Content

Restricted stock units and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. How your stock grant is delivered to you, and whether or not it is vested, are the key factors when determining tax treatment. There are two main types of stock options, each with its own tax results. You can purchase an index mutual fund or ETF directly from a fund provider such as Vanguard. ETFs can be purchased through investing apps such as Robinhood or Acorns. Investment companies such as Fidelity and Charles Schwab allow you to buy both ETF and mutual funds as well as many other investments such as individual stocks and bonds. As a first-time investor, you may have a lot of questions about buying and selling stocks.

If this amount is not included in Box 1 of Form W-2, you still must add it to the amount of compensation income that you report on your 2020 Form 1040, line 7. Unlike example 2, the compensation is calculated as either the bargain element or the actual gain from the sale of the stock – whichever is lower. This is because the market price on the day of the sale is less than that on the day you exercised your option.

This, is also a qualifying disposition because over two years have passed between the offering date and the sale date, and over one year has passed between the date of purchase and the date of sale. And this time, the price per share increased from the offering date to the purchase date. You must show the sale of the stock on your 2020 Schedule D. It’s considered long-term because more than one year passed from the date acquired to the date of sale . That is good, because long-term capital gains are taxed at a rate that is lower than your regular tax rate. If you owned the investment for longer than one year, the sale is a long-term capital gain or loss. Long-term capital gains are typically taxed at special long-term capital gains rates, ranging from 0% to 20%.

If you’ve gotten the hang of retirement accounts, index funds are typically an easy and low-cost way to invest in the stock market. An index fund is a portfolio of stocks designed to match or track a particular financial market index, such as the S&P 500 or the Dow Jones Industrial Average. There are two main categories of index funds – index mutual funds and index exchange traded funds . One main difference between the two is that ETFs can be traded throughout the day much in the same was as a stock while mutual funds trade at the end of each day at a price based on that day’s closing value of the fund. You can also contribute to an IRA, whether or not you invest in a 401.

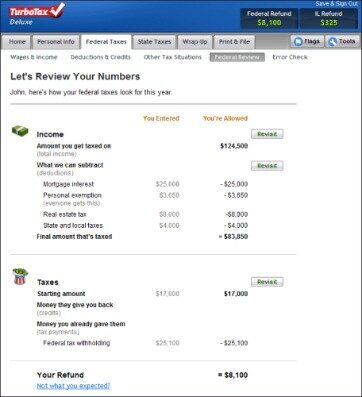

When it comes to your gains, it’s good to know the difference between short term capital gains and long term capital gains. If you have a gain and have held the security for one year or less, it’s taxed as a short-term gain. If you’ve held it for more than a year, it’s taxed as a long-term gain. At the end of the year, you offset your short-term gains with your short-term losses and your long-term gains with your long-term losses. TurboTax Live Premier also helps you calculate capital gains/losses and even set up new rentals and report depreciation.

When a survivor can’t prove his or her contribution, the IRS generally assumes the deceased owner provided all of it. This rule works in the IRS’s favor as far as estate taxes are concerned because the full value of the property must be included in the estate of the first joint owner to die. But it works in the taxpayer’s favor when it comes to the basis because the entire amount is stepped up. If you sell for a loss, though, the basis is either the previous owner’s basis or the value of the stock at the time of the gift, whichever is lower. In other words, you don’t get to write off a loss that occurred while the donor owned the securities.

- Certain assets can have “adjustments” to the basis that can affect the amount gained or lost for tax purposes.

- Incentive Stock Option transactions fall into five possible categories, each of which may get taxed a little differently.

- This rule doesn’t allow you to take the loss if you buy the same or substantially the same investment within 30 days before or after the sale of the investment.

- TurboTax Premier automatically imports investment transactions from hundreds of financial institutions, eliminating time and improving accuracy.

- They can be carried forward into subsequent years, and either deducted against future capital gains or written off against non-investment income at a rate of $3,000 per year until the loss has been fully deducted.

You typically receive Form 1099-DIV if you earn more than $10 in dividend income or capital gains distributions during the year. You’ll report those dividends on Form 1040 and also on Schedule B attached to your tax return if your dividends exceed a certain amount. You should receive Form 1099-INT from your bank or investment accounts if you earn more than $10 in interest income from your account. Otherwise, you simply report your total interest income directly on Form 1040. When you use TurboTax to prepare your taxes, we’ll do these calculations and fill in all the right forms for you. We can even directly import stock transactions from many brokerages and financial institutions, right into your tax return. If you buy or sell a stock option in the open market, the taxation rules are similar to options you receive from an employer.

TurboTax Premier walks you through investment tax scenarios including stocks, bonds, ESPPs, robo-investing, cryptocurrency, rental property income, and more. When you invest in a 401 or IRA, you don’t need to worry about taxes — as long as you leave the money in the account. Any interest, dividends and capital gains from your account can be reinvested and grow on a tax-deferred basis until you start taking withdrawals. This makes tax reporting easy because you don’t have anything to report on your tax return except for tax-deductible contributions to your account. When you sell an investment, you often pay taxes on the profit you make from the sale.

Search Turbotax Support

If you hold the shares for more than one year, any profit will be taxed at the usually lower capital gains rate. When the company buys the shares for you, you do not owe any taxes. Usually, you make contributions to a stock purchase fund for a certain period of time through payroll deductions. At designated points in the year, your employer then uses the accumulated money in the fund to purchase stock for you.

Many beginning investors can’t afford to invest thousands of dollars right out of the gate. Robinhood and some other investment companies have low or no account minimums; they may also require a more hands-on approach. Form 8949 tells the IRS all of the details about each stock trade you make during the year, not just the total gain or loss that you report on Schedule D.

If you don’t want cash withheld from your paycheck, you may be able to pay the tax by having your employer take it out of the shares. For example, if you need 10% tax withheld and receive 100 shares of stock, your employer may be able to liquidate 10 shares and give you a net grant of 90 shares. Only when you are fully vested in the stock do you have 100% ownership rights to do with the stock as you please. As with RSUs, stock grants typically vest after a period of time, or after certain performance measures are met. You’re not liable for income tax until your stock grant vests, at which point you must report income equal to the value of the stock.

Video: Taxes 101: Buying And Selling Stocks

In the above scenario, with Company X going up $2 and Company Y going down $2, you have a realized gain of $20 and a realized loss of $20, respectively. If that were all in the same tax year, the gain is offset by the loss and you owe nothing in taxes. A qualified dividend is a cash payment by a company, typically funded by their income, and has a lower tax rate. Non-qualified dividends and interest are taxed at the same rate as bank interest. Another common taxable event is when a stock or fund pays you a dividend or interest. They’re both cash payments, which you can reinvest at your own option, but they’re taxed differently. If you are a first-time investor, let me be the first to congratulate you on your smart, long-term move and explain how the taxes on your investments work.

How much tax you pay when you sell the stock depends on when you sell it. Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. As of 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. It’s important to take a look at the whole picture of your capital gains and losses for AMT purposes when you sell stock that you purchased by exercising Incentive Stock Options. If the market turns on you after you have exercised your options and the current value of your stock is now less than what you paid, you could still be subject to the Alternative Minimum Tax. If this amount is not included in Box 1 of Form W-2, add it as “Other Income” on your Form 1040.

Your employer will not include any compensation related to your options on your 2020 Form W-2 either. Sell shares at least one year and a day after you purchased them, and at least two years since the original grant date.

Stock Splits

If you invest in a no-load fund—one free of a sales commission—your basis is the same as the share’s net asset value on the day you buy. If you sell the 100 shares for same $40 each, and pay $100 commission on the sale, you have a $200 loss—your $4,100 basis minus the $3,900 proceeds of the sale. The tax not only applies to capital gains income, but also investment income derived from interest, dividends, rental and royalty income, and non-qualified annuity income. For example, let’s say you’re married and have a combined taxable income of $150,000. At that income level, you’ll be eligible for the 15% long-term capital gains tax rate, but your regular federal income tax rate will be 22%.

The bargain element is the difference between the exercise price and the market price on the day you exercised the options and purchased the stock. Or if you sell the shares one year or less from the “exercise date,” which is when you purchase the stock, that is also considered a disqualifying disposition. No compensation is reported to you on your Form W-2, so you do not have to pay taxes on the transaction as ordinary income at your regular tax rate. Exercise your option to purchase the shares, then sell them any time within the same year. With Non-qualified Stock Options, you must report the price break as taxable compensation in the year you exercise your options, and it’s taxed at your regular income tax rate, which in 2020 can range from 10% to 37%.

Let’s assume that you receive options on stock that is actively traded on an established market such as the NASDAQ, but that the options themselves aren’t traded. The tax catch is that when you exercise the options to purchase stock , you have taxable income equal to the difference between the stock price set by the option and the market price of the stock. Exercising options to buy company stock at below-market price triggers a tax bill.

Offsetting Capital Gains With Capital Losses

When your short-term gains exceed your short-term losses, you pay tax on the net gain at the same ordinary income tax rates you pay on most of your other income, such as your wages. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money you gained and report it on a Schedule D. Depending on your situation, you may also need to use Form 8949. Capital assets held for personal use that are sold at a loss generally do not need to be reported on your taxes.

Nonstatutory stock options are granted without one of these plans. When you exercise a nonstatutory stock option, you owe tax on the difference between the price you paid for the stock and its fair market value on the date you exercise the option. The amount of tax you’ll pay on the capital gain typically depends on how much you made from the sale and how long you owned the asset. Over time, investment gains and losses can cause your portfolio to be out of balance. A robo-advisor will periodically buy or sell assets within your portfolio to ensure it’s still in line with your financial goals.

Buying Company Stock At A Discount

In one case we know of, an employee’s payroll department did not withhold federal or state income taxes. He exercised his options by paying $7,000 and sold the stock on the same day for $70,000 then used all the proceeds on the deal, to buy an $80,000 car, leaving very little cash on hand. Come tax return time the following year, he was extremely distressed to learn that he owed taxes on the compensation element of $63,000. For investments outside of a tax-favored retirement account, you usually need to report details of any interest, dividends, and capital gains and losses. In most cases, you’ll receive a 1099 with this information from your financial institution.

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. For many new investors, it’s not clear how your investments are taxed.