Content

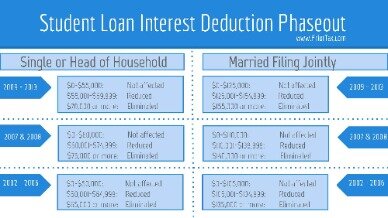

For married taxpayers filing jointly, the limits are $140,000 for a full deduction and between $140,000 and $170,000 for a partial one. While you might have a huge student loan burden and you’re hoping to reduce some of that through debt forgiveness, you might face a tax burden later on.

Reducing your taxable income can help lower how much you owe the government or increase how much you’ll get as a refund. You might get placed in a lower tax bracket, which might qualify you for other deductions and credits. To claim the deduction, use the information found on Form 1098-T from your school to see how much you spent on qualified education expenses. Then fill out and submit IRS Form 8917 with your tax return.

Motley Fool Returns

You may not be financially ready to buy a home or get married until you’ve paid off your student loans. But your student loans impact more than your future purchases — they also affect your taxes. The funds in a 529 plan can also be used to pay off student loans although there are some limitations, including a $10,000 lifetime withdrawal limit. You can use money in a 529 plan for non-education-related expenses, but those distributions are taxable and you’ll be hit with a 10% penalty, too, Miller-Nobles said. A $4,000 deduction is available for single filers or head-of-household filers with a MAGI of $65,000 or less or $130,000 or less for joint filers.

If you made interest rate payments on your student loans during the tax year, you can deduct up to $2,500 in interest paid. In addition to the student loan interest deduction, students enrolled in higher education programs and their parents may be eligible for other tax breaks. Those include the American Opportunity Tax Credit and the Lifetime Learning Credit. A tax credit is even more valuable than a deduction because it is subtracted dollar for dollar from the tax you owe rather than simply reducing your taxable income. Like any tax deduction, the student loan interest deduction reduces your taxable income for the year. So, for example, if you are in the 22% tax bracket and claim a $2,500 deduction, the deduction would reduce your federal income tax for the year by $550.

You and your spouse, if you’re married, cannot be claimed as dependents on someone else’s tax return. You were legally obligated to pay the interest — that is, the loan is in your or your spouse’s name, if you’re married. You cannot claim this deduction for astudent loanin your child’s name even if you were the one making the payments. Even if you used some of the funds for other personal expenses, such as to finance a vacation, the deduction is not entirely lost. You just need to reduce what you claim accordingly to reflect the amounts you actually paid towards school expenses. You use this form to report your eligible school expenses and to calculate the credit.

The loan must be used within a “reasonable period of time” after it is taken out. Loan proceeds must be disbursed within 90 days before the academic period starts or 90 days after it ends.

You are a single filer with income under $70,000, however, your full deduction phases out between $70,000 and $85,000 ($140,000 and $170,000 married filing jointly). If your income falls above those limits, the student loan interest is not tax-deductible. Whenever you pay off your student loan, it’s not a case of just paying off the amount you borrowed.

More In Credits & Deductions

The maximum student loan interest deduction you can claim is $2,500 as of the 2020 tax year, and it might be less. The deduction is reduced for taxpayers with modified adjusted gross incomes in a certain phase-out range and is eventually eliminated entirely if your MAGI is too high. It has to be used for qualified higher education expenses, such as tuition, fees, textbooks, supplies, and equipment needed for coursework. Room and board, student health fees, insurance, and transportation do not count as qualified educational expenses for a student loan interest deduction.

You claim this deduction as an adjustment to income, so you don’t need to itemize your deductions. Typically, an employer will provide employees with $100 per month to help them repay their student loans. The income phaseouts in 2021 are $70,000 to $85,000 and $140,000 to $170,000 .

IRS Publication 970, “Tax Benefits for Education,” includes a worksheet you can use to calculate your modified adjusted gross income and student loan interest deduction. As noted, you can currently deduct up to $2,500 of the interest you paid on an eligible student loan. If you paid less than that, your deduction is capped at the amount you paid. Then, on his first day in office, January 20, 2021, President Joseph R. Biden Jr. continued the “pause” on student loan payments until September 30, 2021. This does not affect private student loans, but it will mean that you may not have interest payments to deduct while this suspension is in effect.

How The Student Loan Interest Tax Deduction Works

Finally, you can also take this deduction if you’re paying off your student loan while still in school full time. Convert the answer to a decimal with three decimal places. Now multiply your student loan interest paid up to $2,500 by the decimal. You can deduct up to $2,500 in student loan interest or the actual amount of interest you paid, whichever is less, if your MAGI is under the threshold where the phase-out begins. Your limit is prorated if your MAGI falls within the phase-out range—for example, $70,000 to $85,000 if you’re single.

This guide will help you figure out how much you can legally write off. Neither you nor your spouse, if filing jointly, can be claimed as dependents on someone else’s return. In addition, many types of student loan discharge are tax-free. Generally, student loan forgiveness for working in a particular occupation is tax free if the loan forgiveness is provided by the loan program. Certain types of student loan forgiveness and discharges are tax-free. The person who paid the interest must have been legally required to pay the interest. This includes payments made by the borrower and the cosigner, if any.

The student loan interest deduction allows you to deduct up to $2,500 of the interest you paid on a loan for higher education. “You can claim the student loan interest deduction based only on amounts actually paid,” Kantrowitz said. But if you do file as married filing jointly, you do get a little bit of a break. The government can adjust your payment if both you and your spouse are making repayments to your federal student loans. Unlike the AOTC, there’s no limit to how many years you can claim the credit. You could get up to $2,000 every year or 20% on the first $10,000 of qualified education expenses. You can use the credit to lower your tax bill, but you won’t get any of the credit back as a refund.

In the case of the student loan interest deduction, you might find that you only have to add back the deduction itself. The student loan interest deduction can be claimed “above the line” as an adjustment to income. You can take it without itemizing, or take the standard deduction as well. It’s subtracted on line 20 of the “Adjustments to Income” section of Schedule 1 of the 2020 Form 1040. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. You can only deduct student loan interest that you have actually PAID during the year. I If I am still in school and haven’t paid anything back on my loans yet, do I still qualify? I haven’t paid any money out of pocket yet back to my debtors.

When you use student loan funds to finance your education, if you are eligible, the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits. A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans. Here’s more about how student loans and educational expenses can affect your taxes. When you make monthly payments to your student loans, it includes your principal payment as well as your interest payment.

By entering your email, you agree to sign up for consumer news, tips and giveaways from ConsumerAffairs. Subtract $65,000 (or $135,000 for married couples filing jointly) from your MAGI. Most of these requirements are relatively straightforward, but the last one may be confusing for those who aren’t familiar with adjusted gross income and modified adjusted gross income . Remember, with TurboTax, we’ll ask you simple questions and fill out the right forms for you, based on your answers. Paid or incurred within a reasonable period of time before or after you took out the loan. Congress might decide to extend the exclusion from income or make it permanent.

- If the credit lowers your income tax to less than zero, you might be able to get a refund on your taxes or increase your tax refund.

- Your previous year’s MAGI must have been less than $59,000 if you filed as a single or head of household or below $118,000 if you filed jointly.

- We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- You can take it without itemizing, or take the standard deduction as well.

- These expenses apply specifically to the student loan interest deduction.

- You can also get some tax benefits by participating in a 529 Plan.

Then you might be able to deduct up to $2,500 worth of the interest you paid for either a federal or private student loan — or both. You can claim the deduction on your federal income tax return, Form 1040. You’ll enter your total student loan interest deductions on Line 33 of your Form 1040. If you’re using a tax filing software, it should prompt you to enter the amount you paid in student loan interest. It will also calculate the amount of the deduction you’re entitled to if your MAGI is too high to qualify for the full student loan interest deduction. You don’t have to itemize your deductions in order to claim the student loan interest tax deduction, though you can if you want. 529 plan contributions may also be eligible for a state income tax deduction or tax credit.

Student loans and taxes can both take a sizeable chunk of your earnings, but fortunately, the government offers a special tax break to those paying back student loans to help reduce the strain. The catch is, you can only write off the amount you’ve paid in student loan interest throughout the year, and only if you meet certain criteria.

Luckily, taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher education. When you file with H&R Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund, guaranteed. If your parents have claimed dependency for you, you subsequently can’t claim dependency for yourself, and you can’t get education credits or the student loan deduction. He previously worked for the IRS and holds an enrolled agent certification. To qualify for a deduction, the student loan must have been taken out for the taxpayer, the taxpayer’s spouse, or dependent. If the student is the legally obligated borrower, a parent who helps with repayment cannot claim the deduction.

Most Student Loan Borrowers Won’t Get A Tax Break This Year

You likely won’t be able to claim the full student loan interest tax deduction. Taking out student loans to pay for school can be the determining factor between attending college and not. They can cover your finances when grants, scholarships, family contributions and other options are depleted. But remember that while student loans can cover you in the short-term, you’ll be paying back far more than the original principal of the loan — and likely for a very long time. The Tuition and Fees Deduction expired on Dec. 31, 2020, but you can still use it one more time to “deduct up to $4,000 of qualified higher education expenses from your taxable income,” Landress said.