any merchant or information or service provider through the Site for purposes of making purchases will be accurate, complete and current. The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021. Filing with all forms, including self-employed.

You get all forms, all credits, and all deductions for less than The Other Guys. Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket. EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021.

Windows 7 Support Has Ended

To get started, create an account either at or by using the mobile app, which is available for download from the Apple App or Google Play stores. How will I know the cost to prepare my return? During the registration process, you will be prompted to answer some questions about your 2020 tax year. For example, did you have a mortgage or dependents, or did you have investment income?

At participating offices. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

But non-citizens without work authorization sometimes have to file U.S. tax returns, too—if they have income from U.S. sources, for example, or if they are entitled to a refund of withheld money under a tax treaty. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

Windows 7 End Of Support

Fees apply when making cash payments through MoneyGram® or 7-11®. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply.

For those with investments in real estate, virtual currencies or partnerships, we will calculate income or losses and file the supplemental forms required. You can easily transfer your 2018 TurboTax return into TurboTax Online, so you won’t lose any information. For instructions on how to fill out and file Form W-7, seeForm W-7 Instructions. While it is possible to use QuickBooks in an “offline mode,” our system requirements for all current versions of QuickBooks do call for an online connection.

The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. Cost-effective — the service is competitively priced and is powered by Ernst & Young LLP , an organization with more than 100 years of experience in tax preparation. In recent history, we have seen sweeping federal tax reform enacted under the Tax Cuts and Jobs Act of 2017. In 2020, a significant tax relief bill, the federal CARES Act was passed in response to the COVID-19 pandemic. If you have cryptocurrency transactions, or own a business that transacts using cryptocurrency, this information must be reported on your annual return.

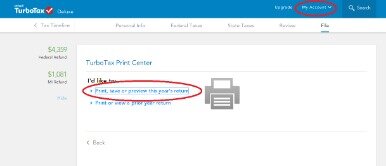

We stay current on tax laws to identify the deductions and credits applicable to you. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted.

Based on your answers to these questions, EY TaxChat gives you a fixed-fee quote for preparing your taxes. Please note that this quote may change if we learn that your returns involve additional complexity or filings. I pre-registered for 2020 TaxChat services — Where will I find my 10% discount?

According to the IRS, it takes 6 to 10 weeks to obtain an ITIN. An ITIN will expire at the end of the year if it is not used on a federal tax return in the last 3 years. TurboTax for tax year 2019 will install on Windows 7 , but when TurboTax for tax year 2020 is released, all TurboTax desktop products will cease installing on Windows 7. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees.

Search Turbotax Support

State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

Our Simply Free Edition is excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer. Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund.

Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Availability of Refund Transfer funds varies by state.

- Extended Security Updates allows you to receive important security updates for Windows 7 from Microsoft for up to three more years.

- We work hard to safeguard your information, so you can file worry-free.

- Available only at participating H&R Block offices.

- ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

- Our 60,000 tax pros have an average of 10 years’ experience.

Get your taxes done by a tax pro in an office, via video chat or by phone. Or do your own with expert, on-demand help. Gather your docs and let your tax pro do the rest. Just review and approve your return.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January.

Enter your income and we’ll guide you through the rest of your return to maximize your refund. Price is a huge advantage for TaxSlayer. People who need advanced tax software, which can run $100 or more elsewhere, can especially benefit from the price difference, particularly when adding a state return. We’ll guide you through the entire filing process to help you file quickly and maximize your refund. Everyone gets free, unlimited phone and email support. And if you need more help, we have you covered from Ask a Tax Pro to Audit Defense.

You acknowledge and agree that TaxSlayer and any of its website co-branding providers have no responsibility for the accuracy or availability of information provided by linked sites. Links to external web sites do not constitute an endorsement by TaxSlayer or its website co-branding providers of the sponsors of such sites or the content, products, advertising or other materials presented on such sites. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise.

Not valid on subsequent payments. Expires January 31, 2021. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.