Content

Distributions used to pay for nonqualified expenses are subject to income tax and a 10% penalty on the earnings portion of the withdrawal. Adjusted qualified education expenses are the total qualified expenses reduced by any tax-free education assistance. If an education credit or deduction is claimed for the student, then the total expenses must also be reduced by the amount of expenses taken into account in determining the credit or deduction. When the beneficiary enrolls in school and starts taking distributions to pay school expenses, he will begin receiving a Form 1099-Q each year.

estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

Financial Services

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. If you do need to include all or part of the distribution on your tax return, follow the instructions for calculating the taxable portion in Publication 970. And try to avoid taking unqualified withdrawals next year so that you can avoid losing your savings to taxes and penalties. You may also qualify for an exclusion if the amount was included in income because you used the expenses to calculate the American opportunity or lifetime learning credit.

Learn more about notice CP161 and how to handle an IRS bill for unpaid taxes with help from the tax experts at H&R Block. A fiduciary acts on behalf of another person using Form 56, Notice Concerning Fiduciary Relationship.

See Peace of Mind® Terms for details. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. Small Business Small business tax prep File yourself or with a small business certified tax professional.

How To Report A Taxable 529 Plan Distribution On Federal Income Tax Returns

Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

Prepare, file and deliver your 1099 and W-2 forms, any time from anywhere. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers. The student beneficiary was changed to someone who was not an eligible family member of the original student beneficiary. Click Education in the Federal Quick Q&A Topics menu to expand, then click Education program payments (Form 1099-Q).

- If you create one of the accounts to put someone other than yourself through school, that student has no control over the funds and is not responsible for any of the tax consequences.

- Are an officer or an employee, or the designee of an officer or employee, having control of a program established by a state or eligible educational institution.

- Form 1099-Q lists the total distributions from a 529 plan or Coverdell ESA during a given tax year, regardless of how the funds were spent.

- Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

- State e-file not available in NH.

She received a check directly from the QTP account that her parents set up. Her grandparents also received a check from the account they set up. Burtha would receive a 1099-Q showing the distribution made to her, and her grandparents would receive a 1099-Q showing the distribution made to them. Both distributions need to be totaled before being compared to Burtha’s AQEE. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. The administrator of your qualified tuition plans must send you the Form 1099-Q in any year you take a distribution or transfer funds between accounts.

You should receive the 1099-Q no later than early February following the close of the tax year since the administrator must send it by January 31. Administrators must also provide a copy of each form to the IRS no later than March 31 if sent electronically, or February 28 if using a paper copy. Create an account online for FREE — you don’t pay anything until you’re ready to file your first form. The distributed funds were not used for qualified education expenses. The earnings portion of a non-qualified 529 plan distribution is subject to income tax and a 10% penalty. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Why Did I Get A Form 1099

Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Personal state programs are $39.95 each (state e-file available for $19.95).

If you’re paying for school expenses from a 529 plan or a Coverdell ESA, you will likely receive an IRS Form 1099-Q, which reports the total withdrawals you made during the year. Form 1099-DIV is an IRS form sent by banks and other financial institutions to investors who receive dividends and distributions from investments during a calendar year. Filers who fill out the form can also enter a distribution code in the blank spaces below boxes 5 and 6 if they choose. Try TurboTax software. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. If you receive Form 1099-Q, don’t panic.

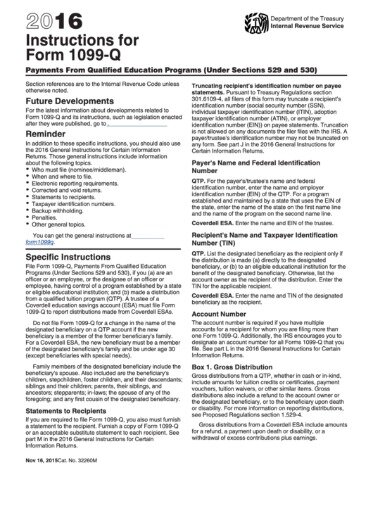

Form 1099-Q should be filed by officers or employees who have control of a program established by a state or qualified educational institution. It can also be filed by anyone who has made a distribution from a 529 plan, also known as a qualified tuition program .

Only the amount of distributed earnings is ever subject to tax. You never pay tax on the basis . When 529 plan funds are used to pay for qualified education expenses there is usually nothing to report on your federal income tax return. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Beneficiary Tax Implications

You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account.

All rights reserved. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

However, the rollover must occur within 60 days of the distribution. Individuals who receive distributions from a Coverdell education savings account or 529 plan are sent a 1099-Q.

No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

We support many 1099 & W-2 form types, sure to meet the employee or contract worker reporting needs of your small to midsize business. Browse the full list of available forms. When you’re dealing with Social Security numbers, tax IDs, and personal financial data, security has to be a top priority. Rest assured that our secure website and strict business processes are designed to protect your data against unauthorized access at every step. Note that any link in the information above is updated each year automatically and will take you to the most recent version of the document at the time it is accessed.

Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year.

Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

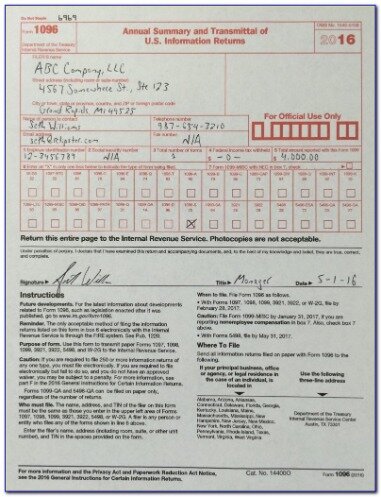

What Is Irs Form 1098

Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. You might get a Form 1099-Q if you used funds from a 529 plan or Coverdell ESA to pay for education expenses. You’ll need the form — and knowledge of IRS rules for reporting education account distributions — when you file your federal income tax return.

H&R Block employees, including Tax Professionals, are excluded from participating. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January.