Content

“You may have an office in your home that is strictly for what you do in your investing. There’s a lot of deductions available there,” says Wheelwright. One of the biggest deductions people overlook is the home office deduction, according to Tom Wheelwright with the CPA firm ProVision. Home office expenses and some costly medical procedures can be deducted.

If parents are helping you pay for school, you can deduct it because it’s your debt, not theirs. It’s important to note you cannot be claimed as someone’s dependent to get any of these credits for education.

If you live in a state that doesn’t impose an income tax, tallying up all the tax you’ve paid on personal and household items can really add up to savings. On the other hand, if your state does have an income tax, it’s usually a better strategy to claim that as a deduction on your tax forms, unless you made some big-ticket purchases, such as a car or boat. Whereas deductions reduce your taxable income, credits directly reduce your taxes. So, if you didn’t know about the child and dependent care, find out if you qualify now. Deductions include medical expenses and work-related expenses. There are also several tax credits you may qualify for if your income is within a certain range.

If, like most taxpayers, you claimed the standard deduction on your previous federal return, the state tax refund is tax-free. Don’t miss these frequently overlooked tax deductions, credits and exemptions.

Can I Claim My Boyfriend Or Girlfriend On My Taxes?

For those of you in an income-tax free state, there are two ways to claim the sales tax deduction on your tax return. One, you can use the IRS tables provided for your state to determine what you can deduct.

Itemizers have the choice between deducting the state income taxes or state and local sales taxes they paid. So, if your state doesn’t have an income tax, the sales tax write-off is clearly the way to go. Preparing and paying for your taxes has become increasingly stressful and complicated for many individuals and families. However, there are some commonly missed tax deductions that will assist you in keeping more of your hard-earned income. In the past, if parents or someone else paid back a student loan incurred by a student, no one got a tax break.

Taxes On Unemployment Benefits: A State

If you paid for the care of a qualifying child or other dependent so that you and your spouse could work, you might qualify for the child and dependent care credit. Students can deduct interest on their loans, up to $2,500 a year. The American Opportunity Tax Credit is available for the first four years of education with a maximum of $2,500 each year. The Lifetime Learning Credit helps those taking classes to acquire or improve job skills. There’s no limit to how many years you can claim it and it’s worth up to $2,000 a year.

The second is if you have a job which entails the use of a home office. In this case, you would claim the deduction on Form 2106 which would only benefit you if you itemized on Schedule A and if the expenses claimed exceeded 2% of your adjusted gross income. Nice job with your suggestions on possible missed deductions. I have always been a student of finances and also being a Realtor helps with knowing all the tax deductions. Low and moderate-income earners can get a credit of as much as 50% of the first $2, 000 that put into a retirement account. Yes, a credit, so it’s up to $1, 000 off the top of your tax bill. Plus, you still get the tax deduction that would otherwise be associated with the contribution.

I look forward to assisting you in keeping as much of your income as possible. While many tax deductions are fairly well-known, there are many that tend to fly under the radar. If you are a teacher, you are able to deduct up to $250 from your Adjusted Gross Income. In addition, along with other employees, you can deduct your remaining out-of-pocket expenses as an itemized deduction. Although many of the expenses can pertain to you, I would suggest discussing them with your tax professional before attempting to take the deductions. Many of the deductions that we will discuss are included in your list of itemized deductions.

For example, ingredients for dishes you prepare for a nonprofit organization’s soup kitchen and stamps you buy for a school’s fund-raising mailing count as charitable contributions. If your contribution totals more than $250, you’ll also need an acknowledgement from the charity documenting the support you provided. If you drove your car for charity during the year, remember to deduct 14 cents per mile, plus parking and tolls paid, for your philanthropic journeys. T2200 from your employer to confirm what type of expenses they require you to pay for. I focus on taxes and accounting for various individuals and small to medium sized business. Lastly, I focus on individual and family wealth management, retirement, college savings, and life/disability insurance.

While a tax deduction reduces your taxable income, a tax credit is a direct dollar-for-dollar reduction of the amount of your taxes due. To qualify for the credit, you must receive trade adjustment assistance or a pension from the government after the termination of your employer-sponsored retirement plan. Taking advantage of available tax deductions can help you make the most of your return. Since tax laws change from year to year, it is important to consult with a tax professional regarding available claims and deductions for the current year to see if you qualify.

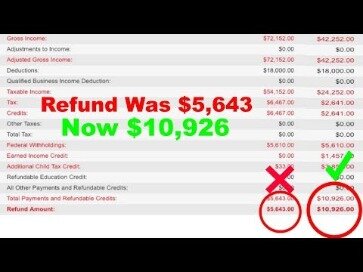

Brandon, I had a very similar experience to you – our tax due was sitting at roughly $1500. The IRS site had a relatively easy-to-understand info page about education-related deductions/credits. Many filers forget to include state sales and income taxes paid as deductions.

Watch Live

Take a look at some of the most commonly missed tax deductions and see which ones apply to you. Most taxpayers also know that they can deduct their student loan interest and Traditional IRA contributions, depending on your income level and other factors. However, there are several deductions that are less well-known . Use TurboTax to help ensure you don’t miss any of the deductions or credits you deserve, so you get your biggest refund, guaranteed. Some employers continue to pay employees’ full salary while they are doing their civic duty, but ask that they turn over their jury fees to the company. The only problem is that the IRS demands that you report those fees as taxable income.

If you paid for your kid’s summer camp so you could work, deduct it, as long your child is under 13 and it wasn’t overnight. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

- Generally, rent is not deductible, at least on the Federal return.

- TurboTax will help you claim them if you are eligible to claim them.

- But I can think of at least a couple of special instances where you might get a partial deduction.

- For most citizens of income-taxing-states, the state and local income tax deduction is usually the better deal.

- That would cut your tax bill by at least $200 using the minimum 20 percent of the expenses.

For example, according to the IRS, if you needed breast reconstruction surgery as part of cancer treatment, you can include the cost in your medical expenses. Your participation in a smoking cessation program can be considered deductible as a medical expense. If you were looking for a job last year and had to travel for interviews, you can deduct those costs up to 2 percent of your adjusted gross income . Don’t miss out on significant savings; save the receipts for sitters and after-school care. If your children are older and in college, don’t forget to deduct the interest you’ve paid on their student loans throughout the year, if applicable.

For example, if you donate clothes to a qualified nonprofit, you can take a tax deduction for the value of the donated items. If you pay someone to take care of your kids such that you can work you might qualify for a tax credit. This is true even if you claim your childcare-related expenses through a tax-favored reimbursement account at work. The reason for this is that such accounts are capped at $5, 000 while expenses up to $6, 000 can qualify for the credit. This deduction makes the most sense for people that live in states without income taxes because you have to choose between the two (sales tax vs. state income tax). Still in school or taking classes to get a graduate degree or improve your job skills?

A commonly missed tax deduction that also relates to charitable organizations is the expenses related to any volunteer work you perform for a charity. You can claim the cost of mileage or gas if you attend meetings of a nonprofit you are involved in. The tax deduction excludes the actual volunteer work you do for the nonprofit. Other commonly missed tax deductions are non-monetary contributions made to charities.

Student Loan Interest Paid By You Or Someone Else

That’s $33 a year for each $1,000 of points you paid—not much, maybe, but don’t throw it away. If, like most investors, you have mutual fund dividends automatically reinvested to buy more shares, remember that each new purchase increases your tax basis in the fund. That, in turn, reduces the taxable capital gain (or increases the tax-saving loss) when you redeem shares. You’re probably familiar with the $2,000 child tax credit, which has been putting money back in parents’ pockets for decades. Unfortunately, if your son or daughter is over 16 years old, you can’t use this credit to trim your tax bill. If you plan to take this deduction, be sure you keep all your gambling receipts (e.g., losing tickets). The write-off for sales tax is added to your local property taxes, and there’s a $10,000 a year maximum for the combined total of these taxes ($5,000 if you’re married but filing a separate return).

If you purchased a taxable bond for more than its face value—as you might have to capture a yield higher than current market rates deliver—Uncle Sam will effectively help you pay that premium. That’s only fair, because the IRS is also going to get to tax the extra interest that the higher yield produces. Members of the National Guard or military reserves may write off the cost of travel to drills or meetings. To qualify, you must travel more than 100 miles from home and be away from home overnight. If you qualify, you can deduct the cost of lodging and half the cost of your meals, plus an allowance for driving your own car to get to and from drills. College credits aren’t just for youngsters, nor are they limited to just the first four years of college. The Lifetime Learning credit can be claimed for any number of years and can be used to offset the cost of higher education for yourself or your spouse .

If you brushed up on skills in 2020, this credit can help pay the bills. The right to claim this tax-saver on your 2020 return phases out as income rises from $59,000 to $69,000 on an individual return and from $118,000 to $138,000 for couples filing jointly.

If you give the money to your employer you have a right to deduct the amount so you aren’t taxed on money that simply passes through your hands. But it’s easy to overlook the child and dependent care credit if you pay your child care bills through a reimbursement account at work.

The credit is worth up to $2,000 a year, based on 20% of up to $10,000 you spend for post-high-school courses that lead to new or improved job skills. Classes you take even in retirement at a vocational school or community college can count.

If you earned $52,427 or less, you can claim The Earned Income Tax Credit. Even if you don’t need to file a return, you may qualify, but you have to put in the paperwork to get it. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. My tax program had the retirement tax credit available, but for whatever reason it did not present it to me by default. I would imagine it isn’t just refinancing the mortgage, but paying it off as well? If you bought a new hybrid vehicle in 2007, you can get a conservation tax credit of $250-$1, 000 and an additional fuel economy credit of $400-$2, 400 .