Content

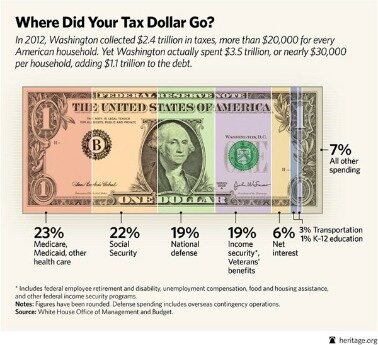

Did you know that with your tax money, the government spends more on nuclear weapons than on the Environmental Protection Agency, or the Children’s Health Insurance Program? Have you thought about how spending on disaster relief compares to spending on agencies designed to curb the climate change that accelerates those disasters? The largest portion of tax revenue is spent to support the military, pay for Social Security, and health care programs. The military spending not only includes the cost of purchasing naval ships, sophisticated aircraft and other equipment—but it also covers the salaries of soldiers and military personnel. It provides benefits to workers who have paid into the system and have reached an established retirement age. Additionally, Social Security pays benefits to disabled workers who can no longer work or have limited income and resources. It also pays survivor benefits to the spouses and children of workers who have died.

- The amount of the estimated shift for fiscal year and the prior two fiscal years from Marin County local agencies to ERAF is as shown below.

- The village’s tourism commission is planning the center near its village hall, about two miles east of Interstate-94 and five miles west of Lake Michigan, where the City of Racine is planning to build its own convention center.

- Medicare provides health coverage to qualifying people 65 and older, and to those with disabilities that leave them unable to work.

- But given the pandemic, Blank estimated the village made abut $30,000 to $35,000 in January.

© 2021 by Wisconsin Public Radio, a service of the Wisconsin Educational Communications Board and the University of Wisconsin-Madison. For technical questions or comments about WPR’s website, streaming or other digital media products, please use our Website Feedback form. Wisconsin Public Radio and WPR.org welcome civil, on-topic comments and opinions that advance the discussion from all perspectives of an issue. Comments containing outside links will only be posted after they’ve been approved by a moderator. Visit our social media guidelines for more information about these policies.

Indianas Tax Dollars At Work

While you may not get a receipt from the IRS any time soon, National Priorities Project went ahead and wrote one up. The federal government also provides the states with money—allowing them to use the funds for state sponsored programs, such as public school systems and unemployment benefits. Those are a portion of the taxes withheld from your paycheck, and due this year on April 15, 2019. Tax Day materials do not include corporate taxes or the individual payroll taxes that directly fund Social Security and Medicare. To read more about where federal revenues come from, visit Where the Money Comes From. Each year, the federal government sets a budget—which establishes the amount it plans to spend on each program.

“I’ve been involved with various room tax laws for more than 20 years, I know what the intent of the room tax law is,” Blank said. “We’re confident we’re interpreting what the room tax statue meant to say and how is meant to be spent.” Dave Blank, CEO of Real Racine, said without a contract, the Mount Pleasant Tourism Commission can’t use the money it generates.

Defense and security spending also includes funding for the Department of Homeland Security and the Transportation Security Administration. Anyone who has read and loved a local site knows that this could be a golden age for community media—richer and more responsive than ever, faster to give voice to a community’s concerns. That will only happen if we, and our local governments, invest in it. According to a study out of the City University of New York Graduate School of Journalism, New York City spends about $18 million a year on its own advertising—enough to employ a couple hundred community journalists.

Online Services

The federal budget covers a wide range of expenditures, but most of the tax revenue is spent on just a handful of government programs. You know you have to pay your taxes, but do you know exactly what the federal government spends your hard earned money on? If not, you may be surprised to learn how the government spends the taxes it collects each year.

Copies of documents are available in alternative formats upon request. This infographic illustrates the sources of each state’s tax revenue. When states serve their traditional role as laboratories of innovation, they increase the American people’s confidence that the government they choose—no matter the size—can be effective, responsive, and in the public interest. “They are a big piece of what we have to offer in Racine County, they have the hotel rooms,” Blank said. “The city and other places have the attractions. And restaurants are scattered among all the municipalities. You need all those things to be a tourism destination.”

While critics often decry “government spending,” it is important to look beyond the rhetoric and determine whether the actual public services that government provides are valuable. To the extent that such services are worth paying for, the only way to do so is ultimately with tax revenue. Consequently, when thinking about the costs that taxes impose, it is essential to balance those costs against the benefits the nation receives from public services. As the chart shows, the remaining fifth of federal spending supports a variety of other public services. A very small slice — less than 1 percent of the budget — goes to non-security programs that operate internationally, including programs providing humanitarian aid.

Where Did The Federal Government Spend All The Money You Paid In Income Taxes For The Tax Year?

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects. Roughly 14 percent of the budget provides assistance to families and individuals in need. This includes refundable tax credits, Supplemental Security Income, Supplemental Nutritional Assistance Program , low-income housing and school meals. Additionally, some of the tax money pays interest payments on the national debt, the money borrowed by the federal government to pay its expenses. In recent history, interest on the national debt has taken almost 10 percent of the annual budget. Our Tax Day materials show how federal funds were spent during fiscal year 2018, the time period that most closely corresponds to the calendar year for which income taxes are due.

With over $20 billion in tax revenue being processed each year by the Indiana Department of Revenue from 65 different tax types, we want you to know how these funds are used. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). A member of the New York City Council has also pushed to move legal notices online, but suggests the city host them directly, going around publishers and their engaged audiences. If you are a person with a disability and require an accommodation to participate in a County program, service, or activity, requests may be made by calling , Dial 711 for CA Relay, or by email at least five business days in advance of the event. We will do our best to fulfill requests received with less than five business days’ notice.

Government That Works

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

Blank said his organization has gotten some small business grants related to the pandemic. The Racine County visitor’s bureau is alleging the Village of Mount Pleasant is unlawfully spending money collected by hotel room taxes. Real Racine is suing the Village of Mount Pleasant, alleging the village is unlawfully spending hotel room tax dollars to build a convention center. Did you know your tax dollars are used to help veterans, support K-12 education and encourage clean water and air, to name a few? The graphic to the right shows where taxes that are collected by DOR are used to serve the state of Indiana. Once processed, funds collected on behalf of the state are made available for use by the 92 state agencies subject to oversight by theState Budget Agency. Taxes collected on behalf of local units of government are distributed to those units for such diverse activities as public safety, economic development, education and many others.

Video: How Your Tax Dollars Are Spent

Approximately 20 percent of the federal budget is spent on defense and security. Most of that 20 percent is for the Department of Defense, which covers the cost of military operations, troop training, equipment, and weapons research.

Most of the tax revenue that the federal government receives comes from the income taxes paid by individuals, Social Security and Medicare taxes and the taxes businesses pay on their profits. There are many government services and programs that we all use, but they couldn’t exist without government spending. Proposition 13, the 1978 ballot measure capped property taxes in the state and thereby sharply diminished the property tax revenues that counties, cities, and special districts had to provide services. ERAF allowed the legislature to reallocate the property tax among local governments. In the midst of the recession in , the State Legislature exercised this power to take city, county, and special district property taxes to fund the state government’s obligation to support schools. The amount of the estimated shift for fiscal year and the prior two fiscal years from Marin County local agencies to ERAF is as shown below. Tax Day is April 15, 2019, the last day to file our tax returns for all income received in 2018.

But the city operates under a massive, long-term contract with two private firms, which control nearly all of its ad spending. The CUNY study found that the agencies almost totally passed over the city’s vibrant ethnic media in favor of collapsing print publications. A tiny fraction of that advertising goes to the digital publications where New Yorkers increasingly get their news.

Our primary goal is to maximize every dollar we spend, making sure our programs are working effectively and efficiently to help the Pennsylvanians who truly need our services. We created the Office ofProgram Integrityto weed out waste, fraud and abuse and to bring integrity to our programs and services. The links in the table below will direct you to programs and services provided by the department.

Hello, I’m Tammy from TurboTax with some interesting information about how the federal government spends your tax dollars. A CBPP analysis using Census’ Supplemental Poverty Measure shows that government safety net programs kept 37 million people out of poverty in calendar year 2018. Without any government income assistance, either from safety net programs or other income supports like Social Security, the poverty rate would have been 24.0 percent in 2018, nearly double the actual 12.8 percent. And these programs reduced the depth of poverty for millions more, even when not bringing them above the poverty line. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.