Content

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. We are an independent, advertising-supported comparison service.

The court rejected Mrs Stark’s claim that she was entitled to the single person’s 25% rebate on rates owed the Council. The court ruled that she was not a single person, because the property was also Mr Stark’s main residence, that is, where Mr Stark would have lived were it not for the demands of his occupation. If you are purchasing a second home today and plan to rent it out seasonally in the future, you will be prohibited from refinancing this as a second home, because the tax transcripts don’t lie. For an investment property, your entire property tax bill is deductible against your rental income as a business expense. If you rent a home out for fewer than 15 days in a year, the IRS doesn’t require you to report any of your rental income. This applies to primary and secondary homes as well as investment properties. If a property is both for personal use and renting, the IRS requires that you divide the expenses when offsetting your rental income.

How Does The Irs Define Primary Residence?

Lenders will review your financials and evaluate your loan-to-value ratio, or LTV. Depending on the lender’s LTV ratio requirements, you may need to provide a large down payment. Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. Know you need to tap into your home’s equity but not sure whether a second mortgage or refinance is best for you? Whether it’s for vacationing, renting out, or use as a secondary residence, buying a second home requires careful thought. Victoria Araj is a Section Editor for Quicken Loans and held roles in mortgage banking, public relations and more in her 15+ years with the company.

And remember that if you live there for two years, move away, and put it on the market almost three years later, you could lose the exemption if the house doesn’t sell very fast. If you’re lucky enough to own two homes, you may have recently packed up and moved to your summer residence. That’s nice, but it can have tax consequences that are anything but a day at the beach. The capital-gains exemption — the amount of gain that you can exclude from taxation — is $250,000 for individuals or $500,000 if you are filing a joint return. So you may want to go ahead and run the numbers of how much you could save in taxes if your second home in Pennsylvania becomes your main home. It’s not a good idea to misrepresent how you plan to live in or rent out your home on your loan application. You will not be the first person who has thought of ways to mislead lenders, and lenders will verify your property’s occupancy during and after the underwriting process.

But you can deduct mortgage interest and property taxes as you would with any home. For a second home, you can deduct property taxes on your tax return as part of the state and local taxes deduction .

So lenders take steps to ensure that the property in question is actually going to be someone’s second home — not just an investment. Retirees don’t have to worry about it, but it’s hard to make the case that you’ve switched states when you’re still working full time at an office around the corner from your old house. If you’re self-employed or telecommuting, you may be able to move away, declare a new state your permanent residence, and continue working. Don’t abandon your current residency until you’ve thought out the tax implications. If you expect to sell your home for a large gain, remember that you can exempt up to $250,000 ($500,000 for married owners) of that gain if you’ve lived there for two of the five years before you sell it.

By making your second home your primary home, you could potentially lessen the capital gains hit. First, you would need to live in the second property for at least two years out of the five years prior to selling it.

You will not be living in the property, and you plan on collecting rent or lease payments from it. To qualify for a second home mortgage, you may also have to meet higher credit score standards, have a down payment of at least 20%, and meet specific cash reserve requirements. Reserve requirements mean you must have enough money in liquid savings to cover the mortgage for a few months if need be. If you want to buy a vacation home, then your property will likely be classified as a second home. A second home classification depends on how you plan to occupy the property, not whether it is actually the second home you’ve ever bought or currently own. “With new SALT limit, IRS explains tax treatment of state and local tax refunds.” Accessed June 18, 2020.

If you rent for 15 or more days, you’ll have to report the income, but you may be able to deduct certain things, such asrental expenses. It’s important to note that either your lender or the investor in your mortgage may place special limits on how often you rent the property. If you’re married, you and your spouse must claim the same property as your primary home. Capital gains tax is what you pay when you sell an asset that has increased in value. When you decide to sell your primary residence and it has increased in value, you’ll be eligible to exclude some of the capital gains from the proceeds of your sale. Currently, the IRS allows taxpayers to exclude up to $500,000 in capital gains if married filing jointly or $250,000 if single. The interest that you pay on your mortgage on a primary and secondary residence may also be tax-deductible, up to a limit.

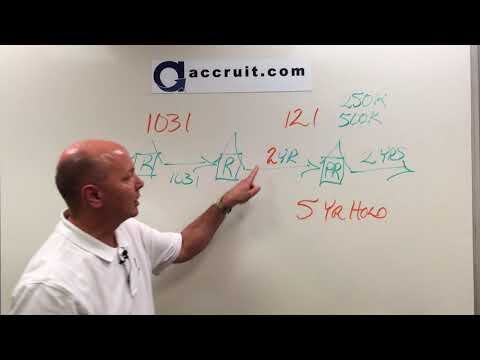

State and local property taxes can be deducted from federal income taxes up to a limit. These generally don’t include taxes on renovations or services. If your second property is held for business or investment, you might be able to defer capital gains taxes under a1031 exchange. Known as a like-kind exchange, this involves selling the property and replacing it with a similar property. Once you have sold the initial property, you must identify its replacement property within 45 days and acquire it within 180 days.

The status of the house matters because second homes and rentals are riskier to finance. Fannie Mae, for example, adds a 3.375 percent charge for a rental home with 20 percent down.

Primary Residence, Defined

You must stay in the home for the larger part of the 180 days or for 10% of the days when you would otherwise rent out the home. Understanding each classification can help you avoid high interest rates and tax implications when purchasing additional properties. Rocket Mortgage by Quicken Loans received the highest score in the J.D. Power 2010 – Primary Mortgage Origination and 2014 – 2020 Primary Mortgage Servicer Studies of customers’ satisfaction with their mortgage sales experience and mortgage servicer company, respectively. Mortgage servicing fees are paid by mortgage owners, but in some situations, servicers can charge borrowers directly. It’s smart to document your need for two primary homes as much as possible.

How your new home is classified could end up saving or costing you a lot of money. Mortgage underwriting can take days or weeks depending on your lender and application. Here’s what to expect from underwriting and what to do about delays. Ideally, this person would refinance and get you off the loan altogether, but that’s not always possible.

How Lenders Define An Investment Property

On the other hand, if this is our second home or a mixed-use home, such an exclusion would not be an option for us. There may also be state tax benefits associated with your primary residence that you don’t want to miss out on, such as homestead exemptions or heating oil credits.

Lenders can use data analysis and algorithms to spot borrowers who may have lied on their mortgage applications. Data from credit bureau files, utility bills, and tax information can help determine whether your addresses are different than those used on loan applications. Investment property mortgages come with the most stringent qualifying criteria because they tend to have higher delinquency rates than other occupancy types. People are more likely to prioritize paying the loan for a home they use before one that’s simply used to generate additional income. If you refinance the mortgage for your primary home, you must be able to prove your residence through documentation (e.g., tax returns or government identification).

If you’re trying to buy one primary residence while you still own another one, the transaction has to make sense. If you buy a new house in the same town, and you plan to convert the old house to a rental, it helps to provide a lease agreement. You may be eligible for a second primary residence if your family has grown too large for your current house, and the loan-to-value ratio is 75 percent or lower. For instance, you may work from an office in your hometown and also at your company headquarters in another state. If you buy a house near your other office, you would probably be allowed to finance the new house as a primary residence.

Tax Bracket Calculator

If you cannot easily determine which residence is your main home, there are a number of factors to consider that will help you identify which one it is. Generally, the residence where you receive mail, the address listed on your tax returns and printed on your drivers’ licenses will identify which residence is your main home. A homeowner can have any number of mortgages against his home, but every loan will have a “priority” which means only 1 loan can be in second lien priority. If there are 3 loans, for example, one will be a first mortgage, one a second mortgage, and one a third mortgage.

As of 2018, homeowners can deduct mortgage interest on loans up to $750,000. You can also claim your mortgage insurance payments if you purchased your home after 2006. If you choose to include these deductions on your tax return, you will have to itemize your deductions instead of claiming thestandard deduction.

- This is because lenders must assess the level of risk in providing you a mortgage, meaning they determine how likely it will be that you pay back your loan.

- And as long as one is your main home and you use the other for personal purposes, you can deduct the mortgage interest, home equity loan interest and mortgage insurance premium payments you pay on both.

- “Know the tax facts about renting out residential property.” Accessed June 18, 2020.

- A time-share used in this way also qualifies for the tax deduction.

- It’s well-known that mortgage interest is deductible on primary residences if you itemize deductions.

- This doesn’t mean you need to use it for any consecutive number of days.

A tax break for the mortgage interest you paid isn’t the only benefit that comes with owning a primary residence. You may also qualify to exclude capital gains when you sell your home. If you have recently purchased a second home or are looking into buying a second home, you’ll need to know how owning to homes impacts your taxes. Specifically, you’ll want to know whether or not you can claim two primary residences on your taxes. And even if you split your time evenly between two residences, you can’t designate both as your main home.

That way, you’ll ensure that you get the correct type of loan for the type of property you intend to purchase. Investment property loans usually have higher interest rates and require a larger down payment than properties that people use as second homes. People sometimes use the terms “investment property” and “second home” interchangeably to describe real property that isn’t their primary residence, but these types of properties are different. Learn the difference between a second home and investment property; it can affect the type of loan you get.

But when it comes to the actual number of days you occupy the property and whether you rent it out when you aren’t using it, there’s no set-in-stone definition. Many lenders won’t offer a second-home loan if the borrower intends to rent the property out for any amount of time.

The owner may also deduct expenses such as the cost of materials to maintain the property, interest and taxes. Your primary property can be an apartment, a houseboat or another form of property that you live in most of the year.

Misrepresentations on mortgage applications are deemed bank fraud, and subject to penalties, prosecution, and even prison time if convicted. If found out, your lender may call the loan due, which means you’d be required to repay the loan in full immediately. If you can’t afford repayment, the lender could choose to foreclose on the property. In extreme or egregious cases, lenders may also notify the Federal Bureau of Investigation .