Content

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. How long do you keep my filed tax information on file? When married taxpayers file separately on the same form and one spouse is entitled to a refund and the other spouse owes, the refund of one spouse is applied to the amount owed by the other spouse. This means the refund received is different than what is shown on the return. If you itemize deductions on your federal income tax return, you may deduct state income taxes paid during the year.

Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee.

Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

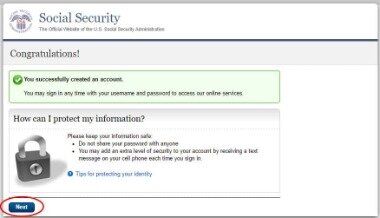

Sign In To Your My Social Security Account To Get Your Copy

For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

Are you waiting for your 1099 forms to arrive so you can start preparing your tax return? Or do you need to obtain copies of older ones for some other reason? If you answered yes to either, there are easy ways to retrieve the forms. Watch this video to find out more about recovering 1099 forms. We mail the 1099-G to the address we have on record as of mid-January, when the forms are printed.

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis.

Trying to find filing options? A 1099-G form shows the amount of state tax refund sent to taxpayers. The 1099-INT form is used to report the amount of interest paid on a refund to the taxpayer.

The U.S. Postal Service will not forward the 1099-G unless they have a change of address on file. Every January, we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

Prepaid Cards

You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account.

A form 1099-G, Certain Government Payments is an income statement issued by a government agency. Key IRS Forms, Schedules & Tax Publications for 2021 by Tina Orem Here are some major IRS forms, schedules and publications everyone should know. IRS Free File & How to Get Free Tax Preparation or Free Tax Help in 2021 by Tina Orem Here’s where to get free tax software, free tax preparation and free tax help this year.

In that case, the exchange might “1099 you” for the income you received. A 1099 isn’t usually required if you barter with someone directly, though you may have to report the income. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

Turbotax Online

So again, for many people a 1099-SA is simply proof that the money left the account and went to you. If you belong to a co-op and received at least $10 in patronage dividends, expect to see Form 1099-PATR in your mailbox. You might receive a 1099-CAP if you hold shares of a corporation that was acquired or underwent a big change in capital structure and you got cash, stock or other property as a result. settle your debt for less than you owe, you’re not entirely off the hook.

CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account.

Banks also often have 1099s available on their websites. If the original issuer can’t be contacted or is unresponsive, you can still go to the IRS for help. “Since all information returns are required to be filed with the IRS, they also have copies that can be sent to the taxpayer upon request,” Hockenberry says. In addition to a Form 1099-G, taxpayers can also verify the refund amount by reviewing their 2018 Arizona individual income tax return. We will inform you when your return has been accepted for processing. Thank you for your patience and we apologize for any inconvenience.

The transcripts will arrive in about three weeks. Regardless of whether or not you receive a 1099 from someone, you are required to report all of your taxable income on your tax return. Some payers may not send a 1099 even if they are over $600 in payments, so don’t rely on 1099s to keep track of all the income you have made during the year. A missing 1099 for interest income issued by banks can be also be replaced by asking the bank to send a duplicate. The same goes for K-1 returns issued by partnerships.

Types Of 1099 Forms

Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns. State e-file available for $19.95. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

So your best bet is usually to file your return when it is due, even if a lost W-2, missing 1099 or other absent documentation means you can’t file a complete return. If you plan ahead and become aware of missing information in advance of the required filing date, there are ways to replace almost any document you may need to file. How common is it for a filer to be confronted with a lost 1099 or other vital document needed to prepare a return? Anyone lacking a computer, internet access or unable to print their Form 1099-G, can request a copy by contacting the department’s Customer Care Center at or toll-free . The department has also established a secure email address,, for taxpayer use.

- You might receive Form 1099-OID if you bought bonds, notes or other financial instruments at a discount to the face value or redemption value at maturity.

- You can authorize your tax pro to contact the IRS and get your transcript for you.

- CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

- However, if the income was not reported to the IRS, then it won’t appear on this transcript.

- Your wireless carrier may charge a fee for data usage.

“These transcripts will include tax return information including W-2s, 1099s, etc.,” Hockenberry says. April may be the cruelest month when it comes to filing income taxes. But exactly how much hassle filing will be is partially decided in the year’s earlier months. Sign in to your account, click on Documents in the menu, and then click the 1099-R tile.

The tax discussion on this website is included for general information only. It is not intended to be, nor should it be construed to be, legal or tax advice to you. Click on the Tax Form and in the expanded view, locate the Download & Print Form option near the bottom. This will start a download of your 1099 form. If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS.

The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest.

Education Credit & Deduction Finder

Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.