Content

The term “options dealer” means any person registered with an appropriate national securities exchange as a market maker or specialist in listed options. Subparagraph shall not apply to any section 1256 contract to the extent such contract is held for purposes of hedging property if any loss with respect to such property in the hands of the taxpayer would be ordinary loss. In the case of any hedging transaction relating to property other than stock or securities, this paragraph shall apply only in the case of a taxpayer described in section 465. For purposes of the preceding sentence, taxable income shall be determined by not taking into account items attributable to hedging transactions.

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations. ©2020 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17).

At participating offices. Only available for returns not prepared by H&R Block.

Subparagraph shall not apply to any hedging loss to the extent that such loss exceeds the aggregate unrecognized gains from hedging transactions as of the close of the taxable year attributable to the trade or business in which the hedging transactions were entered into. Section 1256 contracts are marked-to-market daily. MTM reports both realized activity from throughout the year and unrealized gains and losses on open trading positions at year-end for tax purposes. Section 1256 contracts and straddles are named for the section of the Internal Revenue Code that explains how investments like futures and options must be reported and taxed. Under the Code, Section 1256 investments are assigned a fair market value at the end of the year.

How Are Futures & Options Taxed?

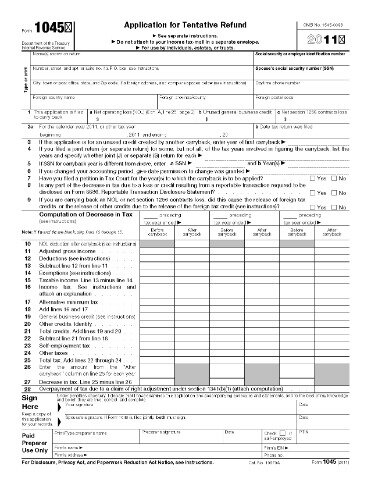

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

See your Cardholder Agreement for details on all ATM fees. H&R Block Emerald Advance® line of credit, H&R Block Emerald Savings® and H&R Block Emerald Prepaid Mastercard® are offered by MetaBank®, N.A., Member FDIC. Cards issued pursuant to license by Mastercard International Incorporated. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021.

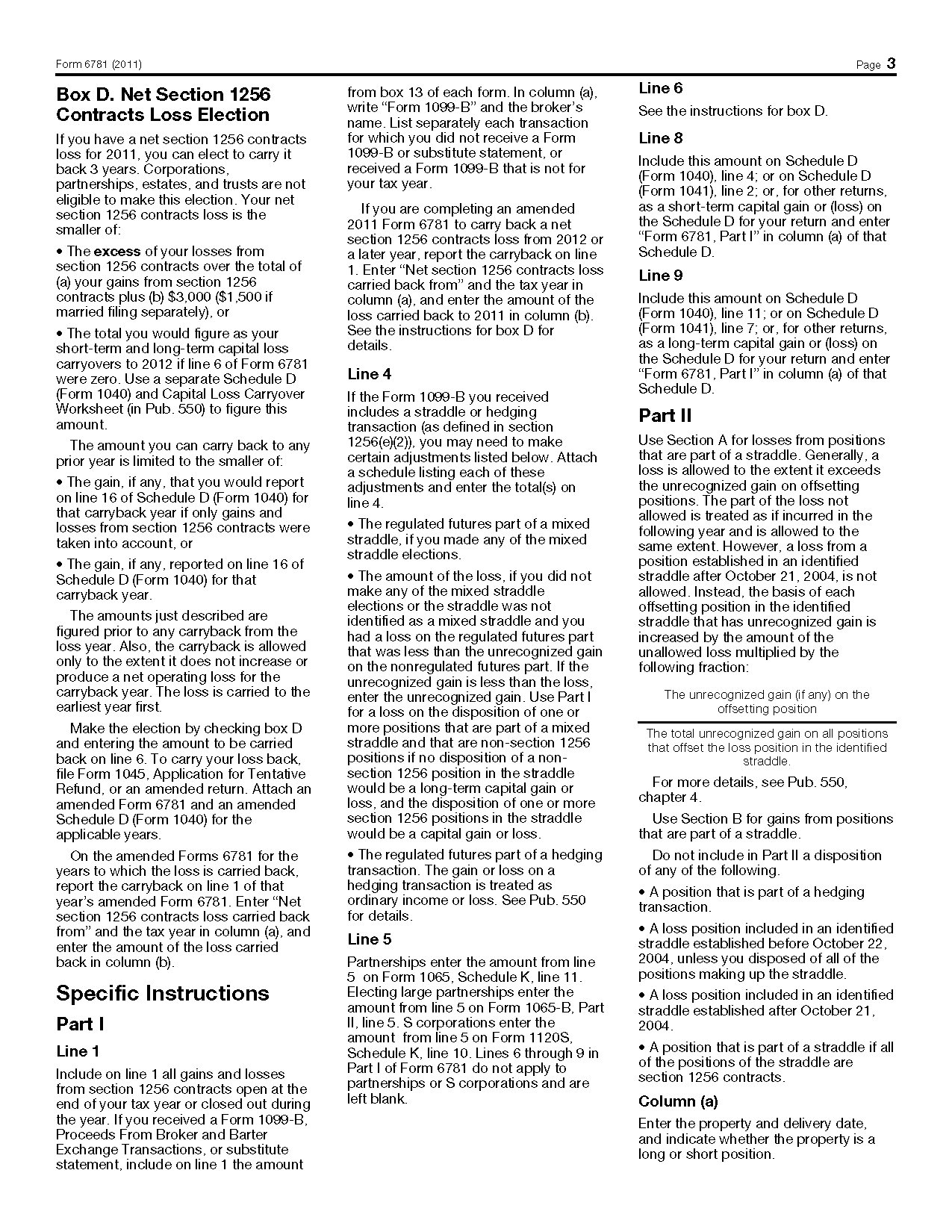

More specific information about Section 1256 contracts can be found in Subtitle A , Chapter 1 , Subchapter P , Part IV of the IRC. No additional detail or complex matched trade report (as required for capital gains from stocks, options, etc.) is required. 60% of the capital gain or loss from Section 1256 Contracts is deemed to be long-term capital gain or loss and 40% is deemed to be short-term capital gain or loss.

On Jan. 30, 2018, he sells his long position for $28,000. Since he has already recognized a $4,000 gain on his 2017 tax return, he will record a $1,000 loss (calculated as $28,000 minus $29,000) on his 2018 tax return, treated as 60% long-term and 40% short-term capital loss. Non-equity options include debt options, commodity futures options, currency options, and broad-based stock index options.

OBTP# B13696 ©2020 HRB Tax Group, Inc. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Starting price for simple federal return.

How To Fill Out Tax Form 6781

Additional feed may apply from SNHU. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

The term “nonequity option” means any listed option which is not an equity option. which is traded on or subject to the rules of a qualified board or exchange.

Your Security Built Into Everything We Do.

Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage.

Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only.

The term unrecognized gain has the same meaning as defined under Straddles, later. If only a portion of the net section 1256 contracts loss is absorbed by carrying the loss back, the unabsorbed portion can be carried forward, under the capital loss carryover rules, to the year following the loss. In the carryover year, treat any capital loss carryover from losses on section 1256 contracts as if it were a loss from section 1256 contracts for that year. When trading the E-minis you do not account for the wash sale rule. The wash sale rule basically states that if you sell a security at a loss and buy replacement stock 30-days before or 30- days after the sale of the same security, you are denied a current tax deduction of that loss .

Thus, an options dealer may have a stock position acquired at an earlier date included in the mixed straddle election. To include the previously acquired stock in the election, the taxpayer must identify both the stock and the option position as being the positions of the mixed straddle before the end of the day on which he acquired the option.

Any hedging loss that is allocated to you for the tax year is limited to your taxable income for that year from the trade or business in which the hedging transaction occurred. Ignore any hedging transaction items in determining this taxable income. If you have a hedging loss that is disallowed because of this limit, you can carry it over to the next tax year as a deduction resulting from a hedging transaction. Figure your net section 1256 contracts gain for any carryback year without regard to the net section 1256 contracts loss for the loss year or any later tax year. The loss is carried to the earliest carryback year first, and any unabsorbed loss amount can then be carried to each of the next 2 tax years. In each carryback year, treat 60% of the carryback amount as a long-term capital loss and 40% as a short-term capital loss from section 1256 contracts.

Not valid on subsequent payments. Expires January 31, 2021.

The fifth condition provides that the exclusion applies only if the Underlying Broad-Based Security Index qualifies as a broad-based security index under the statutory criterion that evaluates the liquidity of the securities comprising an index. The sixth condition provides that the exclusion applies if the options comprising the index are listed and traded on a national securities exchange. Finally, the seventh condition provides that the exclusion applies only if the options comprising the index have an aggregate average daily trading volume of 10,000 contracts. Terminations and transfers.The marked to market rules also apply if your obligation or rights under section 1256 contracts are terminated or transferred during the tax year. In this case, use the fair market value of each section 1256 contract at the time of termination or transfer to determine the gain or loss.

Equity options include options on a group of stocks only if the group is a narrow-based stock index. Warrants based on a stock index that are economically, substantially identical in all material respects to options based on a stock index are treated as options based on a stock index. Bank forward contracts with maturity dates that are longer than the maturities ordinarily available for regulated futures contracts are considered to meet the definition of a foreign currency contract if the above three conditions are satisfied. SPX, DJX, NDX, and RUT options are Index Options.

- With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers.

- In addition, the amount of loss carried back to an earlier tax year cannot increase or produce a net operating loss for that year.

- The carried back losses may generate a tax refund by being offset against §1256 contract gains in that 3rd year going back, with any remaining net loss coming forward year-by-year.

- The implied profit or loss from the fictitious sale are treated as short- or long-term capital gains or losses.

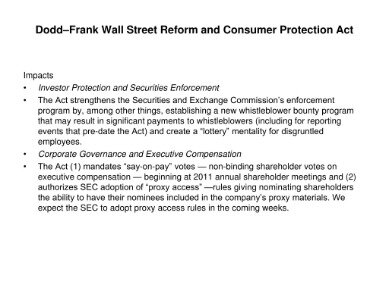

Offsetting positions between Section 1256 contracts and securities can generate tax complications under certain circumstances involving the hedging rule. The IRS is concerned about traders reporting Section 1256 MTM unrealized losses and deferring unrealized gains on offsetting securities positions, so there are rules intended to prevent this. A Section 1256 contract is a type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option, or dealer securities futures contract.

A taxpayer holding a mixed straddle has $100 of unrelated short-term capital gain. He closes out the non-§1256 straddle position242 for a loss of $100. This loss offsets the unrelated gain. The §1256 position is closed out for a gain of $100, subject to 60/40 treatment. While the straddle positions offset each other, the taxpayer winds up with the unrelated short-term gain converted to 60/40 gain. If, on the other hand, the §1256 position is the loss position, the result is the opposite. Assume again that there is $100 of unrelated gain.