Content

Third party designees filing online applications are reminded of their obligation to retain a complete signed copy of the paper Form SS-4 and signed authorization statement for each entity application filed with the IRS. Nominees do not have the authority to authorize third party designees to file Forms SS-4, and should not be listed on the Form SS-4. The Internal Revenue Service has become aware that nominee individuals are being listed as principal officers, general partners, grantors, owners, and trustors in the Employer Identification Number application process. Rather, nominees are temporarily authorized to act on behalf of entities during the formation process. The use of nominees in the EIN application process prevents the IRS from gathering appropriate information on entity ownership, and has been found to facilitate tax non-compliance by entities and their owners. A “nominee” is someone who is given limited authority to act on behalf of an entity, usually for a limited period of time, and usually during the formation of the entity.

NIFA did not consider Mangano to have a satisfactory plan to make up for the lost revenue, and seized control of the county’s finances. The marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. A corporate income tax is levied by federal and state governments on business profits.

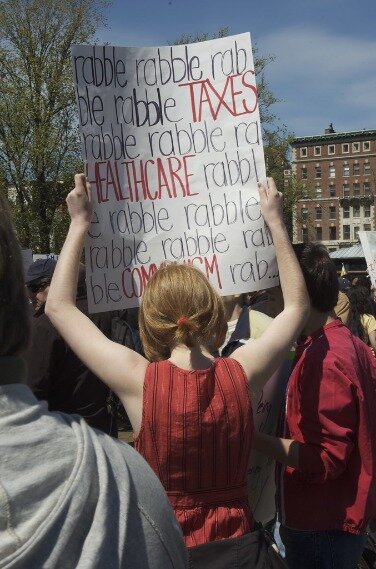

Americans for Prosperity and FreedomWorks were “probably the leading partners” in the September 2009 Taxpayer March on Washington, also known as the “9/12 Tea Party,” according to The Guardian. The movement’s name refers to the Boston Tea Party of December 16, 1773, a watershed event in the launch of the American Revolution. The 1773 event demonstrated against taxation by the British government without political representation for the American colonists, and references to the Boston Tea Party and even costumes from the 1770s era are commonly heard and seen in the Tea Party movement. If you aren’t expecting a rebate – all the more reason to plan something fun to take your mind off it. Medicare officially joined the Social Security tax as part of the Federal Insurance Contributions Act in 1966.

But there is nervousness about embracing it, particularly among a pack of Conservative MPs hostile towards any change. Oddly enough, Labour is even further away, attacking a version of the Conservative party that stopped existing quite some time ago over austerity, and opposing tax rises – even the corporation tax rise said to be a key part of Rishi Sunak’s upcoming budget. If Labour does go ahead and set itself up in opposition to this measure next week, it risks letting the Conservatives walk away with the spoils, able to further project themselves as the party of the workers. Starmer’s calculation on tax seems based on a dated perception of the voter Labour needs to win – more Tony Blair’s southern “Mondeo man” than the working-class, traditionally Labour voter in the north and the Midlands.

Join Us For A Free state Tax Policy Boot Camp

The IRS is considering several ways to identify the responsible parties of entities. However, by updating the information itself, an entity can establish that it is a reliable partner of the IRS in complying with the Federal tax laws.

Taxes levied on domestic saving may reduce the ownership of American investment by domestic residents. However, the U.S. economy is open to international investment, which means that domestic investment opportunities may instead be financed by foreign investors not subject to the increased tax burden.

Lawmakers Reintroduce Bill To Protect Against Double Taxation Of Financial Transactions

This is because the proposed CTC expansion would have ended, and households across the income spectrum would experience lower after-tax incomes. The bottom 20 percent of filers, for example, would experience a 0.2 percent decrease in their after-tax incomes in 2030. The economic effect of Biden’s tax proposals can be separated to show the specific impact of each proposal on long-run economic output . Since our original analysis, the Biden campaign has clarified that it will hold harmless taxpayers making under $400,000 from tax increases associated with the proposed 28 percent cap on itemized deductions.

On December 12, the full Legislature voted on the bus service, and unanimously voted to approve Veolia as the provider for County bus service. Mangano put together the annual Cruise To The Show car show and parade in 2011, featuring concerts, fundraisers, and a parade of classic cars, as well as awards. Mangano, who is a classic car enthusiast, was joined by Governor Andrew Cuomo, and his vintage corvette at the 2011 show. The governor and Mangano want to make Cruise To The Show a huge East Coast car event in Eisenhower Park, and Mangano stated his belief that it would increase tourism. Nassau County Legislator Kevan Abrahams criticized the show as a frivolous expense during a time of County budget cuts, claiming it would cost $75,000 in police overtime and noting that it was funded by a hotel/museum tax, which Abrahams said would have been better spent on museums. In March 2010, Mangano reached an agreement with Democrats to amend the county’s $166 million Capital Improvement Plan to align it with his priorities for the county.

The article quoted Juan Williams as saying that the Tea Party’s opposition to health reform was based on self-interest rather than racism. One 2013 survey found that, in political terms, 20% of self-identified Republicans stated that they considered themselves as part of the Tea Party movement.

Following these errors, Mangano fired Assessor Ted Jankowski, who had been originally appointed by Thomas Suozzi and had been criticized by Republicans, and who was considered to be at fault for the errors not being caught. To fix the assessment system further, former Smithtown Assessor Gregory Hild was appointed to review the system. In October 2009, Mangano’s brothers business, New Media Printing, in Bethpage was found to have more than $900,000 in federal and state tax liens. Bethpage, New York, U.S.Political partyRepublicanSpouseLinda ManganoChildren2Alma materHofstra UniversityEdward P. Mangano is an American politician from the state of New York. A Republican, he was the County Executive from January 2010 to December 2017, and a former legislator in Nassau County, New York. In November 2009, he defeated incumbent Thomas R. Suozzi for Nassau County Executive. In November 2013, he was re-elected, again defeating Suozzi, by 59% to 41%.

This increase is driven by the large expansion of the CTC in 2021, which boosts the bottom 20 percent’s after-tax incomes the most due to the CTC’s increased refundability and size. Taxpayers higher up the income distribution would see smaller increases in after-tax incomes, facing the indirect effects of higher business taxes while receiving a CTC benefit that is a lower share of their after-tax incomes compared to the bottom 20 percent. In 2021, on a conventional basis, taxpayers in the top 1 percent would see their after-tax incomes reduced by around 11.3 percent due to higher taxes on income above $400,000. The top 5 percent would see a reduction in after-tax incomes of about 1.3 percent. Filers in the 90th to 95th percentiles would see a slight reduction in after-tax incomes of about 0.2 percent. On a conventional basis, Biden’s tax plan would make the tax code more progressive.

Most Republicans and 20% of Democrats support the movement according to one Washington Post–ABC News poll. On the other hand, other commentators, including Paul H. Jossey, a conservative campaign finance attorney, and Jim Geraghty of the conservative National Review, believed that the Tea Party to be dead or in decline.

Left leaning opponents have cited various incidents as evidence that the movement is, in their opinion, propelled by various forms of bigotry. Supporters say the incidents are isolated acts attributable to a small fringe that is not representative of the movement. Accusations that the news media are biased either for or against the movement are common, while polls and surveys have been faced with issues regarding the population surveyed, and the meaningfulness of poll results from disparate groups. Martin stated after the election that “with the victory of Donald Trump, the values and principles that gave rise to the tea party movement in 2009 are finally gaining the top seat of power in the White House.”

Tax Tips From Turbotax

Contacted by Carender, Steve Beren promoted the event on his blog four days before the protest and agreed to be a speaker at the rally. Carender also contacted conservative author and Fox News Channel contributor Michelle Malkin, and asked her to publicize the rally on her blog, which Malkin did the day before the event.

It is a version of the Betsy Ross flag with a Roman numeral “II” in the center of the circle of 13 stars symbolizing a second revolution in America. The Second Revolution flag has been called synonymous with Tea Party causes and events. Beginning in 2009, the Gadsden flag became widely used as a protest symbol by Tea Party protesters nationwide. Some lawmakers dubbed it a political symbol due to the Tea Party connection and the political nature of Tea Party supporters.

On July 22, 2010, Mangano announced he would immediately form a committee that would explore privatizing the bus service. On September 24, 2010 he issued a Request for Proposals to privatize Nassau’s public bus service. A partial compromise was reached on April 1, 2011 as the New York State Legislature moved to provide an extra $8.6 million to avoid the July service cuts, which would have eliminated half of Long Island Bus’ lines. This compromise saw Nassau County pay half the increase that the MTA had sought. No provision was made for future years, though, and later in April the MTA Board voted to terminate the Long Island Bus contract at the end of the year.

A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 23.05 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. Additionally, Biden has proposed a variety of new tax credits or expansions to existing credits to help increase after-tax incomes for low-earners.

When the taxpayer is completely revoking authority, the form should state “remove all years/periods” instead of listing the specific tax matter, years or periods. If the representative is withdrawing, list the name, TIN, and address of the taxpayer. Similar rules apply to Form 8821 revocations, please see page 3 of the Form 8821 instructionsPDF. Authorizations regarding tax matters are recorded on the Centralized Authorization File unless Line 4, Specific Use is checked. It allows IRS assistors to verify your permission to speak with your representative/appointee about your private tax related information. Nobody likes tax time – hopefully a Tax Day Party is just what you need to blow off steam. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

- This is because the proposed CTC expansion would have ended, and households across the income spectrum would experience lower after-tax incomes.

- Grant Barrett, co-host of the A Way with Words radio program, has listed teabagger as a 2009 buzzword meaning, “a derogatory name for attendees of Tea Parties, probably coined in allusion to a sexual practice”.

- The CTC would also be made fully refundable, removing the $2,500 reimbursement threshold and 15 percent phase-in rate.

- They believe that the federal government has become too large and powerful.

- According to the American Enterprise Institute, various polls in 2013 estimated that slightly over 10 percent of Americans identified as part of the movement.

- The 1773 event demonstrated against taxation by the British government without political representation for the American colonists, and references to the Boston Tea Party and even costumes from the 1770s era are commonly heard and seen in the Tea Party movement.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Increasing the corporate tax rate to 28 percent would account for the largest revenue gain (about $1 trillion over 10 years) in the plan. Adding other changes on the business side, such as the 15 percent corporate minimum tax and tax increases on international profits, Biden’s taxes on businesses account for about 46 percent of the revenue gains. The Tax Foundation’s General Equilibrium Model assumes that C corporations and the U.S. government can receive financing from abroad without changing interest rates, while the pass-through sector may not be able to fully use foreign capital inflows when tax rates change.

Taxes In The Later 20th Century

We have modified our modeling of this proposal so that filers with less than $400,000 can take the full value of their itemized deductions but those above that threshold have the value of itemized deductions capped at 28 percent. Biden has also newly proposed a 10 percent surtax on imports from offshored business activity and a 10 percent “Made in America” tax credit to incentivize onshoring; we have not included these two proposals in our estimates due to a lack of detail on their design. Since we released our first analysis of Biden’s tax proposals, the campaign has proposed several new tax policies that have impacted our revenue and distributional estimates. We have also added a discussion of the effects of Biden’s plan on Gross National Product , which allows us to examine how it would reduce American incomes. Establishing an advanceable 10 percent “Made in America” tax credit for activities that restore production, revitalize existing closed or closing facilities, retool facilities to advance manufacturing employment, or expand manufacturing payroll. Expands several renewable-energy-related tax credits, including tax credits for carbon capture, use, and storage as well as credits for residential energy efficiency, and a restoration of the Energy Investment Tax Credit and the Electric Vehicle Tax Credit.

Polling now shows support for changes to capital gains tax, and an increase to corporation tax. More people than not want to see taxes increase on online retailers, who they feel have avoided paying their fair share for years – they have supplanted the banks as the business bogeyman of the British people. In a recent focus group I ran, seven of the eight respondents said they would do so if ring-fenced for the NHS, as a way of “paying back in” after the pandemic. Asking people how much they would be willing to pay on a weekly or monthly basis shows people are more relaxed about the prospect than for a long time. The quality of economic responsibility – closely wedded to the careful management of the public finances – is a key demand from voters, and one of the main measures they will use to weigh up their choice at the next election. For Labour, this is important because the economy is their number one weakness; voters still worry that it would be “just like last time” if they were elected again, and concerns about their handling of the economy is the top hesitation about voting for the party in the red wall. For the Conservatives, it is important because – in the absence of Brexit and Corbyn, so key to turning votes blue in 2019 – they need the clear dividing line with Labour that the economy provides.

The following day, the Colorado branch of Americans for Prosperity held a protest at the Colorado Capitol, also promoted by Malkin. Carender held a second protest on February 27, 2009, reporting “We more than doubled our attendance at this one.” Carender first organized what she called a “Porkulus Protest” in Seattle on Presidents Day, February 16, the day before President Barack Obama signed the stimulus bill into law.