Content

One is the qualified business income deduction, which lets you take an income tax deduction for as much as 20% of your self-employment net income. (Learn more about that here.) Plus, there are other deductions available for your home office, health insurance and more. As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Churches and qualified church-controlled organizations that are opposed for religious reasons to payment of Social Security and Medicare taxes can elect to exclude their employees from FICA coverage.

You can pursue a long-held ambition and make it a huge success with plenty hard work and some good luck. The tax rules apply no matter how old you are and even if you’re receiving Social Security or are on Medicare. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you. Compare online loan options for funding and eventually growing your small business. For 2021 the first $142,800 of earnings is subject to the Social Security portion. For 2020, the first $137,700 of earnings was subject to the Social Security portion. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19.

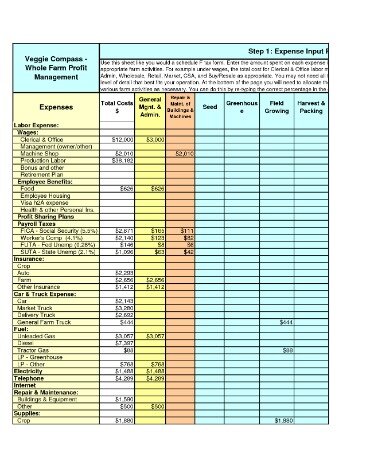

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Expenses related to your self-employment income—Deduct these expenses on Schedule C or Schedule C-EZ. Examples of these costs include travel, office expenses, subscriptions, books and computers.

Once you have established your taxable self-employment income you will then multiply that number by the total amount for Medicare and Social Security taxes, which together, equals (15.3%). President-elect Joe Biden suggested that in addition to increasing marginal tax rates on corporations and high income earners he would remove the cap on FICA taxes for those earning above $400,000 in income. He would treat any income above that level similarly to the first $137,700 and have it fully exposed to FICA taxes. There is currently no maximum limit for the Medicare portion, which totals (2.9%). The IRS self-employment limits for the Social Security portion for 2020 is $137,700, which is subject to (12.4%) of the self-employment tax. High income individuals may be assessed an additional Medicare tax equal to 0.9% of any income above the threashold amount. If self-employed individuals do not pay enough tax throughout the year they may be subject to the underpayment penalty even if they are due a refund.

Minister’s Withholding Calculator

The authors and/or publishers are not responsible for any legal repercussions, adverse effects, or consequences resulting from the use of any of the information discussed on this site. Answer the questions below and click “Calculate Now.” You’ll receive an estimate of your withheld taxes and tax payments. Mortgage Loan Directory and Information, LLC or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents.

- For income tax purposes, facts and circumstances determine whether you’re considered an employee or a self-employed person under common-law rules.

- The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

- Although the income you earn is not subject to self-employment tax if the election is granted, you can use the income as the basis for contributions to a qualified retirement plan, such as a Keogh plan or individual 401.

- You may be self-employed in the eyes of the IRS if you received a 1099 form from an entity you did work for.

- President-elect Joe Biden suggested that in addition to increasing marginal tax rates on corporations and high income earners he would remove the cap on FICA taxes for those earning above $400,000 in income.

- Compare online loan options for funding and eventually growing your small business.

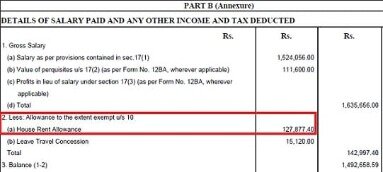

Also, mortgage payments and property tax can be claimed as itemized deductions on Schedule A of your 1040 or 1040SR, even if you paid for them using your housing allowance. Our tax calculators offer insights into Federal income taxes, margin tax rates, payroll taxes, estate taxes and more. All calculators have been updated for 2021 tax year and the 2017 Tax Cuts and Jobs Act. If the church provides a residence, you can exclude from gross income the fair rental value of the house, including utilities, furnished to you as part of your earnings.

Tax Bracket Calculator

How you figured the nondeductible part of your otherwise deductible expenses. Launch to Lead includes 10 lessons in over 38 videos that explore the in-depth process of what it looks like to be confident as you plant your church and watch it grow.

93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers. Ministers, members of religious orders who have not taken a vow of poverty, Christian Science practitioners, and members of recognized religious sects can request exemption from SE tax. The taxpayer must be conscientiously opposed to public insurance because of religious considerations or principles. Expenses- Employee expenses are reported on Schedule A, Form 1040, subject to 2% AGI limitation.

• The amount officially designated by the employer as housing allowance. Amounts must be designated as housing allowance before payment is made. Return to the Schedule C edit menu and enter the income from the Form 1099-MISC or any income from weddings, baptisms, etc. Also enter expenses incurred by the minister related to this income. The expenses will be prorated based on the percentage of tax-free income. Schedule SE will need to be completed to calculate SE tax on the minister’s Form W-2 wages, parsonage and utilities allowance.

This calculator sorts through the tax brackets and filing options to calculate your true tax liability.Marginal Tax Rate Calculator Use this calculator to determine your marginal and effective tax rates for tax year 2016. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act .Payroll Deductions Calculator Use this for a historical look at 2020 payroll deductions. This simple calculator will help you determine your tax refund.Simple Federal Tax Calculator Enter your filing status, income, deductions and credits and we will estimate your total tax for 2019. This simple calculator will help you determine your tax refund.Simple Federal Tax Calculator Enter your filing status, income, deductions and credits and we will estimate your total tax for 2018. This simple calculator will help you determine your tax refund.Simple Federal Tax Calculator Enter your filing status, income, deductions and credits and we will estimate your total tax for 2017. This simple calculator will help you determine your tax refund.Simple Federal Tax Calculator Enter your filing status, income, deductions and credits and we will estimate your total tax for 2016.

The only way to avoid this penalty is if you owe less than $1,000.00. Putting some money into an individual retirement account or other retirement plan is a core financial planning tactic, too, particularly for ministers who have opted out of Social Security.

You will complete this step to be sure that you have maximized all of your deductions. As a general rule, you will pay less self-employment tax if your net income is low. Self-employment tax is money paid to the federal government to fund Social Security and Medicare. Each self-employed individual must pay this tax once they have a net income of $400.00 or more in any given tax year. However, when an individual is self-employed, he or she is both the business and the employee, therefore having to pay both shares of this tax. The exemption applies to wages for ministerial services, but not other self-employment income. If you own the home, you can exclude the fair rental value from your gross income.

Try the only retirement calculator designed for ‘clergy’benefits to discover your true retirement potential. Keep housing allowance for life whether you retire, leave the ministry altogether or move into a new ministry with greater financial independence. First, you will need to establish the amount of your net income from self-employment. To do this you must review all of your self-employment expenses and then subtract your total revenue.

Irs Withholding Calculator

For more information about the common-law rules, see Publication 15-A, Employer’s Supplemental Tax Guide. If a congregation employs you for a salary, you’re generally a common-law employee of the congregation and your salary is considered wages for income tax withholding purposes. However, amounts you receive directly from members of the congregation, such as fees for performing marriages, baptisms, or other personal services, are generally earnings from self-employment for income tax purposes. Both the salary you receive from the congregation and fees you receive from members of the congregation may be included for social security coverage purposes and subject to self-employment tax . A minister who is an employee for federal income tax purposes can also have self-employment income for income tax purposes. For example, ministers who work for only one church would be employees for federal income tax purposes for their church pay. But if they perform weddings and funerals or occasionally preach at another church for pay, that income should be reported as self-employment income for federal income tax purposes.

The Solicitor may promote and/or may advertise Facet Wealth’s investment adviser services and may offer independent analysis and reviews of Facet Wealth’s services. Facet Wealth and the Solicitor are not under common ownership or otherwise related entities.Additional information about Facet Wealth is contained in its Form ADV Part 2A available here. If you had a loss or just a little bit of income from self-employment, be sure to check out the two optional methods in IRS Schedule SE to calculate your net earnings. Self-employment tax is a combination of Social Security and Medicare taxes.

For income tax purposes, facts and circumstances determine whether you’re considered an employee or a self-employed person under common-law rules. Generally, you’re an employee if the church or organization you perform services for has the legal right to control both what you do and how you do it, even if you have considerable discretion and freedom of action.

A statement that the other deductions claimed on your tax return are not allocable to your tax-free income. Although the income you earn is not subject to self-employment tax if the election is granted, you can use the income as the basis for contributions to a qualified retirement plan, such as a Keogh plan or individual 401. The level of tax is different depending on what type of self-employment you are engaged in, so make sure you put your information in the appropriate field on the calculator. The Self-Employment Taxes Calculator enables you to quickly and easily figure out how much tax you owe from your earnings.

But just like a rental allowance, the exclusion cannot be more than the reasonable pay for your services. If you pay for the utilities, you can exclude any allowance designated for utility costs, up to your actual cost. Self-employment can score you a bunch of sweet tax deductions, too.

Information on this site is provided for informational purposes. This site is meant to be used as a reference work only, which may or may not help you make informed decisions concerning your church or ministry. It is not to be used in replacement of or as a substitute for a lawyer or CPA. As always, you should seek the counsel of a competent lawyer or CPA.

The minister’s wages must be excluded from lines 5a and 5c of Form 941. Fill out the form to get a password to watch Tax-Free Money for Ministers. US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility. If you just simply need more time to pay you can request an installment agreement. Second, under section 2042 of the Small Business Jobs Act you can deduct the total health insurance premiums paid on yours and your family’s behalf. Due to the fact the premiums do rise yearly, you should be careful not to overlook this particular deduction.

Ministers And Taxes

However, clergy generally cannot use Schedule C to claim business expenses except for specific income earned from performing religious marriage, funeral, and other ceremonial services. This dual status partly as an employee and partly as a self-employed individual has significant tax consequences. Ministers must use Schedule SE to calculate their self-employment tax.