Say your employee earns $30,000 in regular wages and $2,000 in tips during the quarter. You did not have to pay the employee any sick leave or family leave wages.

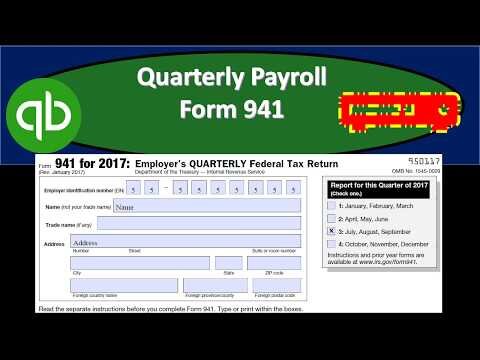

Be sure to check the correct “Report for this Quarter” box at the top right of the form. Since you must file a separate form for each quarter, the IRS imposes four filing deadlines that you must adhere to. The deadlines are April 30, July 31, Oct. 31 and Jan. 31 of each year.

The filing deadline always falls on the last day of the month following the end of the quarter. Employers or business owners who pay wages to an employee must file IRS Form 941 every quarter. Part 3, line 17 asks you whether your business closed or stopped paying wages during the quarter. If you did close your business or stopped paying wages in the quarter, place an “X” next to the box that says “Check here.” Then, enter the final date you paid wages.

Failure to do so and to keep proper payroll system can result in different fines, and accuracy in filling out forms is mandatory to prevent inadvertent underpayment of taxes which also incurs penalties. Generally, any employer who pays wages to an employee has to file an IRS Form 941 each quarter and continue to do so even if there are no employees during some of the quarters. With the multiple payroll tax obligations that employers face, it is easy to overlook some of the Internal Revenue Service requirements, especially when it comes to different forms that all seem similar. However, if taxes are paid without the proper form or with a form that contains inadvertent or deliberate errors, the taxes are not considered paid in full, resulting in penalties. Therefore, to avoid huge and costly mistakes, employers have to understand the differences between various IRS forms, including Form 940, Form 941, and Form 944. Internal Revenue Service Form 941is the Employer’s Quarterly Federal Tax Return. It’s used by employers to report tax withholding amounts for estimated income tax payments, employer payments, and FICA taxes, more commonly known as Social Security and Medicare.

Special Considerations When Filing Form 941

For the 2020 version of Form 941, multiply qualified sick leave wages (5a) and qualified family leave wages (5a) by 0.062 for Social Security tax. Because qualified sick leave and family leave wages aren’t subject to the employer portion of Social Security tax, you only need to multiply those wages by 6.2% (0.062). Qualified sick leave and family leave wages are required for applicable situations under the FFCRA. The decimal represents the rate of Social Security tax on taxable wages. Both you and your employee must contribute 6.2% each paycheck for Social Security. Combined, you and your employee contribute 12.4%, which is the amount you multiply on lines 5a and 5b (0.124). If employees do have compensation subject to Social Security and Medicare taxes, fill out lines 5a-5d next.

If you expect your withholding and FICA tax liability for the year to fall below $1,000, you can contact the IRS to get permission to file Form 944 annually instead. As Fundera highlights, “businesses that hire only farmworkers and people who hire household employees, such as maids or nannies” do not need to file Form 941. Line 13b and 24 are reserved for future use in the revised Form 941, and employers must use it for the first quarter of 2021. If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter. If the due date falls on any federal holiday, then the next business day will be the filing deadline.

You might also be held personally liable for certain unpaid federal taxes. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters. You must file IRS Form 941 if you operate a business and have employees working for you. Certain employers whose annual payroll tax and withholding liabilities are less than $1,000, might get approval to file the annual version—Form 944. When filing Form 941, companies are also expected to pay the employer portion of social security or Medicare tax.

This includes withheld federal income tax, and the employer and employee share of Social Security and Medicare taxes. Then, once a quarter, the employer reports these payments on Form 941, Employer’s Quarterly Federal Tax Return. Total tax payments made for the quarter, including federal income tax, Social Security tax and Medicare tax withheld from employees’ wages plus your own share of Social Security and Medicare taxes.

Social security and Medicare taxes apply to election workers who are paid $1,900 or more in cash or an equivalent form of compensation during 2020. Social security and Medicare taxes apply to the wages of household workers that you paid $2,300 or more in cash wages in 2021.

How To File Irs Form 941

Form 1095-C is a tax form reporting information about an employee’s health coverage offered by an Applicable Large Employer. If you need to correct Form 941, use Form 941-X, Adjusted Employer Quarterly Tax Return or Claim for Refund. For example, if wages were understated or Social Security tax on tips was overstated, and you discover the error, this form is used to correct it. The rate is 2.9 percent, covering both employer and employee share. The tax rate is 12.4%, covering both the employee and employer share. Another exception occurs for employees who only work on a seasonal basis. A business owner will only have to include these employees on their 941 if the employees worked during that quarter.

If depositing monthly, a breakdown of tax liability by month is entered here. Employers depositing taxes semiweekly explain their tax liability for their deposits on Schedule B. There is a next-day deposit requirement for taxes exceeding $100,000.

This form requires employers to report the number of employees, the amounts withheld from each of them, all Social Security withholdings, and all Medicare withholdings. It is also used to report any advances on earned income credits that are paid out to employees if this is applicable. The Sick Leave and Family Leave Tax Credits help employers that must give paid sick leave and family leave to employees who can’t work due to COVID-19. Your business can take these tax credits by keeping part of employment taxes related to employee wages instead of depositing them. You might be able to file an annual federal tax return on Form 944 instead of filing quarterly Forms 941 if you expect your FICA taxes and withheld federal income tax for the year to be $1,000 or less. U.S. businesses with employees must use it to report federal income tax, social security tax and Medicare tax withheld from their employees’ pay. They then need to electronically send the amount withheld to the government.

- The refundable portion of the credit is allowed after the employer share of Social Security tax is reduced to zero by nonrefundable credits.

- Businesses who have employees must file Form 941 to report federal withholdings from employees.

- If you file Form 944 and are a semiweekly depositor, then report your tax liability on Form 945-A, Annual Record of Federal Tax Liability.

- Where you file Form 941 depends on your state and whether you make a deposit with your filing.

- Maybe you Googled a few of your questions or scrolled through the Internal Revenue Service’s website, but you’re still feeling confused and unsure.

Fill out line 7 to adjust fractions of cents from lines 5a-5d. At some point, you will probably have a fraction of a penny when you complete your calculations. The fraction adjustments relate to the employee share of Social Security and Medicare taxes withheld. If applicable, account for the additional 0.9% on line 5d by multiplying taxable wages and tips subject to additional Medicare tax withholding by 0.009. For 2020, the Social Security wage base is $137,700 ($142,800 for 2021).

Employers can receive the tax credit prior to filing tax returns by simply reducing their employment tax deposits. You can also use the IRS EFTPS tax payment system to pay your payroll taxes if turns out that you owe. Part 3 asks questions about your business, and Part 4 asks if the IRS can communicate with your third-party designee if you have one.

Therefore, whether employers use IRS Form 941 or 944 depends on the total income and FICA tax that their business owes for a year. IRS Form 941, Employer’s Quarterly Federal Tax Return, reports payroll taxes and employee wages to the IRS. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as Medicare and Social Security withholdings . It’s your responsibility as an employer to file payroll tax reports like Form 941 and to pay your federal tax liabilities, even if you hire a payroll service. The IRS can assess penalties and interest due to your business if your payroll service fails to file and pay on time.

Don’t forget to sign the form in Part 5, and include the other information asked for in this section before you submit the form. Check for errors, especially those that might cause an underpayment. It’s better to correct errors before you send in the form because this will help you avoid fines and penalties. Returns via mail must be addressed correctly, have enough postage and be postmarked by the U.S.

E-file your Forms before the deadline to avoid late filing penalties. Then, prior to processing your W-2s and 941s, verify that all general ledger liability accounts balance. The tax rates for both Social Security and Medicare have remained the same. IRS compares the amounts on your Form 941 with your annual Form W-3. Save money and don’t sacrifice features you need for your business. Save money and don’t sacrifice features you need for your business with Patriot’s accounting software. After you complete all three pages of 941 and sign it, you’re ready to submit your form to the IRS.

Calculating Base Futa Tax

You must also enter this total on Worksheet 1, Step 2, line 2f. If you are a seasonal employer and don’t have to file Form 941 every quarter, put an “X” next to “Check here” on line 18.

See Topic No. 757 and Publication 15 for rules on deposits and payment of tax with your return. While the IRS prefers and recommends online filing, small businesses also have the option of mailing in Form 941 along with corresponding tax payments. Forms 941 and 944 are even more similar—both are used to report FICA and income tax withholding to the IRS.

Lines 5a-5d are the totals for both the employee and employer portions of Social Security and Medicare taxes withheld from an employee’s wages. Report the total compensation you paid to the applicable employees during the quarter. Form W-2 reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

On line 19, enter the qualified health plan expenses allocable to qualified sick leave wages, if applicable. You must also enter this amount on Worksheet 1, Step 2, line 2b.

Form 941 Definiton

The employee SS tax deferral lets eligible employees temporarily defer the employee portion of Social Security tax until December 31, 2020. If you had any overpayments from previous quarters that you’re applying to your return, include the overpayment amount with your total on line 13a. Record your total taxes after adjustments and nonrefundable credits on line 12. Subtract line 11d from line 10 and enter your total on line 12.

Maybe you Googled a few of your questions or scrolled through the Internal Revenue Service’s website, but you’re still feeling confused and unsure. In order to be tax compliant, employers need to pay attention to various IRS forms and their differences and to make sure that they are filed accurately and on time.

For example, when you file on January 31 you’ll be reporting amounts withheld on payroll from October 1 to December 31 of the previous year. This withheld money is reported to the government via Form 941, a tax form from the Internal Revenue Service . Failure to timely file a Form 941 may result in a penalty of 5 percent of the tax due with that return for each month or part of a month the return is late. A separate penalty applies for making tax payments late or paying less than you owe.