Content

Unless the trust document specifies otherwise, capital gains and losses stay with the trust since they are part of the corpus. An estate or trust can generate income that must be reported on Form 1041, United States Income Tax Return for Estates and Trusts. However, if trust and estate beneficiaries are entitled to receive the income, the beneficiaries must pay the income tax rather than the trust or estate. At the end of the year, all income distributions made to beneficiaries must be reported on a Schedule K-1. Although you have to pay federal income tax as you pull the money out of the IRA, you also get an income tax deduction for that $22,500. If the estate was large enough to be subject to federal estate tax, you can deduct the portion of the federal estate tax attributable to the IRA.

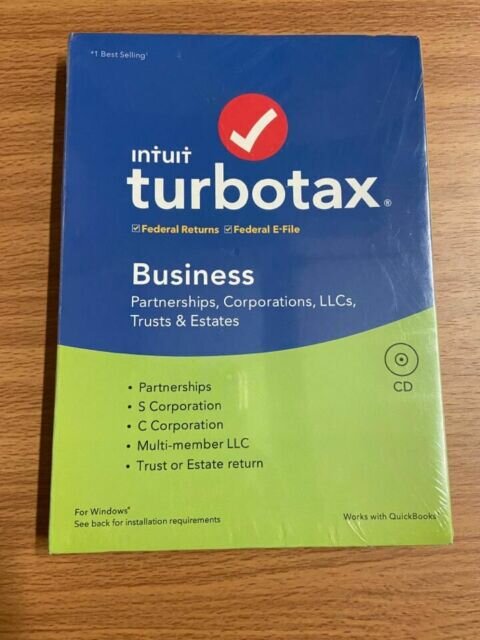

Our expert guides, reviews, and more are designed to help you achieve your financial goals. If this sounds complicated to you , you might want to enlist professional help to process the estate or trust return. This can help make sure that you don’t miss anything or have any glaring errors. While Schedule K-1 forms are tough to generate, they are usually very easy to handle using a typical tax software program. H&R Block for small business supports the Form 1041, but not creating Schedule K-1 forms. People in charge of a large estate will probably want to hire an accountant to help them generate all the necessary tax forms. The accountant can also help you figure out methods of transferring funds in a tax advantaged way.

Schedule K-1 may also show tax credits in box 13, or the information you will need to calculate the domestic production activities income deduction you can take as an income adjustment on your 1040. TurboTax Deluxe helps you find all the money-saving tax deductions related to your estate and trust income. This deduction for federal estate tax on “income in respect of a decedent” is taken on line 16 of Schedule A. Say you inherited a $50,000 IRA when your mother died in 2020, which, because it was included in your mother’s taxable estate, boosted the estate tax bill by $22,500. If it’s a Roth IRA, the inheritance is federal-income-tax-free if the account was opened more than five years before you take any withdrawals.

Your K-1 will report each type, or character, of income you receive in various boxes of the form. For example, box 2a shows the amount of your income from ordinary dividends, and box 2b has the amount of box 2a that is qualified dividends.

A personal representative can be an executor or an administrator of the estate of a person who has died. If the “decedent” named someone to handle the estate in his or her will, that person is the executor. If the will doesn’t name an executor, or if the named executor can’t or won’t do the job, a court can appoint an administrator to handle the estate.

My Uncle Left Me $10,000 Worth Of Stock Is That Taxable?

If it’s a traditional IRA, however, you will usually owe income tax as you withdraw money from the account. Cash, stock and real estate are not taxed as income when you inherit them, but you could have taxable gains when you sell the stock or real estate—depending on the circumstances. Some other assets come with a tax string attached—you’re taxed on part or all of the value, just like the original owner would have been if he or she had lived. This rule comes into play for assets that have what’s called “income in respect of a decedent.” Only when the tax on the net taxable estate exceeds the decedent’s remaining balance of the unified credit does the estate need to remit a tax payment to the IRS. When someone in your family dies while owning property, the federal government imposes an estate tax on the value of all that property.

The law that governs estates is constantly changing may be an inconsistent from one year to the next. The good news is that the estate tax doesn’t affect many American taxpayers who aren’t in the top 2% of the nation’s wealthiest people. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Keep in mind, however, that the income an estate reports on a 1041 is unrelated to the estate tax.

Due to the volatility of the estate tax laws, the amount of the gross estate that is not taxed is not determined until the year of death. The final net taxable estate value is subject to a tax reduction in an amount equal to your remaining balance of the unified credit. Well, the tax laws provide every taxpayer a unified credit amount that exempts from the estate tax the tax on all lifetime gifts and property transfers at death that do not exceed a specified value. Only the value of the tax on all transfers that exceed the unified credit amount is due.

But from the date of death onward, the income is attributed to the deceased’s estate. For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. Although representatives are not expected to pay the decedent’s taxes out of their own pocket, they are legally liable for ensuring that the taxes get paid to the extent allowed by the estate’s assets.

Tax law provides for an extended period of time during which a surviving spouse may take up to $500,000 of home-sale profit tax-free, rather than being restricted to the $250,000 amount allowed for single homeowners. The law allows the surviving spouse to use the $500,000 exclusion if the home is sold within two years of his or her spouse’s death. The person who inherits the property—a house, say, or stocks and bonds – would owe tax only on appreciation after the time of death. It’s important that you pinpoint date-of-death value as soon as possible—the executor should be able to help—to avoid hassles later on when you sell it. If assets have lost value during the original owner’s life, the tax basis is stepped down to date-of-death value.

So you would owe capital gains tax only on the amount of any appreciation after your uncle’s death. If the stock falls in value before you sell it, you would have a tax-saving capital loss.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If you need to prepare a federal tax return for an estate or trust using Form 1041, use our TurboTax Business product. You’ll also need to use one of our personal tax products for your individual tax return.

Free Fed & State, Plus Free Expert Review

Estates have to file an IRS Form 1041 if they earn more than $600 per year. The estate also has to generate Schedule K-1 forms for any beneficiaries of the estate. If you’re simply looking for the best tax software in general, check out our guide to the best tax software here. You can give a certain amount to each person—$15,000 for 2020—without being subject to gift taxes. If the estate is not subject to estate tax, then the valuation date is the date of death. The alternate valuation is only available if it will decrease both the gross amount of the estate and the estate tax liability; this will often result in a larger inheritance to the beneficiaries. Here are four ways that can help you keep it from being swallowed up by taxes.

For ease of use, TurboTax, TaxSlayer, and H&R Block consistently deliver great results. The lowest-cost option that supports Schedule K-1 forms is FreeTaxUSA.

Ways To Protect Your Inheritance From Taxes

Say a taxpayer who has a substantial amount in money-market mutual funds dies on June 30th. Only interest earned up to that date would be reported on the final tax return. Earnings after that date are taxable to the beneficiary of the account, or to the estate. The filing of the deceased taxpayer’s final return usually falls to the executor or administrator of the estate, but if neither is named, then the task needs to be taken over by a survivor of the deceased.

The trust or estate is responsible for paying the income tax on this income, not the beneficiaries. For example, suppose you’re a trustee, and the terms of the trust require all dividend income from a stock portfolio must be distributed equally among the beneficiaries. You must report all dividend income on the 1041, and you report the share of dividend income for each beneficiary on Schedule K-1s. You must furnish a copy of each K-1 to the appropriate beneficiary, and attach all copies to Form 1041 when you file the return with the Internal Revenue Service. The 1041 reports income retained by the trust or estate, as well as the income distributed to beneficiaries, but income taxes are only paid by the trust or estate if the distributions are required.

If the original owner dies before the five-year period has elapsed, you can satisfy the holding period by rolling the account over into an inherited Roth IRA and waiting until the holding period has passed. Income in respect of a decedent refers to income that the decedent had a right to receive at the time of death, but that is not reported on his or her final return.

The representative is responsible for filing an income tax return for the decedent for the year in which he or she died if required. If the decedent was married, the representative can work with the surviving spouse to prepare and file a joint return.

- The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website.

- If you are the beneficiary of a trust, you are responsible for paying tax on your share of the trust income that’s distributed to you.

- Certain rules may apply to when the distributions must occur, however, if the beneficiary is not a spouse.

- You must furnish a copy of each K-1 to the appropriate beneficiary, and attach all copies to Form 1041 when you file the return with the Internal Revenue Service.

- Keep in mind, however, that the income an estate reports on a 1041 is unrelated to the estate tax.

To prevent trusts from being used as tax shelters, higher tax rates kick in at much lower income levels than for individuals. If you withdrew just $5,000 (one-tenth of the account), you deduct 10% of the estate tax bill attributable to the IRA.

I Inherited My Mother’s Traditional Ira Do I Have To Pay Tax On The Full Amount I Receive Each Year From The Account?

In addition, you don’t have to pay tax on the portion of withdrawals attributable to nondeductible contributions that your mother made to the IRA . If your mother was like most taxpayers and did not pay tax on the interest as it accrued each year, the executor of her estate can elect to have the estate pay income tax on the interest earned before your mother’s death. If so, that wipes out your tax liability for that interest when you cash in the bonds. Did you receive a payment or other property from an estate or trust during the year? If so, here’s what you need to know about how it affects your taxes.

Be sure not to confuse this with the estate tax which is paid out of the property the deceased owns when they die. The inheritance tax, however, applies to the people who inherit that property. Hello, I’m Jeremy from TurboTax with important news on state inheritance taxes. If you’re filing a 1041 on behalf of an estate or trust, our TurboTax Business product will walk you through it, step by step.